by Calculated Risk on 1/15/2015 08:33:00 PM

Thursday, January 15, 2015

Friday: CPI, Industrial Production, Consumer Sentiment

From Freddie Mac: Mortgage Rates Decline for Third Consecutive Week

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates falling for the third consecutive week as bond yields continued to drop despite a strong employment report. Averaging 3.66 percent, the 30-year fixed-rate mortgage is at its lowest level since the week ending May 23, 2013 when it averaged 3.59 percent. This also marks the first time the 15-year fixed rate mortgage has fallen below 3 percent since the week ending May 30, 2013.Friday:

30-year fixed-rate mortgage (FRM) averaged 3.66 percent with an average 0.6 point for the week ending January 15, 2014, down from last week when it averaged 3.73 percent. A year ago at this time, the 30-year FRM averaged 4.41 percent.

emphasis added

• At 8:30 AM ET, the Consumer Price Index for December. The consensus is for a 0.4% decrease in CPI, and for core CPI to increase 0.1%.

• At 9:15 AM, the The Fed will release Industrial Production and Capacity Utilization for December. The consensus is for no change in Industrial Production, and for Capacity Utilization to decrease to 80.0%.

• At 9:55 AM, the University of Michigan's Consumer sentiment index (preliminary for January). The consensus is for a reading of 94.1, up from 93.6 in December.

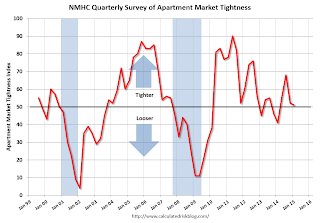

NMHC: Apartment Market Conditions Slightly Tighter in January Survey

by Calculated Risk on 1/15/2015 06:31:00 PM

From the National Multi Housing Council (NMHC): Apartment Markets Moderate Slightly in January NMHC Quarterly Survey

Apartment markets expanded in three of four areas in the January National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions, indicating a slight moderation of the pace of improvement. Only the sales volume index (44) dropped below 50, with market tightness (51), equity financing (55) and debt financing (71) showing continued expansion.

“The apartment markets continue to show strength in most areas,” said Mark Obrinsky, NMHC’s SVP of Research and Chief Economist. “Last year’s ramp-up in new construction finally signaled complete recovery on the supply side. Even so, demand for apartment residences remains strong enough to absorb the increase in deliveries—and then some, as occupancy rates edged up a bit more.”

The Market Tightness Index fell from 52 to 51. More than half (58 percent) of respondents reported unchanged conditions, and slightly over one-fifth (22 percent) saw conditions as tighter than three months ago. Looser conditions were reported by 20 percent of respondents. This is the fourth consecutive quarter where the index has indicated overall improving conditions.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates market conditions were mostly unchanged over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

Lawler: Early Read on Existing Home Sales in December

by Calculated Risk on 1/15/2015 03:28:00 PM

From housing economist Tom Lawler:

Based on local realtor/MLS reports from across the country, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.15 million in December, up 4.5% from November’s pace and up 5.7% from last December’s pace.

On the inventory front, most realtor/MLS reports showed a bigger monthly decline this December compared to last December, and my “guesstimate” is that the NAR will report that the number of existing homes for sale at the end of December was 1,870, down 10.5% from November and up just 0.5% from last December.

Finally, local realtor/MLS data suggest that the national median existing SF home sales price last month was up by about 4.8% from a year earlier.

CR Note: Existing home sales for December will be released next week on Friday, January 23rd.

DataQuick: California Bay Area "Home buying picked up steam" in December

by Calculated Risk on 1/15/2015 02:36:00 PM

From DataQuick: Bay Area Home Sales and Prices Rise in December 2014

Home buying picked up steam late in 2014, with December posting strong month-over-month and year-over-year sales gains. ... A total of 7,456 new and resale houses and condos sold in the nine-county Bay Area in December 2014. That was up month over month 24.2 percent from 6,003 in November 2014 and up year over year 14.1 percent from 6,532 in December 2013, according to CoreLogic DataQuick data.Last month I noted that it seemed like houses were moving again. I wrote 'in my area it seems like a large number of homes went "pending" during the last few weeks' - and sure enough the data suggests a pickup in sales in December.

...

“The Bay Area’s residential real estate market ended 2014 on a cautiously optimistic note, with moderate year-over-year increases in both median price and sales counts,” said John Karevoll, CoreLogic DataQuick analyst. “Supply continues to be constrained, and the mortgage market remains difficult. As long-term trends, cash sales and investor purchases are declining slowly, but they are still significant market factors. We know that there is a significant amount of pent-up demand lying in wait, and there is a good chance the market could see a surge this spring and summer as more homes are put up for sale.”

...

Foreclosure resales accounted for 3.7 percent of all resales in December 2014, up from 2.8 percent in November 2014, and down from 4.6 percent in December 2013. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.6 percent. Foreclosure resales are purchased homes that have been previously foreclosed upon in the prior 12 months.

Short sales made up an estimated 4.0 percent of Bay Area resales in December 2014, up from a revised 3.9 percent in November 2014 and down from 7.9 percent in December 2013. Short sales are transactions in which the sale price fell short of what was owed on the property.

emphasis added

CoStar: Commercial Real Estate prices increased in November

by Calculated Risk on 1/15/2015 01:22:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: CRE Price Recovery Continues With Strong Showing in November

The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—increased by 1% and 0.7%, respectively, in the month of November 2014, contributing to annual gains of 9.9% and 14.8%, respectively, for the 12 months ending in November 2014.

...

VALUE-WEIGHTED U.S. COMPOSITE INDEX SET A NEW HIGH-WATER MARK. Investors’ healthy appetite for core properties propelled growth in the value-weighted U.S. Composite Index, which surpassed its pre-recession peak previously set in 2007 by 5.1% in November 2014.

PRICE GROWTH ACCELERATED IN EQUAL-WEIGHTED INDEX. Price growth in the equal-weighted U.S. Composite Index, influenced more by smaller, non-core deals, accelerated to an annual pace of 14.8% in November 2014, from an average annual pace of 7.5% in 2013.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index indexes.

The value weighted index is at a record high, but the equal weighted is still 14% below the pre-recession peak.

There are indexes by sector and region too.

The second graph shows the percent of distressed "pairs".

The second graph shows the percent of distressed "pairs".The distressed share is down from over 35% at the peak, but still somewhat elevated.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.