by Calculated Risk on 2/05/2015 08:39:00 PM

Thursday, February 05, 2015

Friday: Jobs, Jobs, Jobs

Here was an employment preview I posted earlier: Preview for January Employment Report: Taking the Under

Friday:

• At 8:30 AM ET, the Employment Report for January. The consensus is for an increase of 230,000 non-farm payroll jobs added in January, down from the 252,000 non-farm payroll jobs added in December. The consensus is for the unemployment rate to be unchanged at 5.6% in January from 5.6% the previous month.

Notes: The annual benchmark revision will be released with the January report. The preliminary estimate was an additional 7,000 jobs as of March 2014.

Also, the new population controls will be used in the Current Population Survey (CPS) estimation process. It is important to note that "household survey data for January 2015 will not be directly comparable with data for December 2014 or earlier periods".

• At 3:00 PM, Consumer Credit for December from the Federal Reserve. The consensus is for credit to increase $15.0 billion.

Duy: Fed Updates

by Calculated Risk on 2/05/2015 05:17:00 PM

Tim Duy provides a number of thoughts, and I'd like to highlight one: Fed Updates

3.) Fed ready to lower NAIRU? I have argued in the past that if the Fed is faced with ongoing slow wage growth, they would need to reassess their estimates of NAIRU. Cardiff Garcia reminded me:There is much more in Duy's post.

@TheStalwart @TimDuy Whether/extent to which Fed reverts nat-rate estimates to pre-2010 range is one of 2015's big Qs pic.twitter.com/CKieHx2zRCWhile David Wessel adds today:

— Cardiff Garcia (@CardiffGarcia) February 4, 2015

JPMorgan run the Fed's statistical model of the economy and says the NAIRU (which was 5.6%+ through 2013 data) is now down to 5%.Jim O'Sullivan from High Frequency Economics says not yet:

— David Wessel (@davidmwessel) February 5, 2015

"Hard-to-fill" @NFIB jobs series up to 26 in Jan (+1). Corroborates unempl decline, with no sign of lower #NAIRU pic.twitter.com/DVYGyGV4e6A reduction in the Fed's estimate of the natural rate of unemployment would likely mean a delayed and more gradual path of policy tightening, should of course the Fed ever get the chance to pull off the zero bound. Keep an eye on this issue!

— Jim O'Sullivan (@osullivanEcon) February 5, 2015

NAHB: Builder Confidence improves Year-over-year for the 55+ Housing Market in Q4

by Calculated Risk on 2/05/2015 02:20:00 PM

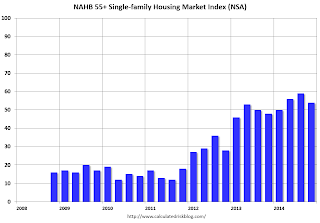

This is a quarterly index from the the National Association of Home Builders (NAHB) and is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low. Note that this index is Not Seasonally Adjusted (NSA) and usually dips in Q4 compared to Q3 (just seasonal).

From the NAHB: Builder Confidence in the 55+ Housing Market Ends Fourth Quarter on a Record High

The fourth quarter results of the National Association of Home Builders’ (NAHB) latest 55+ Housing Market Index (HMI) released today show that builders are feeling quite positive about the market. All segments of the market—single-family homes, condominiums and multifamily rental—registered increases compared to the same quarter a year ago. The single-family index increased six points to a level of 54, which is the highest fourth-quarter reading since the inception of the index in 2008 and the 13th consecutive quarter of year over year improvements.

...

All components of the 55+ single-family HMI posted increases from a year ago: present sales increased five points to 58, expected sales for the next six months rose two points to 64 and traffic of prospective buyers increased six points to 39.

“The strength of the 55+ segment of the housing industry has been fueled in part by rising home values,” said NAHB Chief Economist David Crowe. “Older home owners are finding it easier to sell their existing homes at a favorable price, allowing them to rent or buy a new home in a 55+ community.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ HMI through Q4 2014. The index increased in Q4 to 54 from 48 in Q4 2013. This indicates that more builders view conditions as good than as poor.

There are two key drivers in addition to the improved economy: 1) there is a large cohort moving into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Goldman Sachs Employment Forecast: 210,000 jobs added, Unemployment Rate decline to 5.5%

by Calculated Risk on 2/05/2015 12:40:00 PM

Note: Yesterday I wrote: Preview for January Employment Report: Taking the Under

From Goldman Sachs economist David Mericle: January Payrolls Preview

We forecast nonfarm payroll job growth of 210k in January, below the consensus forecast of 230k. Payroll employment growth exceeded 250k in each of the last four months and averaged 246k over the 12 months of 2014, a substantial pick-up from the 194k average gain in 2013. On balance, labor market indicators were softer in January, with the decline in the ISM non-manufacturing employment index the most notable sign of slower hiring. We also expect a moderately positive two-month back-revision. The January report will also include annual benchmark revisions to payroll employment, but the preliminary revisions released in September indicated very little change.

...

We expect employment gains to push the unemployment rate down to 5.5% in January from an unrounded 5.565% in December, though new population controls that will be included with the January report create some uncertainty.

...

The two-tenths decline in average hourly earnings was the major surprise of the December payrolls report. But as we argued last month, calendar distortions and an unusual pattern of holiday retail hiring likely accounted for most of the downside surprise. We therefore expect average hourly earnings to rebound this month, growing an above-trend +0.4% in January, although we see some risk of a softer January gain coupled with an upward revision to December. Average hourly earnings rose just 1.7% over the year ending in December, contributing to the soft 2.1% year-on-year increase in our wage tracker. We expect an acceleration to around 2.75% by year-end, still well below the 3-4% rate of wage growth that Fed Chair Janet Yellen has identified as normal.

emphasis added

Trade Deficit increases in December to $46.6 Billion

by Calculated Risk on 2/05/2015 08:55:00 AM

The Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $46.6 billion in December, up $6.8 billion from $39.8 billion in November, revised. December exports were $194.9 billion, down $1.5 billion from November. December imports were $241.4 billion, up $5.3 billion from November.The trade deficit was much larger than the consensus forecast of $38.0 billion.

The first graph shows the monthly U.S. exports and imports in dollars through December 2014.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in December.

Exports are 17% above the pre-recession peak and up 1% compared to December 2013; imports are 4% above the pre-recession peak, and up about 5% compared to December 2013.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $73.64 in December, down from $82.95 in November, and down from $91.33 in December 2013. The petroleum deficit has generally been declining and is the major reason the overall deficit has declined since early 2012.

Note: There is a lag due to shipping and long term contracts, but oil prices will really decline over the next several months - and the oil deficit will get much smaller.

The trade deficit with China increased to $28.3 billion in December, from $24.5 billion in December 2013. The deficit with China is a large portion of the overall deficit.

The increase in the trade deficit was due to a higher volume of oil imports (volatile month-to-month), a larger deficit with China, and a larger deficit with the Euro Area ($11.7 billion in Dec 2014 compared to $8.8 billion in Dec 2013).