by Calculated Risk on 1/16/2015 01:22:00 PM

Friday, January 16, 2015

Key Measures Show Low Inflation in December

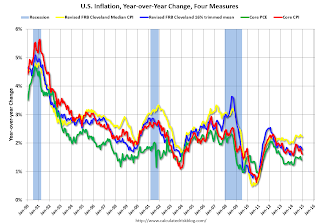

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in December. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for December here. Motor fuel declined at a 69% annualized rate in December, following a 55% annualized rate decline in November, and a 31% annualized rate decline in October!

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.4% (-4.4% annualized rate) in December. The CPI less food and energy was unchanged (0.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.6%. Core PCE is for November and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized, trimmed-mean CPI was at 1.2% annualized, and core CPI was unchanged annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is close to 2%).

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in December

by Calculated Risk on 1/16/2015 11:46:00 AM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in December.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales.

Short sales are down in these areas (except Sacramento).

Foreclosures are up in a few areas (working through the logjam).

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Dec-14 | Dec-13 | Dec-14 | Dec-13 | Dec-14 | Dec-13 | Dec-14 | Dec-13 | |

| Las Vegas | 10.0% | 20.7% | 8.0% | 8.5% | 18.0% | 29.2% | 34.1% | 44.4% |

| Reno** | 8.0% | 24.0% | 5.0% | 4.0% | 13.0% | 28.0% | ||

| Phoenix | 29.2% | 32.9% | ||||||

| Sacramento | 6.2% | 6.1% | 7.1% | 5.4% | 13.3% | 11.5% | 15.4%** | 19.5%** |

| Minneapolis | 3.7% | 5.5% | 12.6% | 17.1% | 16.3% | 22.7% | ||

| Mid-Atlantic | 4.9% | 8.0% | 11.2% | 9.3% | 16.1% | 17.3% | 20.3% | 19.3% |

| Orlando | 4.8% | 13.5% | 26.7% | 19.1% | 31.5% | 32.7% | 40.0% | 45.0% |

| Bay Area CA* | 4.0% | 7.9% | 3.7% | 4.6% | 7.7% | 12.5% | 19.0% | 23.5% |

| So. California* | 6.2% | 10.2% | 5.0% | 5.8% | 11.2% | 16.0% | 23.8% | 28.8% |

| Hampton Roads | 21.5% | 29.1% | ||||||

| Northeast Florida | 30.6% | 37.9% | ||||||

| Toledo | 37.9% | 36.5% | ||||||

| Tucson | 28.7% | 32.3% | ||||||

| Des Moines | 20.3% | 23.1% | ||||||

| Georgia*** | 25.5% | N/A | ||||||

| Omaha | 20.5% | 23.9% | ||||||

| Memphis* | 15.0% | 21.0% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Preliminary January Consumer Sentiment increases to 98.2

by Calculated Risk on 1/16/2015 10:01:00 AM

Fed: Industrial Production decreased 0.1% in December

by Calculated Risk on 1/16/2015 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

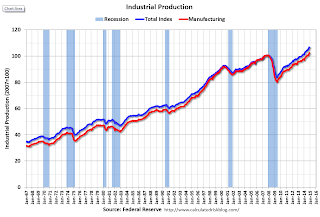

Industrial production decreased 0.1 percent in December after rising 1.3 percent in November. The decrease in December reflected a sharp drop in the output of utilities, as warmer-than-usual temperatures reduced demand for heating; excluding utilities, industrial production rose 0.7 percent. Manufacturing posted a gain of 0.3 percent for its fourth consecutive monthly increase. The index for mining increased 2.2 percent after falling in the previous two months. At 106.5 percent of its 2007 average, total industrial production in December was 4.9 percent above its level of a year earlier. For the fourth quarter of 2014 as a whole, industrial production advanced at an annual rate of 5.6 percent, with widespread gains among the major market and industry groups. Capacity utilization for the industrial sector decreased 0.3 percentage point in December to 79.7 percent, a rate that is 0.4 percentage point below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.7 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.7% is 0.4% below the average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased 0.1% in December to 106.5. This is 27.2% above the recession low, and 5.7% above the pre-recession peak.

This was slightly below expectations.

BLS: CPI decreased 0.4% in December, Core CPI Unchanged

by Calculated Risk on 1/16/2015 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.4 percent in December on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 0.8 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.4% decrease for CPI, and below the forecast of a 0.1% increase in core CPI.

The gasoline index continued to fall sharply, declining 9.4 percent and leading to the decrease in the seasonally adjusted all items index. The fuel oil index also fell sharply, and the energy index posted its largest one-month decline since December 2008, although the indexes for natural gas and for electricity both increased. The food index, in contrast, rose 0.3 percent, its largest increase since September.

The index for all items less food and energy was unchanged in December, following a 0.2 percent increase in October and a 0.1 percent rise in November. This was only the second time since 2010 that it did not increase.

emphasis added