by Calculated Risk on 4/09/2015 03:01:00 PM

Thursday, April 09, 2015

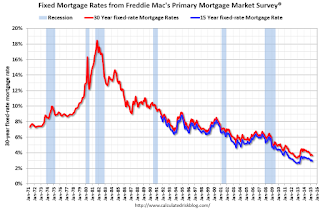

Freddie Mac: 30 Year Mortgage Rates decrease to 3.66% in Latest Weekly Survey

From Freddie Mac today: Mortgage Rates Lower on Weak Jobs Report

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving lower following a weaker than expected jobs report for March. ...

30-year fixed-rate mortgage (FRM) averaged 3.66 percent with an average 0.6 point for the week ending April 9, 2015, down from last week when it averaged 3.70 percent. A year ago at this time, the 30-year FRM averaged 4.34 percent.

15-year FRM this week averaged 2.93 percent with an average 0.6 point, down from last week when it averaged 2.98 percent. A year ago at this time, the 15-year FRM averaged 3.38 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

30 year mortgage rates are up a little (31 bps) from the all time low of 3.35% in late 2012, but down from 4.34% a year ago.

The Freddie Mac survey started in 1971. Mortgage rates were below 5% back in the 1950s.

Lawler: Good Start to Spring home-selling Season

by Calculated Risk on 4/09/2015 12:10:00 PM

From the WSJ: Housing Market Sees Hopeful Signs of Spring

The downturn was brutal for Jacksonville; home sales sank and foreclosures were running at high levels during the crisis. But in recent months, home sales have shot up, the percentage of distressed homes on the market has declined and traffic at model homes in new subdivisions has been brisk.Other cities with solid year-over-year performance are Phoenix and Las Vegas.

Local home builders and real-estate agents report the most vibrant period of home sales since 2006. Finalized sales of existing homes in the Jacksonville area were up 18% in March from a year earlier, and pending sales were up 30% in that span, according to the Northeast Florida Association of Realtors.

...

“The spring home-selling season is off to a very good start,” said Thomas Lawler, a housing economist in Leesburg, Va. “I think the rest of the season is going to be materially better than a year ago.”

Weekly Initial Unemployment Claims increased to 281,000, 4-Week Average Lowest Since 2000

by Calculated Risk on 4/09/2015 08:36:00 AM

The DOL reported:

In the week ending April 4, the advance figure for seasonally adjusted initial claims was 281,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 268,000 to 267,000. The 4-week moving average was 282,250, a decrease of 3,000 from the previous week's revised average. This is the lowest level for this average since June 3, 2000 when it was 281,500. The previous week's average was revised down by 250 from 285,500 to 285,250.The previous week was revised down to 267,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 282,250.

This was below the consensus forecast of 285,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, April 08, 2015

Thursday: Unemployment Claims

by Calculated Risk on 4/08/2015 08:48:00 PM

From the WSJ: After Foreclosures, Home Buyers Are Back

... For those who lost their homes in the early years of the crisis, credit scores are improving as the black marks drop away, improving their ability to borrow again. This could have widespread implications for the U.S. economy, including a boost in demand for mortgages in the coming years.Thursday:

Fair Isaac Corp. ... estimates that there were 910,000 consumers whose credit reports showed they had foreclosure proceedings begin on their homes between October 2007 and October 2008. Of those, some 264,400 had no evidence of the event on their credit reports by last October. That number will rise by up to 645,600 by the end of this year, according to FICO.

“The dark shadow of the foreclosure crisis is finally beginning to fade,” says Mark Zandi, chief economist at Moody’s Analytics, a unit of Moody’s Corp. “That should be a positive for single-family housing and, by extension, for the broader economy.”

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 268 thousand.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.2% increase in inventories.

Goldman: "The Effect of Slowing Energy Sector Activity on Non-Energy Payrolls"

by Calculated Risk on 4/08/2015 04:32:00 PM

An excerpt from a research piece by Goldman Sachs economist Alec Phillips: The Effect of Slowing Energy Sector Activity on Non-Energy Payrolls

Oil & gas-related employment has declined each of the last three months. We find that in previous oil-sector downturns, job growth in non-energy sectors that are closely related to the oil & gas industry--particularly certain segments of manufacturing and construction--has declined by three to four times as much as the decline in oil & gas employment itself. This means that in addition to the 10k or so monthly declines in energy-related jobs we expect over the next several months, we should begin to see more of an effect in these other areas as well.The overall impact of lower oil prices will be a positive on the US economy, however, as Professor Tim Duy noted early this year:

...

Taking a broader view, we continue to expect that lower energy prices should prove a net benefit for growth and we would expect the negative direct and indirect effects of slowing energy activity on the labor market to be offset by the positive effects on employment in industries that are more closely tied to consumption. Overall, we expect monthly payroll growth over the next several months to be roughly in line with the current 3-month average of 197k. If we are correct that weakness in oil-related employment will spill over into slower job growth in closely-related non-energy sectors, the burden will be on consumer-related sectors to produce a greater share of payroll growth than they have on average over the last several months. While this seems likely over the longer run, it does raise the possibility that the negative effects on job growth from slowing oil production, where the adjustment has been more immediate than expected, could be a bit more front-loaded than the employment boost from consumer spending.

I tend agree that the net impact [from the decline in oil prices] will be positive, but note that the negative impacts will be fairly concentrated and easy for the media to sensationalize, while the positive impacts will be fairly dispersed. We all know what is going to happen to rig counts, high-yield energy debt, and the economies of North Dakota and at least parts of Texas. "Kablooey," I think, is the technical term. Easy media fodder. Much more difficult to see the positive impact spread across the real incomes of millions of households, with particularly solid gains at the lower ends of the income distribution. This will be most likely revealed in the aggregate data and be much less newsworthy.To add to Duy, the negative impacts will happen quicker than the positive impacts, but lower oil prices are still a positive for 2015.

emphasis added