by Calculated Risk on 2/03/2015 05:51:00 PM

Tuesday, February 03, 2015

Lawler: Historical New Housing Put in Place (Completions/Placements)

Here is some interesting data (just for background) from housing economist Tom Lawler:

Note: Manufactured housing placements prior to 1974 and for 2014 based on shipments. Census stopped releasing estimates for MH placements this summer.

Note that while the total number of new housing units completed/put in place from 2003 to 2007 was almost identical to that for 1983 to 1987, single-family production was 41% higher.

Since the end of 2007, the number of single-family (attached and detached) homes occupied by renters has probably increased by over 4 million.

| Housing Put in Place by Type (Annual Average, Thousands of Units) | ||||

|---|---|---|---|---|

| Single Family | Multi- family | Manufactured Housing | Total | |

| 1968-72 | 928 | 641 | 435 | 2,004 |

| 1973-77 | 1,061 | 575 | 324 | 1,960 |

| 1978-82 | 1,016 | 487 | 251 | 1,754 |

| 1983-87 | 1,053 | 581 | 269 | 1,903 |

| 1988-92 | 976 | 326 | 202 | 1,504 |

| 1993-07 | 1,102 | 231 | 305 | 1,638 |

| 1998-02 | 1,251 | 324 | 273 | 1,848 |

| 2003-07 | 1,485 | 301 | 119 | 1,905 |

| 2008-12 | 553 | 207 | 57 | 817 |

| 2013 | 569 | 195 | 56 | 820 |

| 2014 | 630 | 264 | 60 | 953 |

U.S. Light Vehicle Sales decrease to 16.6 million annual rate in January

by Calculated Risk on 2/03/2015 02:27:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 16.55 million SAAR in January. That is up 8.9% from January 2013, and down 1.5% from the 16.80 million annual sales rate last month. The comparison to January 2014 was easy (sales were impacted by the severe weather last year).

From John Sousanis at Wards Auto: January 2015 U.S. LV Sales Thread: Trucks Spur Strong January Sales

Led by strong gains in truck sales, U.S. automakers sold 1.149 million light vehicles in January, a 9.3% increase in daily sales (over 26 days) compared with year-ago (25 days). The resultant seasonally adjusted annual rate - roughly 16.55 million - was the industry's highest January SAAR since 2006.

General Motors led all automakers, accounting for 17.7% of the month's LV sales, followed by Ford (15.2%) and Toyota (14.8%).

Subaru recorded the largest year-over-year growth with a 28.3% increase in daily sales, while Volvo and Volkswagen registered industry-worst 3.8% DSR declines.

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for January (red, light vehicle sales of 16.55 million SAAR from WardsAuto).

This was at the consensus forecast of 16.6 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.This was another strong month for vehicle sales - the ninth consecutive month with a sales rate over 16 million.

A few comments on Inflation, the Unemployment Rate and Demographics

by Calculated Risk on 2/03/2015 12:38:00 PM

A key question right now is how low the unemployment rate can fall before inflation picks up. Right now core inflation is falling, but some of that is probably due to bleed through from falling energy prices. So we have to be careful reading too much into the low core inflation numbers.

Last year, many of the "hawks" at the Fed were arguing inflation would pick up when the unemployment rate fell to 6%. They were clearly wrong since the unemployment rate was at 5.6% in December!

Professor Krugman wrote this morning: Tough Fedding

[M]y point is that recent data are perfectly consistent with the view that full employment requires an unemployment rate below 5 percent; the most recent data would suggest an even lower rate. This might or might not be right; I don’t know. But the Fed doesn’t know either.Although monetary policy works with a lag, as Krugman notes, no one knows when inflation will pick up - and the risks of raising too soon far outweigh the risks of waiting too long.

And in the face of that uncertainty, the crucial question is what happens if you’re wrong. And the risks still seem hugely asymmetric.

I'd like to add on inflation that there might be a demographics component, as I noted early this year:

On inflation, I've been looking at this from a demographics perspective. If we look at the annual change in the prime working age population, there is one other period similar to the current situation - the early-to-mid 60s.I expect the FOMC will wait until core inflation is clearly moving back towards their 2% target - and hopefully wait until wage growth is increasing.

...

In the 1960s, inflation didn't pickup until the unemployment rate had fallen close to 4%. There could be several demographics reasons for the low inflation (in addition to policy reasons). As an example, maybe older workers were being replaced by younger workers who made less (just like today), and maybe the slow increase in the prime working age population put less pressure on resources.

Ignoring for the moment monetary and fiscal policy differences between the periods ... maybe the unemployment rate will have to fall below 5% before inflation picks up.

CoreLogic: House Prices up 5.0% Year-over-year in December

by Calculated Risk on 2/03/2015 09:14:00 AM

Notes: This CoreLogic House Price Index report is for December. The recent Case-Shiller index release was for November. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: Home Prices Up 5 Percent Year Over Year for December 2014

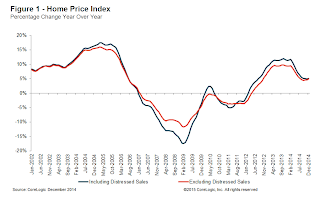

CoreLogic® ... today released its December 2014 CoreLogic Home Price Index (HPI®) which shows that home prices nationwide, including distressed sales, increased 5 percent in December 2014 compared to December 2013. This change represents 34 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, fell by 0.1 percent in December 2014 compared to November 2014.

Twenty-seven states and the District of Columbia are at or within 10 percent of their peak. Three states showed year-over-year home price depreciation, including distressed sales, in December; these states were Maryland (-0.7 percent), Vermont (-0.9 percent) and Connecticut (-2.2 percent).

Excluding distressed sales, home prices increased 4.9 percent in December 2014 compared to December 2013 and increased 0.1 percent month over month compared to November 2014. Distressed sales include short sales and real estate owned (REO) transactions....

“For the full year of 2014, home prices increased 7.4 percent, down from an 11.1-percent increase in 2013,” said Sam Khater, deputy chief economist at CoreLogic. “Nationally, home price growth moderated and stabilized at 5 percent the last four months of the year. The moderation can be clearly seen at the state level, with Colorado, Texas and New York at the high end of appreciation, ending the year with increases of about 8 percent. This contrasts with previous appreciation rates in the double digits—for instance, Nevada and California which experienced increases of more than 20 percent earlier in 2014.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.1% in November, and is up 5.0% over the last year.

This index is not seasonally adjusted, and this small month-to-month decrease was during the seasonally weak period.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty four consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty four consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increases had been slowing, but has mostly moved sideways over the last four months.

Monday, February 02, 2015

Tuesday: Vehicle Sales

by Calculated Risk on 2/02/2015 08:12:00 PM

Two quick observations ...

First, the December construction spending report probably means a slight upward revision to Q4 GDP.

The advance Q2 report showed 4.0% annualized real GDP growth, and that was eventually revised up to 4.6%. And the advance Q3 report showed 3.5%, and that was revised up to 5.0%. Maybe we will eventually get to 3%+ for Q4 ...

Second, on mortgage rates from Matthew Graham at Mortgage News Daily:

Mortgage rates were just slightly higher today, but generally did a good job of holding on to recent gains. For perspective, last Friday was the only day in the past 21 months with lower rates, and many borrowers may find their quotes unchanged over the weekend. Almost everyone else would simply see minor increases in upfront costs as opposed to changes in the contract rate itself. Those remain steady with conforming 30yr fixed rates of 3.625% widely available for top tier scenarios and 3.5% not far behind.Tuesday:

• All day: Light vehicle sales for January. The consensus is for light vehicle sales to decrease to 16.6 million SAAR in January from 16.8 million in December (Seasonally Adjusted Annual Rate).

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for December. The consensus is for a 2.0 decrease in December orders.