by Calculated Risk on 1/06/2015 09:03:00 AM

Tuesday, January 06, 2015

CoreLogic: House Prices up 5.5% Year-over-year in November

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 5.5 Percent Year Over Year in November 2014

Home prices nationwide, including distressed sales, increased 5.5 percent in November 2014 compared to November 2013. This change represents 33 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, rose by 0.1 percent in November 2014 compared to October 2014.

...

Excluding distressed sales, home prices nationally increased 5.3 percent in November 2014 compared to November 2013 and 0.3 percent month over month compared to October 2014. Also excluding distressed sales, all states and the District of Columbia showed year-over-year home price appreciation in November. Distressed sales include short sales and real estate owned (REO) transactions. ...

“After decelerating for most of the year, home price growth has been holding firm between a 5-percent and 6-percent growth rate for the last four months,” said Sam Khater, deputy chief economist at CoreLogic. “However, pockets of weakness are clear in Baltimore and Washington D.C., and three of the top four states with the highest price appreciation are energy intensive and had been benefitting from the energy boom which is currently receding as oil prices trend downward. These states—Texas, Colorado and North Dakota, may see some downward pressure on prices in 2015.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.1% in November, and is up 5.5% over the last year.

This index is not seasonally adjusted, and this small - but positive - month-to-month increase was during the seasonally weak period.

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty three consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty three consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increases had been slowing, but has moved sideways over the last few months.

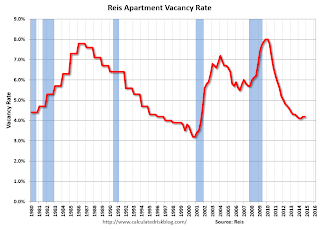

Reis: Apartment Vacancy Rate unchanged in Q4 at 4.2%

by Calculated Risk on 1/06/2015 08:28:00 AM

Reis reported that the apartment vacancy rate was unchanged in Q4 at 4.2%, the same as in Q3. In Q4 2013 (a year ago), the vacancy rate was also at 4.2%, and the rate peaked at 8.0% at the end of 2009.

Some comments from Reis Senior Economist Ryan Severino:

The national vacancy rate was unchanged at 4.2% during the fourth quarter. This follows last quarter's slight 10 basispoint increase in vacancy which was the first increase since the fourth quarter of 2009. Although vacancy did not continue to increase this quarter, the unchanged vacancy rate shows that the days of excess demand are likely over. Additionally, the surge in construction that we have observed in recent periods eased a bit this quarter after increasing during each of the last two quarters. Some of this is due to seasonality ‐ the market tends to slow during the fourth and first quarters of calendar years. Meanwhile, demand had a surprising rebound during the fourth quarter to 45,027 units, the highest quarterly figure since the fourth quarter of 2013. This is an important point ‐ even as construction increases in 2015 and beyond, demand will remain robust due to the large number of young renters in the US. However, as we mentioned last quarter, this is the beginning of an up cycle in vacancy and demand will struggle to keep pace with the significant amounts of new construction that should come online over the next few years.

...

While the market is still very tight at 4.2%, that level of vacancy is not going to be sustainable over the next few years. Supply will outpace demand and vacancy will slowly drift upward. While we still anticipate that the market will remain relatively tight, rising vacancy is likely to put downward pressure on NOI growth over the next few years, even as rents continue to grow.

Asking and effective rents both grew by 0.6% during the fourth quarter. This is a bit of a slowdown from the pace observed during the second and third quarters, but seasonality surely contributed to this. This was the weakest quarterly rate of rent growth since the first quarter of 2013. None the less, the trend in rents over time is up. 2014 annual rent growth for asking and effective rents was 3.5% and 3.6%, respectively. Not only is this the best performance in the apartment market since 2007, but apartment easily remains the best performing property type in this respect. Yet again, rents reached record‐high nominal levels during the fourth quarter. Although an improving labor market with more jobs and faster wage growth should provide landlords with more leverage to increase rents, over time this will be stymied by the sheer number of new units that are going to come online, increasing competition in the market. Although rent growth should remain positive for the next five years, the rate of growth is anticipated to slow, even as new units come online with rents that are higher than the market average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

Apartment vacancy data courtesy of Reis.

Monday, January 05, 2015

Tuesday: ISM Non-Manufacturing Index

by Calculated Risk on 1/05/2015 07:32:00 PM

For fun, here is a graph (click on graph for larger image) from Doug Short and shows the S&P 500 since the 2007 high ...

Tuesday:

• Early: Reis Q4 2014 Apartment Survey of rents and vacancy rates.

• At 10:00 AM ET, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for November. The consensus is for a 0.2 decrease in November orders.

• Also at 10:00 AM ET, ISM non-Manufacturing Index for December. The consensus is for a reading of 58.2, down from 59.3 in November. Note: Above 50 indicates expansion.

U.S. Light Vehicle Sales decrease to 16.8 million annual rate in December

by Calculated Risk on 1/05/2015 02:05:00 PM

Based on a WardsAuto estimate, light vehicle sales were at a 16.75 million SAAR in December. That is up 8.8% from December 2013, and down 1.7% from the 17.09 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 16.75 million SAAR from WardsAuto).

This was below the consensus forecast of 16.9 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was another strong month for vehicle sales - the eighth consecutive month with a sales rate over 16 million - and the best year since 2006.

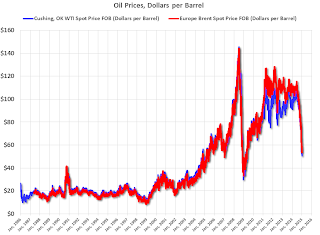

WTI Crude Oil Falls Close to $50 per Barrel

by Calculated Risk on 1/05/2015 11:41:00 AM

From Business Insider: Oil Keeps Falling

US crude and Brent futures dropped to fresh 5-1/2-year lows Monday as worries about a surplus of global supplies amid weak demand continued to drag on oil markets.Note: For why prices are falling, see A Comment on Oil Prices and Question #7 for 2015: What about oil prices in 2015?

At 4.20pm GMT (11.20 am ET), West Texas Intermediate crude was trading at $50.30 a barrel, a decline of more than 4.5% from Friday's close to the lowest level since April 2009.

Brent crude, the international benchmark, was also down more than 5% to below $54 a barrel, the lowest price since May 2009.

Click on graph for larger image

Click on graph for larger imageThis graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI has fallen 4.5% today to $50.31 per barrel, and Brent to $53.33.

Oil prices are off about 53% from the peak last year, and if this price decline holds, there should be further declines in gasoline prices over the next couple of weeks. Nationally gasoline prices are around $2,18 per gallon, and gasoline futures are down about 6 cents per gallon today.