by Calculated Risk on 2/04/2015 07:01:00 AM

Wednesday, February 04, 2015

MBA: Mortgage Applications increase, FHA Refinance Applications up 76%

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 30, 2015. ...

The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier.

...

“Following several weeks of already elevated refinance activity due to falling interest rates, FHA refinance applications increased 76.5 percent in response to a reduction in annual mortgage insurance premiums which took effect January 26,” said Lynn Fisher, MBA’s Vice President of Research and Economics. “Conventional refinance volume was up only 0.5 percent for the week while VA refinance volume was down 24.3 percent. FHA purchase applications were also up 12.4 percent over the week prior, despite a decrease in purchase applications in the rest of the market.” ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.79 percent, the lowest level since May 2013, from 3.83 percent, with points increasing to 0.29 from 0.26 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

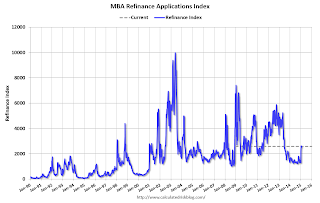

Click on graph for larger image.The first graph shows the refinance index.

2014 was the lowest year for refinance activity since year 2000.

It looks like 2015 will see more refinance activity than in 2014, especially from FHA loans!

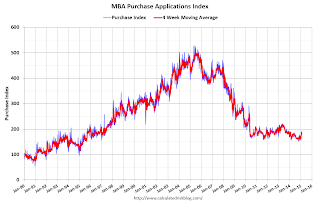

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the purchase index is up 3% from a year ago.

Tuesday, February 03, 2015

Wednesday: ADP Employment, ISM non-Manufacturing

by Calculated Risk on 2/03/2015 09:00:00 PM

From the WSJ: Oil Prices Surge 7% to One-Month High

U.S. oil futures notched a fourth consecutive gain, their longest winning streak since August. Prices have risen 19% in that time. The benchmark crude-oil contract on the New York Mercantile Exchange settled up $3.48, or 7%, at $53.05 a barrel, the highest settlement price since Dec. 31, 2014.Still down almost 50% from a year ago. A wild ride!

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 220,000 payroll jobs added in January, down from 241,000 in December.

• At 10:00 AM, the ISM non-Manufacturing Index for January. The consensus is for a reading of 56.5, up from 56.2 in December. Note: Above 50 indicates expansion.

Lawler: Historical New Housing Put in Place (Completions/Placements)

by Calculated Risk on 2/03/2015 05:51:00 PM

Here is some interesting data (just for background) from housing economist Tom Lawler:

Note: Manufactured housing placements prior to 1974 and for 2014 based on shipments. Census stopped releasing estimates for MH placements this summer.

Note that while the total number of new housing units completed/put in place from 2003 to 2007 was almost identical to that for 1983 to 1987, single-family production was 41% higher.

Since the end of 2007, the number of single-family (attached and detached) homes occupied by renters has probably increased by over 4 million.

| Housing Put in Place by Type (Annual Average, Thousands of Units) | ||||

|---|---|---|---|---|

| Single Family | Multi- family | Manufactured Housing | Total | |

| 1968-72 | 928 | 641 | 435 | 2,004 |

| 1973-77 | 1,061 | 575 | 324 | 1,960 |

| 1978-82 | 1,016 | 487 | 251 | 1,754 |

| 1983-87 | 1,053 | 581 | 269 | 1,903 |

| 1988-92 | 976 | 326 | 202 | 1,504 |

| 1993-07 | 1,102 | 231 | 305 | 1,638 |

| 1998-02 | 1,251 | 324 | 273 | 1,848 |

| 2003-07 | 1,485 | 301 | 119 | 1,905 |

| 2008-12 | 553 | 207 | 57 | 817 |

| 2013 | 569 | 195 | 56 | 820 |

| 2014 | 630 | 264 | 60 | 953 |

U.S. Light Vehicle Sales decrease to 16.6 million annual rate in January

by Calculated Risk on 2/03/2015 02:27:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 16.55 million SAAR in January. That is up 8.9% from January 2013, and down 1.5% from the 16.80 million annual sales rate last month. The comparison to January 2014 was easy (sales were impacted by the severe weather last year).

From John Sousanis at Wards Auto: January 2015 U.S. LV Sales Thread: Trucks Spur Strong January Sales

Led by strong gains in truck sales, U.S. automakers sold 1.149 million light vehicles in January, a 9.3% increase in daily sales (over 26 days) compared with year-ago (25 days). The resultant seasonally adjusted annual rate - roughly 16.55 million - was the industry's highest January SAAR since 2006.

General Motors led all automakers, accounting for 17.7% of the month's LV sales, followed by Ford (15.2%) and Toyota (14.8%).

Subaru recorded the largest year-over-year growth with a 28.3% increase in daily sales, while Volvo and Volkswagen registered industry-worst 3.8% DSR declines.

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for January (red, light vehicle sales of 16.55 million SAAR from WardsAuto).

This was at the consensus forecast of 16.6 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.This was another strong month for vehicle sales - the ninth consecutive month with a sales rate over 16 million.

A few comments on Inflation, the Unemployment Rate and Demographics

by Calculated Risk on 2/03/2015 12:38:00 PM

A key question right now is how low the unemployment rate can fall before inflation picks up. Right now core inflation is falling, but some of that is probably due to bleed through from falling energy prices. So we have to be careful reading too much into the low core inflation numbers.

Last year, many of the "hawks" at the Fed were arguing inflation would pick up when the unemployment rate fell to 6%. They were clearly wrong since the unemployment rate was at 5.6% in December!

Professor Krugman wrote this morning: Tough Fedding

[M]y point is that recent data are perfectly consistent with the view that full employment requires an unemployment rate below 5 percent; the most recent data would suggest an even lower rate. This might or might not be right; I don’t know. But the Fed doesn’t know either.Although monetary policy works with a lag, as Krugman notes, no one knows when inflation will pick up - and the risks of raising too soon far outweigh the risks of waiting too long.

And in the face of that uncertainty, the crucial question is what happens if you’re wrong. And the risks still seem hugely asymmetric.

I'd like to add on inflation that there might be a demographics component, as I noted early this year:

On inflation, I've been looking at this from a demographics perspective. If we look at the annual change in the prime working age population, there is one other period similar to the current situation - the early-to-mid 60s.I expect the FOMC will wait until core inflation is clearly moving back towards their 2% target - and hopefully wait until wage growth is increasing.

...

In the 1960s, inflation didn't pickup until the unemployment rate had fallen close to 4%. There could be several demographics reasons for the low inflation (in addition to policy reasons). As an example, maybe older workers were being replaced by younger workers who made less (just like today), and maybe the slow increase in the prime working age population put less pressure on resources.

Ignoring for the moment monetary and fiscal policy differences between the periods ... maybe the unemployment rate will have to fall below 5% before inflation picks up.