by Calculated Risk on 7/05/2015 02:38:00 PM

Sunday, July 05, 2015

No!

The Financial Times reports: Early results suggest Greece heads for No With about a third of the vote counted, "No" had 61% of the vote and was leading in every region of Greece.

And from the WSJ: First Official Projection Says at Least 61% of Greeks Voted ‘No’ in Referendum

A first official projection of Greece’s referendum outcome, based on early counting, said that at least 61% of Greeks voted “no” to creditors’ demands on Sunday ...

Shanghai Cliff Diving

by Calculated Risk on 7/05/2015 11:45:00 AM

Note: The polls in Greece close at noon ET, and early results might be available around 2:30 PM ET.

The WSJ has a running discussion: Greek Referendum — Live

Paul Krugman wrote this morning: Meanwhile In China

I am, of course, anxiously awaiting the results of Greferendum, although the next few days in Greece will be terrible whoever wins. But we shouldn’t lose sight of other risks facing the world. ... in the past month, mainly in the past few days, the Shanghai stock index has fallen almost 30 percent.This graph shows the Shanghai SSE Composite Index and the S&P 500 (in blue).

Click on graph for larger image.

Click on graph for larger image.The SSE Composite index is at 3,686.92, down almost 6% on Friday, and down close to 30% from the recent peak.

Saturday, July 04, 2015

Greece Sunday: δίλημμα

by Calculated Risk on 7/04/2015 07:09:00 PM

δίλημμα: Dilemma. There is no good choice on Sunday.

Poor fiscal policies led to the need for a bailout. And the poorly designed bailout program has crushed the Greek economy. Now the creditors want more of the same, expecting a different result; so voting "Yes" seems like the definition of insanity. But a "No" vote will mean complete chaos.

From the WSJ: On Bailout Referendum’s Eve, Greeks Are Deeply Divided on Which Course to Take

Polls have the two sides evenly balanced. There are no public data that break down the demographics and the inclinations of “yes” and “no,” but conversations around this city depict a populace that is split in two: Haves and have-nots, young and old, those bitten by austerity and those less exposed, those with money in the closed banks and those without.From Reuters: Greece's 'yes' voters eye razor thin margin ahead of crucial referendum

The opinion poll by the respected ALCO institute, published in the Ethnos newspaper on Friday, put the "Yes" camp on 44.8 percent against 43.4 percent for the No" vote. But the lead was within the pollster's 3.1 percentage point margin of error, with 11.8 percent saying they are still undecided.From Bloomberg: D-Day for Greek Banks Looms Following Austerity Referendum

Without a fresh injection from the European Central Bank -- or a reduced ceiling on withdrawals -- ATMs will start running dry within hours of the vote, according to Louka Katseli, chairwoman of the National Bank of Greece.Grim.

“Liquidity is adequate through the end of the bank holiday” that’s due to end Monday night, Katseli told reporters Friday as she left meetings at the Finance Ministry. Asked whether developments depend on the ECB, Katseli said “yes.”

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 7/04/2015 12:23:00 PM

An update: Last year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group, Decline in the Labor Force Participation Rate: Mostly Demographics and Long Term Trends, and The Future's so Bright ...

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through June 2015.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

See: Demographics and GDP: 2% is the new 4%

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and is now growing close to 0.5% per year - and this should boost economic activity.

Friday, July 03, 2015

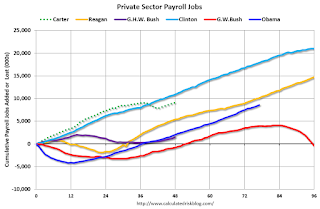

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 7/03/2015 12:15:00 PM

By request, here is an update on an earlier post through the June employment report.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Note: We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,884 |

| Clinton 2 | 10,073 |

| GW Bush 1 | -844 |

| GW Bush 2 | 381 |

| Obama 1 | 2,018 |

| Obama 2 | 6,5161 |

| 129 months into 2nd term: 10,785 pace. | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the third year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 844,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 463,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 2,018,000 more private sector jobs at the end of Mr. Obama's first term. Twenty eight months into Mr. Obama's second term, there are now 8,534,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 638,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -702 |

| Obama 2 | 331 |

| 129 months into 2nd term, 55 pace | |

Looking forward, I expect the economy to continue to expand through 2016 (at least), so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

For the public sector, the cutbacks are clearly over at the state and local levels, and it appears cutbacks at the Federal level might also be over. Right now I'm expecting some increase in public employment during Obama's 2nd term, but nothing like what happened during Reagan's second term.

Here is a table of the top three presidential terms for private job creation (they also happen to be the three best terms for total non-farm job creation).

Clinton's two terms were the best for both private and total non-farm job creation, followed by Reagan's 2nd term.

Currently Obama's 2nd term is on pace to be the 2nd best ever for private job creation. However, with very few public sector jobs added, Obama's 2nd term is only on pace to be the third best for total job creation.

Note: Only 33 thousand public sector jobs have been added during the first twenty nine months of Obama's 2nd term (following a record loss of 702 thousand public sector jobs during Obama's 1st term). This is less than 3% of the public sector jobs added during Reagan's 2nd term!

| Top Employment Gains per Presidential Terms (000s) | ||||

|---|---|---|---|---|

| Rank | Term | Private | Public | Total Non-Farm |

| 1 | Clinton 1 | 10,884 | 692 | 11,576 |

| 2 | Clinton 2 | 10,073 | 1,242 | 11,315 |

| 3 | Reagan 2 | 9,357 | 1,438 | 10,795 |

| Obama 21 | 6,516 | 33 | 6,549 | |

| Pace2 | 10,785 | 55 | 10,840 | |

| 129 Months into 2nd Term 2Current Pace for Obama's 2nd Term | ||||

The second table shows the jobs needed per month for Obama's 2nd term to be in the top three presidential terms.

| Average Jobs needed per month (000s) for Obama's 2nd Term | ||||

|---|---|---|---|---|

| to Rank | Private | Total | ||

| #1 | 230 | 265 | ||

| #2 | 187 | 251 | ||

| #3 | 150 | 223 | ||