by Calculated Risk on 6/27/2015 08:51:00 AM

Saturday, June 27, 2015

Schedule for Week of June 28, 2015

The key report this week is the June employment report on Thursday.

Other key indicators include the June ISM manufacturing index on Wednesday, June vehicle sales on June, and the April Case-Shiller house price index on Tuesday.

10:00 AM: Pending Home Sales Index for May. The consensus is for a 0.6% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for June.

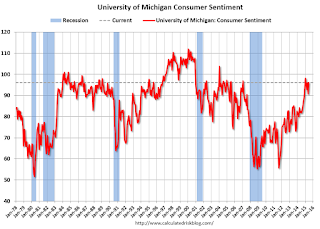

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the March 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.4% year-over-year increase in the Comp 20 index for April. The Zillow forecast is for the National Index to increase 4.0% year-over-year in April, and for prices to be unchanged month-to-month seasonally adjusted.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a reading of 50.6, up from 46.2 in May.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in June, up from 200,000 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 53.2 from 52.8 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 53.2 from 52.8 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion at 52.8% in May. The employment index was at 51.7%, and the new orders index was at 55.8%.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.2 million SAAR in June from 17.7 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 17.2 million SAAR in June from 17.7 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

8:30 AM: Employment Report for June. The consensus is for an increase of 228,000 non-farm payroll jobs added in June, down from the 280,000 non-farm payroll jobs added in May.

The consensus is for the unemployment rate to decrease to 5.4%.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In May, the year-over-year change was almost 3.1 million jobs.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should pickup.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 271 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is a 0.3% decrease in orders.

All US markets will be closed in observance of the Independence Day weekend.

Friday, June 26, 2015

June NFP: Merrill and Nomura Forecasts

by Calculated Risk on 6/26/2015 05:56:00 PM

The June employment report will be released on Thursday, July 2nd. Here are a couple of forecasts:

From Nomura:

[W]e forecast a 230k increase in private payrolls, with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 235k. We forecast that manufacturing employment increased by 5k in June. We forecast that average hourly earnings for private employees rose by 0.17% m-o-m in June, a slower pace than trend due to a calendar quirk. Last, we expect the household survey to show that the unemployment rate ticked down to 5.4% from 5.5%, previously.From Merrill:

We look for job growth of 220,000, a slowdown from the 280,000 pace in May but consistent with the recent trend. As a result, the unemployment rate will likely lower to 5.4% from 5.5%. With the continued tightening in the labor market, we think average hourly earnings (AHE) will increase a “strong” 0.2%, allowing the yoy rate to hold at 2.3%.

Vehicle Sales Forecasts for June: Over 17 Million Annual Rate Again, Best June in a Decade

by Calculated Risk on 6/26/2015 03:41:00 PM

The automakers will report June vehicle sales on Wednesday, July 1st. Sales in May were at 17.7 million on a seasonally adjusted annual rate basis (SAAR), and it appears sales will in June will be over 17 million SAAR again.

Note: There were 26 selling days in June, one less than in June 2014. Here are a few forecasts:

From Edmunds.com: Auto Industry Poised for Best June Sales in a Decade, Forecasts Edmunds.com

Edmunds.com ... forecasts that 1,484,487 new cars and trucks will be sold in the U.S. in June for an estimated Seasonally Adjusted Annual Rate (SAAR) of 17.3 million. The projected sales will be a 9.0 percent decrease from May 2015, but a 4.7 percent increase from June 2014. If the sales volume holds, it will mark the best-selling month of June since 2006, and the biggest June SAAR since 2005.From J.D. Power: June New-Vehicle Retail Sales Strongest For the Month in a Decade

emphasis added

The forecast for new-vehicle retail sales in June 2015 is 1,169,600 units, a 1 percent increase on a selling-day adjusted basis compared with June 2014 and the highest retail sales volume for the month since June 2005, when sales hit 1,350,004. Retail transactions are the most accurate measure of consumer demand for new vehicles. [Total forecast 17.2 million SAAR]From Kelley Blue Book: New-Car Sales To Rise Nearly 6 Percent In June 2015, According To Kelley Blue Book

New-vehicle sales are expected to increase 5.8 percent year-over-year to a total of 1.5 million units in June 2015, resulting in an estimated 17.4 million seasonally adjusted annual rate (SAAR), according to Kelley Blue Book ...Another strong month for auto sales. Let the good times roll!

...

"With another month of new-car sales growth in June 2015, the sixteenth in a row, the auto industry continues its incredibly strong momentum. With a 17.4 million projected SAAR for June, it would mark the third month above 17 million out of the past four months," said Alec Gutierrez, senior analyst for Kelley Blue Book. "However, heading into the summer months, sales should flatten out at a more sustainable pace."

Are Multi-Family Housing Starts near a peak?

by Calculated Risk on 6/26/2015 12:37:00 PM

I'm wondering if multi-family housing starts are near a peak. The architecture billings index for multi-family residential market was negative for the fourth consecutive month, and that suggests a slowdown for new apartment construction later this year.

That doesn't mean apartment construction will slow sharply, especially since demographics are still favorable for apartments (as discussed below). But multi-family construction might move sideways.

However the NMHC Market Tightness Index was still favorable for apartments in Q1, but not as favorable as a few years ago.

Note: Parts of this post are from previous posts.

The first graph shows single (blue) and multi-family (red) housing starts for the last several years.

Multi-family is volatile month-to-month, but it does appear that growth is slowing. Of course multi-family permits were very high last month, so we might see another pickup in starts.

This has been quite a boom for apartments. It was five years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive.

The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

Demographics are still favorable, but my sense is the move "from owning to renting" has slowed. And more supply has been coming online.

On demographics, a large cohort has been moving into the 20 to 34 year old age group (a key age group for renters). Also, in 2015, based on Census Bureau projections, the two largest 5 year cohorts are 20 to 24 years old, and 25 to 29 years old (the largest cohorts are no longer be the "boomers"). Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in the 20 to 34 year age group has been increasing. This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

The circled area shows the recent and projected increase for this group.

From 2020 to 2030, the population for this key rental age group is expected to remain mostly unchanged.

This favorable demographic is a key reason I've been positive on the apartment sector for the last five years - and I expect new apartment construction to stay relatively strong for a few more years.

And on supply, here is the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Note that the blue line (multi-family starts) might be starting to move more sideways.

Whereas multi-family starts were only up slightly in May (NSA), mutli-family completions were up 60%!

Completions will continue to rise - with more supply coming on the market - even if starts do move sideways.

And looking forward on demographics ...

This graph is from 1990 to 2060 (all data from BLS: current to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

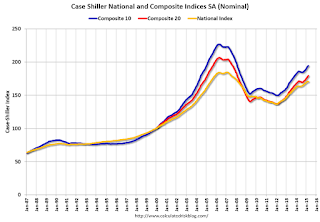

Final June Consumer Sentiment increases to 96.1

by Calculated Risk on 6/26/2015 10:03:00 AM