by Calculated Risk on 8/03/2015 09:44:00 AM

Monday, August 03, 2015

ISM Manufacturing index decreased to 52.7 in July

Note: This was released early.

The ISM manufacturing index suggested expansion in July. The PMI was at 52.7% in July, down from 53.5% in June. The employment index was at 52.7%, down from 55.5% in June, and the new orders index was at 56.5%, up from 56.0%.

From the Institute for Supply Management: July 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in July for the 31st consecutive month, and the overall economy grew for the 74th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The July PMI® registered 52.7 percent, a decrease of 0.8 percentage point below the June reading of 53.5 percent. The New Orders Index registered 56.5 percent, an increase of 0.5 percentage point from the reading of 56 percent in June. The Production Index registered 56 percent, 2 percentage points above the June reading of 54 percent. The Employment Index registered 52.7 percent, 2.8 percentage points below the June reading of 55.5 percent, reflecting growing employment levels from June but at a slower rate. Inventories of raw materials registered 49.5 percent, a decrease of 3.5 percentage points from the June reading of 53 percent. The Prices Index registered 44 percent, down 5.5 percentage points from the June reading of 49.5 percent, indicating lower raw materials prices for the ninth consecutive month. Comments from the panel reflect a combination of optimism mixed with uncertainties about international markets and the impacts of the continuing decline in oil prices."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 53.7%, and indicates slower manufacturing expansion in July.

BEA: Personal Income increased 0.4% in June, Core PCE prices up 1.3% year-over-year

by Calculated Risk on 8/03/2015 08:36:00 AM

From the BEA, the Personal Income and Outlays report for June:

Personal income increased $68.1 billion, or 0.4 percent ... in June, according to the Bureau of Economic Analysis.On inflation: the PCE price index was up 0.3% year-over-year (the decline in oil prices pushed down the headline price index). However core PCE is only up 1.3% year-over-year - still way below the Fed's target.

...

Real PCE -- PCE adjusted to remove price changes -- decreased less than 0.1 percent in June, in contrast to an increase of 0.4 percent in May. ... The price index for PCE increased 0.2 percent in June, compared with an increase of 0.3 percent in May. The PCE price index, excluding food and energy, increased 0.1 percent in June, the same increase as in May.

The June price index for PCE increased 0.3 percent from June a year ago. The June PCE price index, excluding food and energy, increased 1.3 percent from June a year ago.

Sunday, August 02, 2015

Monday: Auto Sales, ISM Mfg Index, Construction Spending, Personal Income and Outlays

by Calculated Risk on 8/02/2015 08:53:00 PM

Weekend:

• Schedule for Week of August 2, 2015

Monday:

• At 8:30 AM, Personal Income and Outlays for June. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 10:00 AM, ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.7, up from 53.5 in June. The ISM manufacturing index indicated expansion at 53.5% in June. The employment index was at 55.5%, and the new orders index was at 56.0%.

• Also at 10:00 AM, Construction Spending for June. The consensus is for a 0.6% increase in construction spending.

• All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.2 million SAAR in July from 17.1 million in June (Seasonally Adjusted Annual Rate).

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up slightly and DOW futures are up 20 (fair value).

Oil prices were down over the last week with WTI futures at $46.84 per barrel and Brent at $51.81 per barrel. A year ago, WTI was at $105, and Brent was at $106 - so prices are down over 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.65 per gallon (down about $0.85 per gallon from a year ago).

Hotels: Best Week Ever, On Pace for Record Occupancy in 2015

by Calculated Risk on 8/02/2015 11:14:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 25 July

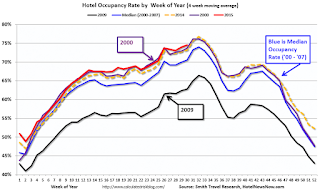

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 19-25 July 2015, according to data from STR, Inc.The 79.1% occupancy rate reported for last week was the best week on record (the four week average will peak in August).

In year-over-year measurements, the industry’s occupancy increased 1.5% to 79.1%. Average daily rate for the week was up 5.1% to US$125.04. Revenue per available room increased 6.6% to finish the week at US$98.91.

emphasis added

For the same week in 2009, ADR (average daily rate) was $98.13 and RevPAR (Revenue per available room) was $65.77. ADR is up 25% since July 2009, and RevPAR is up 50%!

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The occupancy rate will be high during the summer travel season.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and 2015 will probably be the best year ever for hotels.

Late July is usually the best time of the year for hotels - although the four week average usually peaks in August. A very strong year, and a key reason new hotel construction has picked up.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Saturday, August 01, 2015

Schedule for Week of August 2, 2015

by Calculated Risk on 8/01/2015 11:51:00 AM

The key report this week is the July employment report on Friday.

Other key indicators include the July ISM manufacturing index and July vehicle sales, both on Monday, and the Trade Deficit on Wednesday.

8:30 AM ET: Personal Income and Outlays for June. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.7, up from 53.5 in June.

10:00 AM: ISM Manufacturing Index for July. The consensus is for the ISM to be at 53.7, up from 53.5 in June.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 53.5% in June. The employment index was at 55.5%, and the new orders index was at 56.0%.

10:00 AM: Construction Spending for June. The consensus is for a 0.6% increase in construction spending.

All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.2 million SAAR in July from 17.1 million in June (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for July. The consensus is for light vehicle sales to increase to 17.2 million SAAR in July from 17.1 million in June (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the June sales rate.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for June. The consensus is a 1.7% increase in orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for July. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in July, down from 238,000 in June.

8:30 AM: Trade Balance report for June from the Census Bureau.

8:30 AM: Trade Balance report for June from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through April. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $43.0 billion in June from $41.9 billion in May.

10:00 AM: the ISM non-Manufacturing Index for July. The consensus is for index to increase to 56.2 from 56.0 in June.

10:00 AM: Speech by Fed Governor Jerome Powell, The Structure and Liquidity of Treasury Bond Markets, At the Brookings Institute Conference: Are There Structural Issues in the U.S. Bond Markets?, Washington, D.C.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 273 thousand from 267 thousand.

8:30 AM: Employment Report for July. The consensus is for an increase of 212,000 non-farm payroll jobs added in July, down from the 223,000 non-farm payroll jobs added in June.

The consensus is for the unemployment rate to be unchanged at 5.3%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was over 2.9 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

3:00 PM: Consumer Credit for June from the Federal Reserve. The consensus is for an increase of $17.4 billion in credit.