by Calculated Risk on 6/22/2015 10:10:00 AM

Monday, June 22, 2015

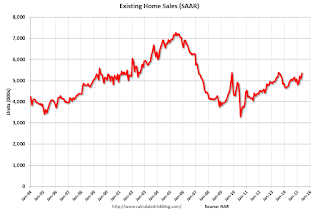

Existing Home Sales in May: 5.35 million SAAR, Inventory up 1.8% Year-over-year

The NAR reports: Existing-Home Sales Bounce Back Strongly in May as First-time Buyers Return

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 5.1 percent to a seasonally adjusted annual rate of 5.35 million in May from an upwardly revised 5.09 million in April. Sales have now increased year-over-year for eight consecutive months and are 9.2 percent above a year ago (4.90 million)....

Total housing inventory at the end of May increased 3.2 percent to 2.29 million existing homes available for sale, and is 1.8 percent higher than a year ago (2.25 million). Unsold inventory is at a 5.1-month supply at the current sales pace, down from 5.2 months in April.

Click on graph for larger image.

Click on graph for larger image.Chicago Fed: "Index shows economic growth slightly below average in May"

by Calculated Risk on 6/22/2015 08:38:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth slightly below average in May

The Chicago Fed National Activity Index (CFNAI) moved up to –0.17 in May from –0.19 in April. Two of the four broad categories of indicators that make up the index increased from April, but only the employment, unemployment, and hours category made a positive contribution to the index in May.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased slightly to –0.16 in May from –0.20 in April. May’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Sunday, June 21, 2015

Monday: Existing Home Sales

by Calculated Risk on 6/21/2015 08:24:00 PM

First a couple of articles on Greece (this is a key week).

From the WSJ: Greece Pitches Last-Ditch Bailout Plan as Crisis Nears Endgame

From Larry Summers at the Financial Times: Greece is no longer about numbers. It is about the high politics of Europe

Pretty grim.

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for May. This is a composite index of other data.

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 6/21/2015 12:36:00 PM

One of the areas I focused on during the housing bubble and subsequent bust was California's Inland Empire.

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.

Saturday, June 20, 2015

Schedule for Week of June 21, 2015

by Calculated Risk on 6/20/2015 08:41:00 AM

The key reports this week are May New Home sales on Tuesday, the 3rd estimate of Q1 GDP on Wednesday, and May Existing Home Sales on Monday.

For manufacturing, the May Richmond and Kansas City Fed surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR).