by Calculated Risk on 6/24/2015 01:11:00 PM

Wednesday, June 24, 2015

Black Knight: Mortgage Delinquencies increased in May

According to Black Knight's First Look report for May, the percent of loans delinquent increased 4% in May compared to April, and declined 12% year-over-year.

The percent of loans in the foreclosure process declined 2% in May and were down 22% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.96% in May, up from 4.77% in April.

The percent of loans in the foreclosure process declined in May to 1.49%. This was the lowest level of foreclosure inventory since January 2008.

The number of delinquent properties, but not in foreclosure, is down 326,000 properties year-over-year, and the number of properties in the foreclosure process is down 212,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for May in early July.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| May 2015 | Apr 2015 | May 2014 | May 2013 | |

| Delinquent | 4.96% | 4.70% | 5.62% | 6.08% |

| In Foreclosure | 1.49% | 1.55% | 1.91% | 3.05% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,591,000 | 1,463,000 | 1,670,000 | 1,708,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 922,000 | 952,000 | 1,169,000 | 1,335,000 |

| Number of properties in foreclosure pre-sale inventory: | 754,000 | 764,000 | 966,000 | 1,525,000 |

| Total Properties | 3,268,000 | 3,179,000 | 3,805,000 | 4,569,000 |

AIA: Architecture Billings Index increased in May

by Calculated Risk on 6/24/2015 10:12:00 AM

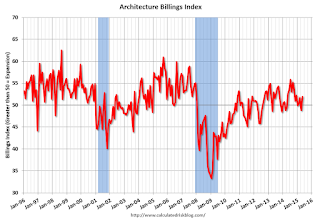

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Returns to Positive Territory

Led by growing demand for new schools, hospitals, cultural facilities and municipal buildings, the Architecture Billings Index (ABI) increased in May following its second monthly drop this year. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the May ABI score was 51.9, up from a mark of 48.8 in April. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.5, up from a reading of 60.1 the previous month.

“As has been the case for the past several years, while the design and construction industry has been in a recovery phase, we continue to receive mixed signals on business conditions in the marketplace,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Generally, the business climate is favorable, but there are still construction sectors and regions of the country that are struggling, producing the occasional backslide in the midst of what seems to be growing momentum for the entire industry.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in May, up from 48.8 in April. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. The multi-family residential market was negative for the fourth consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting an increase in CRE investment in 2015.

Q1 GDP Revised Up to -0.2% Annual Rate

by Calculated Risk on 6/24/2015 08:35:00 AM

From the BEA: Gross Domestic Product: First Quarter 2015 (Third Estimate)

Real gross domestic product -- the value of the production of goods and services in the United States, adjusted for price changes -- decreased at an annual rate of 0.2 percent in the first quarter of 2015, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.2 percent.Here is a Comparison of Third and Second Estimates. PCE growth was revised up from 1.8% to 2.1%. Residential investment was revised up from 5.0% to 6.5%.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the decrease in real GDP was 0.7 percent. With the third estimate for the first quarter, exports decreased less than previously estimated, and personal consumption expenditures (PCE) and imports increased more ...

emphasis added

Q1 will probably be revised up again when the annual revision is released on July 30th.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Index up 18% YoY

by Calculated Risk on 6/24/2015 07:00:00 AM

From the MBA: Refi, Purchase Applications Both Up in Latest MBA Weekly Survey

Mortgage applications increased 1.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 19, 2015....

The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index was unchanged compared with the previous week and was 18 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.19 percent from 4.22 percent, with points decreasing to 0.38 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity has mostly declined recently.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 18% higher than a year ago.

Tuesday, June 23, 2015

Wednesday: GDP

by Calculated Risk on 6/23/2015 08:54:00 PM

From Merrill Lynch:

We look for GDP growth to be revised higher to 0.4% qoq saar in 1Q, a notable improvement from the second release of -0.7%. This reflects stronger consumer spending given the upward revision to March core control retail sales and the QSS survey. We also look for somewhat stronger nonresidential structures investment, although it will continue to be a drag as a result of a drop in mining investment. Residential investment also looks likely to be revised higher as does government spending. Looking ahead, we expect growth to rebound to 3.4% in 2Q. ...CR Note: The annual revision will be released on July 30th, along with the "advance" estimate for Q2 GDP.

This will not be the final revision to 1Q GDP — it will likely be revised yet again with the annual GDP revision in July. A recent hot topic has been that 1Q real GDP has residual seasonality issues. The BEA plans to resolve some of these seasonality issues in the annual revision, thus we could see a sizeable upward revision to 1Q after this upcoming third release.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 1st quarter 2015 (third estimate). The consensus is that real GDP decreased 0.2% annualized in Q1, revised up from the 0.7% decrease second estimate.

• During the day, the AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).