by Calculated Risk on 4/06/2015 07:07:00 AM

Monday, April 06, 2015

Black Knight February Mortgage Monitor: Foreclosure Rate still "175 percent above pre-crisis norms"

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for February today. According to BKFS, 5.36% of mortgages were delinquent in February, down from 5.56% in January. BKFS reported that 1.58% of mortgages were in the foreclosure process, down from 2.22% in February 2014.

This gives a total of 6.94% delinquent or in foreclosure. It breaks down as:

• 1,646,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,067,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 800,000 loans in foreclosure process.

For a total of 3,512,000 loans delinquent or in foreclosure in February. This is down from 4,106,000 in February 2014.

From Black Knight:

Delinquency and foreclosure inventories continue to trend towards pre-crisis normsAlso from Black Knight:

February’s delinquency rate, while still 17 percent above the pre-crisis norm of 4.6 percent, was down 49 percent from its January 2010 peak of 10.6 percent

At 1.58 percent, the foreclosure rate remained 175 percent above precrisis norms, but was still down 63 percent from its October 2011 peak

Today, the Data and Analytics division of Black Knight Financial Services released its latest Mortgage Monitor Report, based on data as of the end of February 2015. Black Knight revisited its periodic review of potential refinance candidates, looking at broad-based eligibility criteria, and found that in light of recent mortgage interest rate decreases, the population of potential refinance candidates currently sits at 7.1 million. However, according to Trey Barnes, Black Knight’s senior vice president of Loan Data Products, this number has the potential to decline should rates climb, even marginally.There is much more in the mortgage monitor.

“Black Knight looked at the population of borrowers whose current interest rates – as well as credit scores and loan-to-value ratios – mark them as good candidates for refinancing,” said Barnes. “In February 2014, there were approximately 4.1 million borrowers who could both benefit from and potentially qualify for refinancing their mortgages. Through a combination of declining interest rates and increased equity among borrowers driven by home price increases, an additional three million borrowers now meet the same broad-based eligibility criteria as compared to one year prior. As of the end of February 2015, there were a total of 7.1 million potential refinance candidates.

Sunday, April 05, 2015

Monday: ISM Non-Manufacturing Index

by Calculated Risk on 4/05/2015 07:28:00 PM

From CNBC: Jobs shocker may show economy is in real trouble

The economic data has been weak recently - and Q1 GDP will be weak. This might be due to a combination of seasonal factors, poor weather, the West Cost port slowdown, the stronger dollar and lower oil prices (the negative impacts are more obvious, but overall lower prices will be a positive).

But there is no recession in sight. R-E-L-A-X.

Monday:

• Early, Black Knight Mortgage Monitor for February

• At 10:00 AM ET, the Fed will release the monthly Labor Market Conditions Index (LMCI).

• At 10:00 AM, ISM non-Manufacturing Index for March. The consensus is for a reading of 56.7, down from 56.9 in February. Note: Above 50 indicates expansion.

Weekend:

• Schedule for Week of April 5, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 17 and DOW futures are down 142 (fair value).

Oil prices were mixed over the last week with WTI futures at $49.70 per barrel and Brent at $55.36 per barrel. A year ago, WTI was at $101, and Brent was at $106 - so prices are down 50% or so year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.39 per gallon (down more than $1.10 per gallon from a year ago).

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 4/05/2015 10:55:00 AM

By request, a few more employment graphs ...

Here are the previous posts on the employment report:

• March Employment Report: 126,000 Jobs, 5.5% Unemployment Rate

• Employment Report Comments and Graphs

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and the "less than 5 weeks", "6 to 14 weeks" and "15 to 26 weeks" are all close to normal levels.

The long term unemployed is less than 1.7% of the labor force - the lowest since December 2008 - however the number (and percent) of long term unemployed remains elevated.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 912 thousand.

Construction employment is still far below the bubble peak - and below the level in the late '90s.

The BLS diffusion index for total private employment was at 61.4 in March, down from 65.8 in February.

The BLS diffusion index for total private employment was at 61.4 in March, down from 65.8 in February. For manufacturing, the diffusion index was at 47.5, down from 61.3 in February.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. Above 60 is very good. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Manufacturing was weak in March - probably due to the decline in oil prices, the strong dollar, some weather impact and the effects of the West Coast port slowdown.

Overall private job growth was fairly widespread in March, a good sign.

Saturday, April 04, 2015

Update: Framing Lumber Prices down Year-over-year

by Calculated Risk on 4/04/2015 03:20:00 PM

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices didn't fall as sharply either.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through March 2015 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are down about 9% from a year ago, and CME futures are down 13% year-over-year.

Schedule for Week of April 5, 2015

by Calculated Risk on 4/04/2015 10:49:00 AM

This will be a light week for economic releases.

10:00 AM: ISM non-Manufacturing Index for March. The consensus is for a reading of 56.7, down from 56.9 in February. Note: Above 50 indicates expansion.

At 10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS.

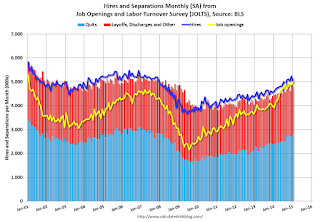

10:00 AM: Job Openings and Labor Turnover Survey for February from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in January to 4.998 million from 4.877 million in December.

The number of job openings (yellow) were up 28% year-over-year, and Quits were up 17% year-over-year.

3:00 PM: Consumer Credit for March from the Federal Reserve. The consensus is for a $14 billion increase in credit.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes for Meeting of March 17-18, 2015

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 285 thousand from 268 thousand.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.2% increase in inventories.