by Calculated Risk on 3/15/2015 11:08:00 AM

Sunday, March 15, 2015

FOMC Preview: Remove "Patient"

The FOMC will meet on Tuesday and Wednesday. The FOMC statement will be released Wednesday at 2:00 PM ET. Fed Chair Janet Yellen will hold a press conference at 2:30 PM. Here is what I expect on Wednesday:

• The initial focus will be on the word "patient" in the FOMC statement. From the January statement:

"Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy."It seems very likely "patient" will be removed on Wednesday.

• How the FOMC discusses inflation will also be important since inflation has declined sharply and is well below the FOMC 2% target. My guess is these sentences will remain about the same, but the FOMC could express more concern about low inflation:

"Inflation has declined further below the Committee’s longer-run objective, largely reflecting declines in energy prices. Market-based measures of inflation compensation have declined substantially in recent months; survey-based measures of longer-term inflation expectations have remained stable.• The key focus will be on Fed Chair Janet Yellen's press conference and the FOMC projections.

...

Inflation is anticipated to decline further in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of lower energy prices and other factors dissipate. The Committee continues to monitor inflation developments closely."

• The following paragraph from Fed Chair Janet Yellen's testimony on February 24th seemed to suggest "patient" would be dropped from the FOMC statement at the meeting this week. Sentence by sentence from her testimony:

The FOMC's assessment that it can be patient in beginning to normalize policy means that the Committee considers it unlikely that economic conditions will warrant an increase in the target range for the federal funds rate for at least the next couple of FOMC meetings.That just repeated the previous understanding. If the FOMC wants to have the option to raise rates in June, they would most likely drop "patient" from the statement in March (June is the second meeting after March).

If economic conditions continue to improve, as the Committee anticipates, the Committee will at some point begin considering an increase in the target range for the federal funds rate on a meeting-by-meeting basis. Before then, the Committee will change its forward guidance.Yes, the FOMC needs to drop "patient" before they move to a meeting-by-meeting basis.

However, it is important to emphasize that a modification of the forward guidance should not be read as indicating that the Committee will necessarily increase the target range in a couple of meetings.This was an important clarification.

My guess is Yellen will reiterate that dropping "patient" does not mean a rate hike is guaranteed two meetings later - just that a hike may be considered based on incoming data (employment and inflation). She will also state that the first rate hike will be data dependent.

• It will also be interesting to see the changes to the FOMC projections. For review, here are the previous projections. GDP is looking weak in Q1, and it is possible GDP projections for 2015 will be decreased slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 2.6 to 3.0 | 2.5 to 3.0 | 2.3 to 2.5 | |

| Sept 2014 Meeting Projections | 2.6 to 3.0 | 2.6 to 2.9 | 2.3 to 2.5 | |

The unemployment rate was at 5.5% in February, so the unemployment rate projection for Q4 2015 might be lowered slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 5.2 to 5.3 | 5.0 to 5.2 | 4.9 to 5.3 | |

| Sept 2014 Meeting Projections | 5.4 to 5.6 | 5.1 to 5.4 | 4.9 to 5.3 | |

As of January, PCE inflation was up only 0.2% from January 2014, and core inflation was up 1.3%. PCE inflation will probably be revised down for 2014, and will be well below the FOMC's 2% target. A key will be projections for 2016 and 2017.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 1.0 to 1.6 | 1.7 to 2.0 | 1.9 to 2.0 | |

| Sept 2014 Meeting Projections | 1.6 to 1.9 | 1.7 to 2.0 | 1.9 to 2.0 | |

PCE core inflation was up only 1.3% in January. A key will be if PCE core inflation is revised down for 2014 in the projections.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2015 | 2016 | 2017 | |

| Dec 2014 Meeting Projections | 1.5 to 1.8 | 1.7 to 2.0 | 1.8 to 2.0 | |

| Sept 2014 Meeting Projections | 1.6 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 | |

Saturday, March 14, 2015

Schedule for Week of March 15, 2015

by Calculated Risk on 3/14/2015 10:00:00 AM

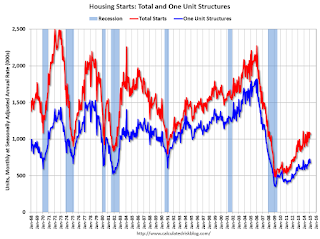

The key economic report this week is February housing starts on Tuesday.

For manufacturing, the February Industrial Production and Capacity Utilization report, and the March NY Fed (Empire State), and Philly Fed surveys, will be released this week.

The FOMC meets on Tuesday and Wednesday.

8:30 AM: NY Fed Empire State Manufacturing Survey for March. The consensus is for a reading of 7.0, down from 7.8 last month (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for February.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.5%.

10:00 AM: The March NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 last month. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for February.

8:30 AM: Housing Starts for February. Total housing starts were at 1.065 million (SAAR) in January. Single family starts were at 678 thousand SAAR in January.

The consensus is for total housing starts to decrease to 1.040 million (SAAR) in February.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for January

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to make no change to policy, however the word "patient" will probably be removed from the statement opening the possibility of a rate hike as early as June.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 293 thousand from 289 thousand.

10:00 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 7.0, up from 5.2 last month (above zero indicates expansion).

No economic releases scheduled.

Friday, March 13, 2015

Year 4: It Never Rains in California

by Calculated Risk on 3/13/2015 07:51:00 PM

Another heat wave in California this weekend (the high was 90 where I live). This is the fourth year in a row with little rain or snow in the mountains (the statewide snowpack is about 17% of normal for this date). California is the largest agricultural state, and an ongoing drought could have an impact on food prices - and on the economy.

An Op-Ed in the LA Times: California has about one year of water left. Will you ration now?

January was the driest in California since record-keeping began in 1895. Groundwater and snowpack levels are at all-time lows. We're not just up a creek without a paddle in California, we're losing the creek too.Maybe it is time to revisit the Alaska-California Undersea Aqueduct proposal.

Data from NASA satellites show that the total amount of water stored in the Sacramento and San Joaquin river basins — that is, all of the snow, river and reservoir water, water in soils and groundwater combined — was 34 million acre-feet below normal in 2014. That loss is nearly 1.5 times the capacity of Lake Mead, America's largest reservoir.

Statewide, we've been dropping more than 12 million acre-feet of total water yearly since 2011. Roughly two-thirds of these losses are attributable to groundwater pumping for agricultural irrigation in the Central Valley. ... Wells are running dry. In some areas of the Central Valley, the land is sinking by one foot or more per year.

As difficult as it may be to face, the simple fact is that California is running out of water.

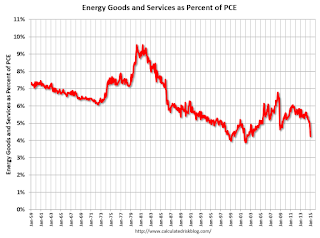

Energy expenditures as a percentage of consumer spending

by Calculated Risk on 3/13/2015 04:06:00 PM

Here is a graph of expenditures on energy goods and services as a percent of total personal consumption expenditures through January 2015.

This is one of the measures that Professor Hamilton at Econbrowser looks at to evaluate any drag on GDP from energy prices.

Click on graph for larger image.

Data source: BEA Table 2.3.5U.

The huge spikes in energy prices during the oil crisis of 1973 and 1979 are obvious. As is the increase in energy prices during the 2001 through 2008 period.

With some further declines - WTI oil futures fell 4% today to $45.09 per barrel - we might see energy expenditures as a percent of PCE at new lows and resume the long term down trend.

CoStar: Commercial Real Estate prices increased in January

by Calculated Risk on 3/13/2015 11:18:00 AM

Here is a price index for commercial real estate that I follow.

From CoStar: CRE Price Indices Start 2015 on a Strong Note with Solid Gains in January

COMPOSITE PRICE INDICES POST SOLID GAINS IN JANUARY 2015. Following a strong 2014, prices for commercial real estate (CRE) continued to climb in January 2015, supported by an expanding economy, strengthening market fundamentals and continued low interest rates. The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—each increased by 1.2% in January 2015, contributing to annual gains of more than 12% in each index.

VALUE-WEIGHTED COMPOSITE INDEX REACHES NEW HIGH. Thanks to steady gains in recent months, the value-weighted U.S. Composite Index reached a record high in January 2015, and now stands 7.5% above its prerecession peak in 2007, reflecting strong competition among investors for large, high-quality commercial properties.

EQUAL-WEIGHTED COMPOSITE INDEX RISES TO WITHIN 13.4% OF PRERECESSION HIGH. After beginning its recovery later in the current cycle, the equal-weighted U.S. Composite Index has continued to grow steadily in the 12 months since January 2014, although it remains 13.4% below its 2007 prerecession peak. The increase in the equal-weighted U.S. Composite Index, which is influenced by smaller deals, reflects the general movement of capital into secondary markets and property types, as investors search for higher yields after property pricing has escalated in core U.S. coastal markets.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is at a record high, but the equal weighted is still 13.4% below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak, but still a little elevated.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.