by Calculated Risk on 7/14/2015 03:23:00 PM

Tuesday, July 14, 2015

Update: The California Budget Surplus

In November 2012, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved significantly since then. Here is the most recent update from California State Controller Betty Yee: CA Controller’s June Cash Report Shows Another Surge to End 2014-15 Fiscal Year

California ended the fiscal year with another unexpected revenue surge in June, with total General Fund receipts surpassing the Governor’s May estimates by $859.4 million, according to State Controller Betty T. Yee’s monthly report of California’s cash balance, receipts, and disbursements published today.Some states are still struggling, but California is doing much better.

For the second year in a row, the General Fund ended with a positive cash balance.

June capped a 12-month boom in state revenues, driven largely by personal income tax. For the fiscal year ending June 30, total revenues for the General Fund (the source of most state spending) were $6.8 billion more than anticipated a year ago, when the 2014-15 budget was enacted. This was 6.4 percent higher than projected. Compared to the previous fiscal year, California revenues were $12.7 billion higher, a bump of 12.5 percent.

June’s revenues easily outstripped projections included in the Governor’s revised budget released only a month earlier. Personal income tax led the way, coming in $762.5 million higher than anticipated in the May Revision

emphasis added

CoreLogic: "Foreclosure Rate of 1.3 Percent is Back to December 2007 Levels"

by Calculated Risk on 7/14/2015 12:40:00 PM

From CoreLogic: National Overview through May 2015

A CoreLogic analysis shows 41,000 foreclosures were completed in May 2015, a 19.2 percent year-over-year decline from 51,000 in May 2014. By comparison, before the decline in the housing market in 2007, completed foreclosures averaged 21,000 per month nationwide between 2000 and 2006.

...

Approximately 491,000 homes in the United States were in some stage of foreclosure as of May 2015, compared to 676,000 in May 2014, a decrease of 27.4 percent. This was the 43rd consecutive month with a year-over-year decline. As of May 2015, the foreclosure inventory represented 1.3 percent of all homes with a mortgage, compared to 1.7 percent in May 2014.

Click on graph for larger image.

Click on graph for larger image.Here is a map from the May report that shows foreclosure inventory by state.

Some key "bubble" states - like Arizona and California - have mostly recovered.

Several judicial foreclosure states - like New Jersey and Florida - are still struggling.

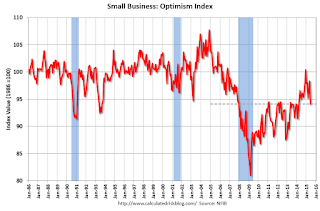

NFIB: Small Business Optimism Index decreased in June

by Calculated Risk on 7/14/2015 10:45:00 AM

From the National Federation of Independent Business (NFIB): Small Business Takes Significant Hit in June

The Small Business Optimism Index fell 4.2 points to 94.1 ... The 42 year Index average is 98.0, while the pre-recession average is 99.5 (1974-2007). This leaves the current reading 4 points below the overall average ...

It looks like small businesses “hired in May and then went away”. So, small businesses took a breather from job creation in June after a string of five solid months of job creation. On balance, owners added a net -0.01 workers per firm in recent months, essentially zero.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 94.1 in June from 98.3 in May. This is the lowest level since May 2014.

Retail Sales decreased 0.3% in June

by Calculated Risk on 7/14/2015 08:39:00 AM

On a monthly basis, retail sales were down 0.3% from May to June (seasonally adjusted), and sales were up 1.4% from June 2014.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for June, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $442.0 billion, a decrease of 0.3 percent from the previous month, but up 1.4 percent above June 2014. ... The April 2015 to May 2015 percent change was revised from +1.2 percent to +1.0 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline decreased 0.4%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales ex-gasoline increased by 3.5% on a YoY basis (1.4% for all retail sales).

Retail and Food service sales ex-gasoline increased by 3.5% on a YoY basis (1.4% for all retail sales).The decrease in June was below the consensus expectations of unchanged, and sales in April and May were revised down. A weak report.

Monday, July 13, 2015

Tuesday: Retail Sales

by Calculated Risk on 7/13/2015 05:56:00 PM

The verdict is almost unanimous. The Greek deal is bad for Greece, bad for Germany and bad for Europe. Everyone loses.

It appears the negotiations became personal - and destructive. Europe was Schäuble'd.

From the WSJ: Third Time’s the Charm? Little Optimism Over New Greece Bailout

The plan repeats the central features of the previous bailouts in 2010 and 2012. In return for loans, Greece’s creditors—other eurozone governments and the International Monetary Fund—want to see stringent fiscal retrenchment as well as market-oriented overhauls of Greece’s economy.The definition of insanity: "doing the same thing over and over again and expecting different results." (attributed to Einstein).

...

Although heavy austerity greatly reduced Greece’s budget deficit, the economic collapse meant that its ratio of debt to gross domestic product—an indicator of solvency—rose even higher. ...

Critics including many economists and some policy makers have leveled a string of criticisms at Greece’s earlier bailouts. Among the most common charges: The scale and pace of fiscal austerity proved to be an overdose that Greece’s sclerotic economy and unstable political system couldn’t cope with. Forecasts for growth, tax revenues and privatization revenues were overly optimistic.

Tuesday:

• At 8:30 AM ET, Retail sales for June will be released. The consensus is for retail sales to increase 0.3% in June, and to increase 0.6% ex-autos.

• At 9:00 AM, NFIB Small Business Optimism Index for June.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.2% increase in inventories.