by Calculated Risk on 1/19/2015 07:08:00 PM

Monday, January 19, 2015

Tuesday: Homebuilder Confidence

Here is a big convention in Las Vegas, from the WSJ: Larger Home-Builders Show Reflects Industry Optimism

The National Association of Home Builders’ International Builders Show, combined with the Kitchen & Bath Industry Show, is expected to attract 125,000 attendees and occupy 750,000 square feet of meeting and showroom space at the sprawling Las Vegas Convention Center.For a chuckle, here are the NAR's forecast for 2015:

It is the largest edition of the trade show in many years, due partly to its consolidation with other shows and partly to the gradual recovery of the home-building market. It brings with it mildly upbeat outlooks for a return of momentum in the spring season, which unofficially begins after the Super Bowl and typically hits its stride in March.

The National Association of Realtors Chief Economist Lawrence Yun estimates that new-home sales will increase by 41% to 624,000 this year from 2014 and that construction starts for single-family homes will rise by nearly 32% to 840,000.No way!

Tuesday:

• At 10:00 AM ET, the January NAHB homebuilder survey. The consensus is for a reading of 58, up from 57 in December. Any number above 50 indicates that more builders view sales conditions as good than poor.

Weekend:

• Schedule for Week of January 18, 2015

• Update: Predicting the Next Recession

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 4 and DOW futures are down 45 (fair value).

Oil prices were down over the last week with WTI futures at $47.51 per barrel and Brent at $48.84 per barrel. A year ago, WTI was at $93, and Brent was at $107 - so prices are down 49% and 55% year-over-year respectively.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.04 per gallon (down about $1.25 per gallon from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Las Vegas: On Pace for Record Visitor Traffic in 2014, Convention Attendance Slowly Returning

by Calculated Risk on 1/19/2015 01:38:00 PM

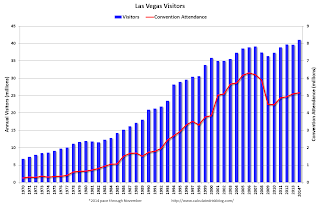

Just an update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2012, although visitor traffic was down slightly in 2013.

We only have data through November, but visitor traffic almost certainly set a new record in 2014.

However convention attendance is only returning slowly. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale).

Through November, visitor traffic in 2014 is running 3.5% above 2013.

Convention traffic is up about 1% from last year, and is still way below the pre-recession peak. In general, the gamblers are back - and the conventions are slowly returning.

Note: I wonder if the previous convention peak in 2005 and 2006 was related to housing related meetings, like "How to Flip a House", "How to Buy with no money down", and "how to build a real estate empire by borrowing against your home and buying Las Vegas houses" type conventions!

Year 4: It Never Rains in California

by Calculated Risk on 1/19/2015 10:14:00 AM

This is worth a mention - the drought in California is a "growing" concern ...

From the San Jose Mercury News: California drought: What happened to the rain?

An unusually wet December has given way to a hot, totally dry January. And it's creating angst among drought-weary residents ...This is the fourth year in a row with little rain or snow in the mountains (the statewide snowpack is about 36% of normal for this date). California is the largest agricultural state, and an ongoing drought could have an impact on food prices - and on the economy.

Weather experts, however, say not to panic. They emphasize that it's too soon to say that California is headed into its fourth straight year of drought. And they point out that a dry January is not out of the ordinary in a typical Northern California winter.

"A midwinter dry spell occurs almost every winter, and it averages 19 days," said meteorologist Jan Null, owner of Golden Gate Weather Services in Saratoga. "Now if it persists on to February and March, then we're getting out of the normal realm."

Sunday, January 18, 2015

Duy: "Will The Fed Take a Dovish Turn Next Week?"

by Calculated Risk on 1/18/2015 11:12:00 PM

Another excellent piece from Tim Duy: Will The Fed Take a Dovish Turn Next Week?

As it stands now, we are heading into the next FOMC meeting with the growing expectation that the Fed will take a dovish turn. Is it not obvious that global economic turmoil, collapsing oil prices, weak inflation, and a stronger dollar are clearly pointing to rapidly rising downside risks to the US economy? For financial market participants, they answer is a clear "yes." Expectations of the first rate hike have been pushed out to the end of this year, seemingly in complete defiance of Fed plans for policy normalization. The Fed may get there as well and abandon their carefully crafted mid-year plan, but I suspect they will not move quite as rapidly as financial market participants desire.

As a general rule, the Fed tends to act in a more deliberate fashion....

Bottom Line: I reiterate my view that despite the generally positive data flow, and the upward boost from oil, I don't see how they can justify raising rates without some reasonable acceleration in wage growth. ... my broader point is this: During normal times the Fed moves methodically if not ponderously. The current state of the economy gives them room to move as such. So I would not be surpised to see a fairly steady hand revealed in the next FOMC statement.

Update: Predicting the Next Recession

by Calculated Risk on 1/18/2015 09:37:00 AM

Recently there has been some discussion of a recession in 2015. That seems very unlikely to me - I'm not even on "recession watch". I decided to repeat a post I wrote in January 2013. (two years ago). This still seems correct - and I've added a few updates in italics.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

[CR Update: 2013 was a little better than I expected, but still sluggish. And 2014 had a weak start, but the last three quarters were solid.]

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR Update: Most of the poor policy choices in the U.S. are behind us. Austerity hurt the recovery, but austerity appears over at the state and local level and diminished at the Federal level.]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR Update: This still seems correct - no recession this year.]