by Calculated Risk on 5/15/2015 12:47:00 PM

Friday, May 15, 2015

Lawler: Early Read on Existing Home Sales in April

From housing economist Tom Lawler:

Based on available local realtor association/MLS reports from across the country, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.20 million in April, up 0.2% from March’s pace and up 9.5% from last April’s seasonally-adjusted pace.

On the inventory front, local realtor/MLS reports suggest that the monthly gain in the inventory of existing homes for sale last month was smaller than last April’s huge jump, and I project that the NAR’s existing home inventory estimate for April will be 2.23 million, up 11.5% from March but unchanged from last April. I should point out that the NAR’s inventory estimate for April has for many years showed a larger monthly gain – and the May estimate a smaller gain/larger decline – than local realtor/MLS reports would suggest. I’m not sure why, but the differences may reflect different “pull dates” for the publicly-released reports relative to the “NAR” reports realtor associations/MLS send to the NAR.

Finally, local realtor/MLS reports suggest that the median single-family home sales price for April as estimated by the NAR was up about 8.5% from last April.

CR Note: The NAR is scheduled to release April existing home sales on Thursday, May 21st.

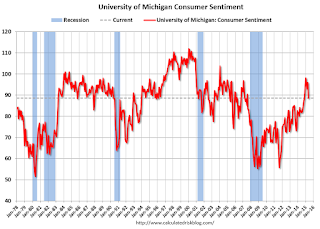

Preliminary May Consumer Sentiment declines to 88.6

by Calculated Risk on 5/15/2015 10:03:00 AM

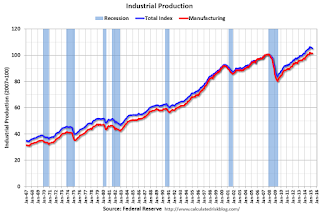

Fed: Industrial Production decreased 0.3% in April

by Calculated Risk on 5/15/2015 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.3 percent in April for its fifth consecutive monthly loss. Manufacturing output was unchanged in April after recording an upwardly revised gain of 0.3 percent in March. In April, the index for mining moved down 0.8 percent, its fourth consecutive monthly decrease; a sharp fall in oil and gas well drilling has more than accounted for the overall decline in mining this year. The output of utilities fell 1.3 percent in April. At 105.2 percent of its 2007 average, total industrial production in April was 1.9 percent above its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in April to 78.2 percent, a rate that is 1.9 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.2% is 1.9% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.3% in April to 105.2. This is 25.6% above the recession low, and 4.4% above the pre-recession peak.

This was below expectations of no change, although March was revised up - and much of the decline over the last few months was due to the "a sharp fall in oil and gas well drilling".

Thursday, May 14, 2015

Friday: Industrial Production, Empire State Mfg, Consumer Sentiment

by Calculated Risk on 5/14/2015 06:43:00 PM

From Professor Tim Duy: Get Used To It

Bottom Line: We probably need to get used to the occasional negative GDP growth numbers in the context of overall expansion for the US economy. The concept of "stall speed" will need to be revised accordingly.Yes, due to demographics, 2% GDP growth is the new 4%.

Friday:

• At 8:30 AM ET, the NY Fed Empire State Manufacturing Survey for May. The consensus is for a reading of 5.0, up from -1.2 last month (above zero is expansion).

• At 9:15 AM, the The Fed will release Industrial Production and Capacity Utilization for April. The consensus is for no change in Industrial Production, and for Capacity Utilization to be unchanged at 78.4%.

At 10:00 AM, the University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 95.8, down from 95.9 in April.

Weekly Initial Unemployment Claims as a Percent of Labor Force

by Calculated Risk on 5/14/2015 03:21:00 PM

Earlier I mentioned that the 4-week moving average of weekly claims was the lowest since April 2000. And if the average falls just a little further, the average will be the lowest in over 40 years.

Of course that doesn't take into account the size of the labor force.

The following graph shows the 4-week moving average of weekly claims since 1967 as a percent of the labor force.

Click on graph for larger image.

As a percent of the labor force, weekly claims are at an all time record low.

Note: There is a general downward slope to weekly claims - interrupted by periods of recession. The downward slope is probably related to changes in hiring practices - such as background checks and drug tests, and maybe better planning.