by Calculated Risk on 6/25/2015 08:35:00 PM

Thursday, June 25, 2015

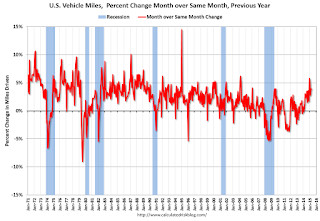

DOT: Vehicle Miles Driven increased 3.9% year-over-year in April, Rolling 12 Months at All Time High

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by 3.9% (10.2 billion vehicle miles) for April 2015 as compared with April 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 267.9 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for April 2015 is 262.4 billion miles, a 3.7% (9.5 billion vehicle miles) increase over April 2014.

The rolling 12 month total is moving up, after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

The second graph shows the year-over-year change from the same month in the previous year.

In April 2015, gasoline averaged of $2.56 per gallon according to the EIA. That was down significantly from April 2014 when prices averaged $3.74 per gallon.

In April 2015, gasoline averaged of $2.56 per gallon according to the EIA. That was down significantly from April 2014 when prices averaged $3.74 per gallon. Gasoline prices aren't the only factor - demographics is also key. However, with lower gasoline prices, miles driven - on a rolling 12 month basis - is at a new high.

Update: "Scariest jobs chart ever"

by Calculated Risk on 6/25/2015 04:18:00 PM

During the recent recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever".

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak (now April 2014 with revisions).

I was asked if I could post an update to the graph, and here it is.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in April 2014, employment is now 2.4% above the previous peak.

Note: most previous recessions end on the graph when employment reached a new peak, although I continued the 2001 recession too. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Freddie Mac: Mortgage Serious Delinquency rate declined in May

by Calculated Risk on 6/25/2015 01:17:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in May to 1.58%, down from 1.66% in April. Freddie's rate is down from 2.10% in May 2014, and the rate in May was the lowest level since November 2008.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for May in a few days.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The serious delinquency rate has fallen 0.52 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until late 2016.

So even though delinquencies and distressed sales are declining, I expect an above normal level of Fannie and Freddie distressed sales through 2016 (mostly in judicial foreclosure states).

Kansas City Fed: Regional Manufacturing Activity Declined in June

by Calculated Risk on 6/25/2015 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Declined at a Slower Pace

The Federal Reserve Bank of Kansas City released the June Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined at a slightly slower pace, and producers’ expectations improved modestly.Some of this recent decline in the Kansas City region has been due to lower oil prices.

“Regional factory conditions continued to decline in June, especially in energy-producing areas,” said Wilkerson. “However, firms continue to expect some stabilization in the months ahead and for orders to rise by the end of the year.”

...

Tenth District manufacturing activity declined at a slightly slower pace than the previous month, and producers’ expectations improved modestly. Most price indexes continued to rise, particularly for raw materials.

The month-over-month composite index was -9 in June, up from -13 in May but down from -7 in April ... On the other hand, although still negative, the new orders, order backlog, employment, and new orders for export indexes edged higher.

emphasis added

Personal Income increased 0.5% in May, Spending increased 0.9%

by Calculated Risk on 6/25/2015 08:46:00 AM

The BEA released the Personal Income and Outlays report for May:

Personal income increased $79.0 billion, or 0.5 percent ... in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $105.9 billion, or 0.9 percent.The following graph shows real Personal Consumption Expenditures (PCE) through May 2015 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.6 percent in May, compared with an increase of less than 0.1 percent in April. ... The price index for PCE increased 0.3 percent in May, compared with an increase of less than 0.1 percent in April. The PCE price index, excluding food and energy, increased 0.1 percent in May, the same increase as in April.

The May price index for PCE increased 0.2 percent from May a year ago. The May PCE price index, excluding food and energy, increased 1.2 percent from May a year ago.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was higher than expected. And the increase in PCE was above the 0.7% increase consensus. A strong report.

On inflation: The PCE price index increased 0.2 percent year-over-year due to the sharp decline in oil prices. The core PCE price index (excluding food and energy) increased 1.2 percent year-over-year in May.

Using the two-month method to estimate Q2 PCE growth, PCE was increasing at a 3.1% annual rate in Q2 2015 (using the mid-month method, PCE was increasing 4.2%). This suggests a rebound in PCE in Q2, and decent Q2 GDP growth.