by Calculated Risk on 3/16/2015 05:47:00 PM

Monday, March 16, 2015

Tuesday: Housing Starts

From Reuters: U.S. fuel consumption is soaring amid cheaper prices (ht Shane)

Fuel demand in Texas is growing strongly as lower oil prices encourage motorists to use their vehicles more and buy larger replacements.Tuesday:

Receipts of motor fuel taxes in February 2015 were 6 percent higher than in the same month in 2014, according to the Texas Comptroller of Public Accounts.

• 8:30 AM ET, Housing Starts for February. Total housing starts were at 1.065 million (SAAR) in January. Single family starts were at 678 thousand SAAR in January. The consensus is for total housing starts to decrease to 1.040 million (SAAR) in February.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for January

WTI Crude Oil Falls Close to $43 per Barrel

by Calculated Risk on 3/16/2015 01:54:00 PM

From the WSJ: Oil Prices Fall to Six-Year Intraday Low

Crude prices extended losses in early New York trading on a report, issued by a private data provider, that showed rising oil stockpiles at a key U.S. storage hub. Earlier, oil dropped as traders weighed the prospect of more Iranian crude hitting the global market, as negotiators came closer to a tentative political agreement on Tehran’s nuclear program.

...

Recently, light, sweet crude for April delivery recently fell $1.65, or 3.7%, at $43.19 a barrel on the Nymex. It dipped as low as $42.85 a barrel, the lowest intraday price since March 12, 2009. Oil is now on pace for a five-session losing streak and is down nearly 14% in that span.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI has fallen 2.8% today to $43.52 per barrel, and Brent to $53.23.

WTI oil prices are off almost 60% from the peak last year, and there should be further declines in gasoline prices over the next couple of weeks. Nationally gasoline prices are around $2,42 per gallon, and gasoline futures are down about 4 cents per gallon today.

NAHB: Builder Confidence decreased to 53 in March

by Calculated Risk on 3/16/2015 10:05:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 53 in March, down from 55 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

From Reuters: Builder Confidence Drops Two Points in March

Builder confidence in the market for newly built, single-family homes in March fell two points to a level of 53 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) released today.

“Even with this slight slip, the HMI remains in positive territory and we expect the market to improve as we enter the spring buying season,” said NAHB Chairman Tom Woods, a home builder from Blue Springs, Mo.

“The drop in builder confidence is largely attributable to supply chain issues, such as lot and labor shortages as well as tight underwriting standards,” said NAHB Chief Economist David Crowe. “These obstacles notwithstanding, we are expecting solid gains in the housing market this year, buoyed by sustained job growth, low mortgage interest rates and pent-up demand.”

Two of the three HMI components posted losses in March. The component gauging current sales conditions fell three points to 58 while the component measuring buyer traffic dropped two points to 37. The gauge charting sales expectations in the next six months held steady at 59.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast of 56.

Fed: Industrial Production increased 0.1% in February

by Calculated Risk on 3/16/2015 09:26:00 AM

From the Fed: Industrial production and Capacity Utilization

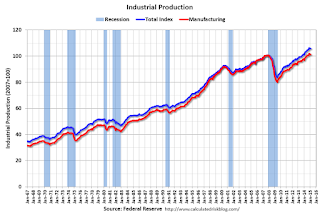

Industrial production increased 0.1 percent in February after decreasing 0.3 percent in January. In February, manufacturing output moved down 0.2 percent, its third consecutive monthly decline. The rates of change for the total index in January and for manufacturing in both December and January are lower than previously reported. The index for mining fell 2.5 percent in February; drops in the indexes for coal mining and for oil and gas well drilling and servicing primarily accounted for the decrease. The output of utilities jumped 7.3 percent, as especially cold temperatures drove up demand for heating. At 105.8 percent of its 2007 average, total industrial production in February was 3.5 percent above its level of a year earlier. Capacity utilization for the industrial sector decreased to 78.9 percent in February, a rate that is 1.2 percentage points below its long-run (1972–2014) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.0 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.9% is 1.2% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.1% in January to 102.8. This is 26.4% above the recession low, and 2.6% above the pre-recession peak.

This was below expectations, and there were downward revisions to prior months.

Sunday, March 15, 2015

Monday: Industrial Production, Empire State Mfg, Homebuilder Confidence

by Calculated Risk on 3/15/2015 09:08:00 PM

From Jim Hamilton: U.S. oil supply update (excerpt):

U.S. crude oil inventories continued to increase last week, signaling that so far supply continues to outstrip demand. And the Wall Street Journal reports a strategy followed by some companies that could enable them to bring production back up quickly if prices recover:Monday:

Now many are adopting a new strategy that will allow them to pump even more crude as soon as oil prices begin to rise. They are drilling wells but holding off on hydraulic fracturing, or forcing in water and chemicals to free oil from shale formations. The delay in the start of fracking lets companies store oil in the ground in a way that enables them to tap it unusually quickly if they wish– and flood the market again.The backlog of wells waiting to be fracked– some are calling it fracklog– adds to the record above-ground inventories to restrain any significant price resurgence. Eventually, however, the economic fundamentals have to prevail, and we will settle down to a price around the true long-run marginal cost. The 2020 WTI futures contract closed at $67/barrel last week. But today North Dakota’s Williston Basin Sweet is fetching less than $29/barrel.

• 8:30 AM ET, the NY Fed Empire State Manufacturing Survey for March. The consensus is for a reading of 7.0, down from 7.8 last month (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.5%.

• At 10:00 AM, the March NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekend:

• Schedule for Week of March 15, 2015

• FOMC Preview: Remove "Patient"

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 5 and DOW futures are down 30 (fair value).

Oil prices were down sharply over the last week with WTI futures at $44.11 per barrel and Brent at $53.56 per barrel. A year ago, WTI was at $99, and Brent was at $107 - so prices are down 50%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.43 per gallon (down about $1.00 per gallon from a year ago). Prices in California are now declining following a refinery fire in February and a strike that is now over.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |