by Calculated Risk on 8/02/2015 08:53:00 PM

Sunday, August 02, 2015

Monday: Auto Sales, ISM Mfg Index, Construction Spending, Personal Income and Outlays

Weekend:

• Schedule for Week of August 2, 2015

Monday:

• At 8:30 AM, Personal Income and Outlays for June. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.7, up from 53.5 in June. The ISM manufacturing index indicated expansion at 53.5% in June. The employment index was at 55.5%, and the new orders index was at 56.0%.

• Also at 10:00 AM, Construction Spending for June. The consensus is for a 0.6% increase in construction spending.

• All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.2 million SAAR in July from 17.1 million in June (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up slightly and DOW futures are up 20 (fair value).

Oil prices were down over the last week with WTI futures at $46.84 per barrel and Brent at $51.81 per barrel. A year ago, WTI was at $105, and Brent was at $106 - so prices are down over 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.65 per gallon (down about $0.85 per gallon from a year ago).

Hotels: Best Week Ever, On Pace for Record Occupancy in 2015

by Calculated Risk on 8/02/2015 11:14:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 25 July

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 19-25 July 2015, according to data from STR, Inc.The 79.1% occupancy rate reported for last week was the best week on record (the four week average will peak in August).

In year-over-year measurements, the industry’s occupancy increased 1.5% to 79.1%. Average daily rate for the week was up 5.1% to US$125.04. Revenue per available room increased 6.6% to finish the week at US$98.91.

emphasis added

For the same week in 2009, ADR (average daily rate) was $98.13 and RevPAR (Revenue per available room) was $65.77. ADR is up 25% since July 2009, and RevPAR is up 50%!

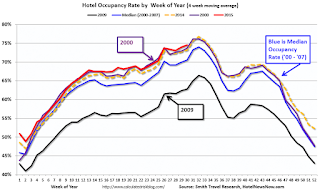

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate will be high during the summer travel season.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and 2015 will probably be the best year ever for hotels.

Late July is usually the best time of the year for hotels - although the four week average usually peaks in August. A very strong year, and a key reason new hotel construction has picked up.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, August 01, 2015

Schedule for Week of August 2, 2015

by Calculated Risk on 8/01/2015 11:51:00 AM

The key report this week is the July employment report on Friday.

Other key indicators include the July ISM manufacturing index and July vehicle sales, both on Monday, and the Trade Deficit on Wednesday.

8:30 AM ET: Personal Income and Outlays for June. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.7, up from 53.5 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.7, up from 53.5 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 53.5% in June. The employment index was at 55.5%, and the new orders index was at 56.0%.

10:00 AM: Construction Spending for June. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.2 million SAAR in July from 17.1 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.2 million SAAR in July from 17.1 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is a 1.7% increase in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in July, down from 238,000 in June.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through April. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.0 billion in June from $41.9 billion in May.

10:00 AM: the ISM non-Manufacturing Index for July. The consensus is for index to increase to 56.2 from 56.0 in June.

10:00 AM: Speech by Fed Governor Jerome Powell, The Structure and Liquidity of Treasury Bond Markets, At the Brookings Institute Conference: Are There Structural Issues in the U.S. Bond Markets?, Washington, D.C.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 273 thousand from 267 thousand.

8:30 AM: Employment Report for July. The consensus is for an increase of 212,000 non-farm payroll jobs added in July, down from the 223,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to be unchanged at 5.3%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was over 2.9 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for June from the Federal Reserve. The consensus is for an increase of $17.4 billion in credit.

July 2015: Unofficial Problem Bank list declines to 290 Institutions

by Calculated Risk on 8/01/2015 08:13:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 2015.

Changes and comments from surferdude808:

Update on the Unofficial Problem Bank List for July 2015. During the month, the list fell from 309 institutions to 290 after 20 removals and one addition. Assets dropped by $5.9 billion to an aggregate $83.9 billion. A year ago, the list held 452 institutions with assets of $146.1 billion.

Actions have been terminated against Anderson Brothers Bank, Mullins, SC ($506 million); Pacific National Bank, Miami, FL ($379 million); Geauga Savings Bank, Newbury, OH ($357 million); The Peoples Bank, Chestertown, MD ($229 million); Home Loan Investment Bank, F.S.B., Warwick, RI ($216 million); Crown Bank, Edina, MN ($193 million); Farmers & Merchants Bank, Statesboro, GA ($170 million); Eagle Valley Bank, National Association, Saint Croix Falls, WI ($127 million); Evergreen National Bank, Evergreen, CO ($102 million); Surety Bank, DeLand, FL ($96 million); Peoples State Bank, Lake City, FL ($70 million); Liberty Savings Bank, FSB, Whiting, IN ($55 million); First Security Bank of Helena, Helena, MT ($40 million); Peoples Bank and Trust Company of Clinton County, Albany, KY ($33 million); and Hometown Community Bank, Cyrus, MN ($26 million).

Premier Bank, Denver, CO ($32 million) failed. Finding merger partners were Bank of Manhattan, N.A., El Segundo, CA ($481 million Ticker: MNHN); American Bank of St. Paul, Saint Paul, MN ($312 million); Pacific Rim Bank, Honolulu, HI ($131 million); and ProBank, Tallahassee, FL ($45 million).

The addition this month was Home Federal Savings and Loan Association of Nebraska, Lexington, NE ($56 million).

Friday, July 31, 2015

Fannie Mae: Mortgage Serious Delinquency rate declined in June, Lowest since August 2008

by Calculated Risk on 7/31/2015 06:27:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in June to 1.66% from 1.70% in May. The serious delinquency rate is down from 2.05% in June 2014, and this is the lowest level since August 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has only fallen 0.39 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe serious delinquencies will be close to normal in 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.