by Calculated Risk on 7/19/2015 11:38:00 AM

Sunday, July 19, 2015

EIA: West Coast Gasoline Prices "likely to remain elevated until later this summer"

An interesting article from the EIA: California gasoline prices rise further as lengthier supply chain is strained. A few excerpts:

West Coast spot prices for conventional gasoline increased sharply last week, while falling slightly on the Gulf Coast and remaining flat on the East Coast. The Los Angeles, California, spot price for conventional gasoline increased nearly 90 cents per gallon (cents/gal) between July 6 and July 13, while San Francisco, California, and Portland, Oregon prices increased 24 cents/gal and 5 cents/gal, respectively (Figure 1). This most recent price rise results from a delay in receipts of waterborne imports of gasoline blending components and a decrease in total motor gasoline inventories within an already constrained supply chain.

Click on graph for larger image.

Click on graph for larger image.West Coast spot gasoline prices typically trade at a premium to prices in other regions of the country because of the region's unique product specifications and relative isolation from other domestic and international markets. As a result, West Coast gasoline markets are primarily supplied by in-region production, and prices react more quickly and strongly during times of local supply shortages. The West Coast gasoline spot price differential has been higher than usual for the past several months following a series of supply disruptions caused by an unplanned refinery outage in February and additional refinery outages in April. Also, West Coast gasoline demand is up 4% in the first four months of 2015 compared with the same time last year, putting additional pressure on the supply chain.

...

Other periods of price spikes have occurred in California, most notably in 2008, 2009, and 2012, that were similar in duration and magnitude to the current situation. By early June of this year, the other refineries were back in operation so only the Torrance refinery remains down. Prices will likely stabilize again when imports and inventories increase, but are likely to remain elevated until the repairs to the Torrance refinery are completed later this summer.

Saturday, July 18, 2015

Schedule for Week of July 19, 2015

by Calculated Risk on 7/18/2015 08:22:00 AM

The key reports this week are June New Home sales on Friday, and June Existing Home Sales on Wednesday.

No economic releases scheduled.

10:00 AM ET: Regional and State Employment and Unemployment for June.

10:00 AM: The Federal Reserve will release the Annual revision for Industrial Production and Capacity Utilization

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for May 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% month-to-month increase for this index.

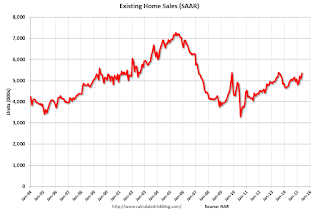

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 5.40 million on seasonally adjusted annual rate (SAAR) basis. Sales in May were at a 5.35 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 5.45 million SAAR.

A key will be the reported year-over-year change in inventory of homes for sale.

During the day: The AIA's Architecture Billings Index for June (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 279 thousand from 281 thousand.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

11:00 AM: the Kansas City Fed manufacturing survey for July.

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the April sales rate.

The consensus is for an increase in sales to 550 thousand Seasonally Adjusted Annual Rate (SAAR) in June from 546 thousand in May.

Friday, July 17, 2015

Mortgage News Daily: Mortgage Rates Near July Lows

by Calculated Risk on 7/17/2015 07:15:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slowly Approach July Lows

Mortgage rates continued the recent trend of very small improvements today. Most lenders are essentially unchanged, and while a few rate sheets were higher than yesterday's, they were the exception. The average improvement was so small that it would have no effect on the contract rate in most cases. That means closing costs would be just slightly lower for the same rates quoted yesterday. While some of the most aggressive lenders are back to quoting conventional 30yr fixed rates of 4.0%, most remain at 4.125%. ...Here is a table from Mortgage News Daily:

emphasis added

Comments on June Housing Starts

by Calculated Risk on 7/17/2015 02:48:00 PM

Total housing starts in June were above expectations, and, including the upward revisions to April and May, starts were strong.

There was also a significant increase for permits again in June (mostly for the volatile multi-family sector).

Earlier: Housing Starts increased to 1.174 Million Annual Rate in June

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Even with weak housing starts in February and March, total starts are still running 10.9% ahead of 2014 through June.

Single family starts are running 9.1% ahead of 2014 through June.

Starts for 5+ units are up 14.9% for the first six months compared to last year.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

The blue line (multi-family starts) was moving more sideways, but jumped up in June.

Multi-family completions are increasing.

Even with the surge in permits this over the last two months - and strong multi-family starts in June - I think most of the growth in multi-family starts is probably behind us - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

A strong report.

Key Measures Show Low Inflation in June

by Calculated Risk on 7/17/2015 11:39:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.6% annualized rate) in June. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for June here. Motor fuel was up sharply again in June.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.9% annualized rate) in June. The CPI less food and energy rose 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.8%. Core PCE is for May and increased 1.2% year-over-year.

On a monthly basis, median CPI was at 3.6% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI was at 2.2% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is above 2%).

Inflation is still low, and a key question is: Will inflation move up towards 2%?