by Calculated Risk on 12/18/2014 10:00:00 AM

Thursday, December 18, 2014

Philly Fed Manufacturing Survey declines to 24.5 in December

From the Philly Fed: December Manufacturing Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased 16 points, from a reading of 40.8 in November to 24.5 this month ... The new orders [to 19.7] and current shipments indexes also weakened significantly.This was at the consensus forecast of a reading of 25.0 for December. Note: These declines were from the extremely high readings in November - usually a reading of 24.5 would be considered robust (above zero indicates expansion).

...

The current employment index fell 15 points [to 9.7] ...

The diffusion index for future activity edged down 6 points, to 51.9, in December ...

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through December. The ISM and total Fed surveys are through November.

The average of the Empire State and Philly Fed surveys declined in December (the Empire State was negative), but this still suggests another decent ISM report for December.

Weekly Initial Unemployment Claims decreased to 289,000

by Calculated Risk on 12/18/2014 08:33:00 AM

From the DOL reported:

In the week ending December 13, the advance figure for seasonally adjusted initial claims was 289,000, a decrease of 6,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 294,000 to 295,000. The 4-week moving average was 298,750, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 250 from 299,250 to 299,500.The previous week was revised up to 295,000.

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 298,750.

This was lower than the consensus forecast of 295,000, and the level suggests few layoffs.

Wednesday, December 17, 2014

Comments on Fed Chair Yellen's Press Conference

by Calculated Risk on 12/17/2014 07:55:00 PM

A few key takeaways:

• There has been no change in FOMC policy. Replacing "considerable time" with "patient" was because we are moving further in time from the end of QE3 . The first rate hike will be a "considerable time" from October.

• "Patient" means it is unlikely the FOMC will raise rates at the next two meetings (not impossible, but very unlikely). Here is the sentence in the statement: "Based on its current assessment, the Committee judges that it can be patient in beginning to normalize the stance of monetary policy". Based on Dr. Yellen's comments, it sounded to me like the FOMC will remove "patient" about two meetings before the first rate hike.

• Yellen was not very concerned about the financial crisis in Russia spilling over into the U.S. She said "spillovers to the United States, both through trade and financial channels, would be small."

• Yellen thought the impact of the decline in oil prices on inflation would be transitory, and that core inflation would move towards the Fed's 2% target.

• Yellen made it clear that a policy change could happen at any meeting (not just meetings followed by a scheduled press conference). She said: “Every meeting that we have is a live meeting at which the committee could make a policy decision and we will feel free to do so. I would really like to strongly discourage the expectation that policy moves can only occur when there’s a scheduled press conference.”

• Yellen reminded everyone that monetary policy works with a lag, and that the FOMC has to forecast when a better labor market will lead to higher inflation (not yet, obviously).

• Yellen argued that it is important that the Fed stay independent. She opposes auditing the Fed's policy decisions (the Fed is already audited financially). Of course the people pushing the policy audits have been wrong about everything ... so we are lucky they are not in charge!

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 295 thousand from 294 thousand.

• At 10:00 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 25.0, down from 40.8 last month (above zero indicates expansion).

Zillow: Negative Equity declines further in Q3 2014, "Down by Almost Half Since 2012 Peak"

by Calculated Risk on 12/17/2014 04:48:00 PM

From Zillow: Negative Equity Down By Almost Half Since 2012 Peak, But There’s Still a Ways to Go

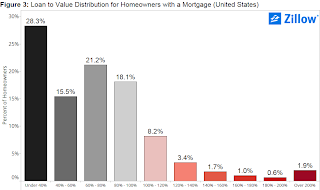

The national negative equity rate continued to decline in the third quarter, falling to 16.9 percent, according to the third quarter Zillow Negative Equity Report, down almost half from its 31.4 percent peak in the first quarter of 2012. More than 7 million previously underwater homeowners, those homeowners owing more on their home than it is worth, have been freed from negative equity since its peak.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q3 2014.

Negative equity fell from 21 percent in the third quarter of 2013 and 17.9 percent in the second quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Nationally, of the homeowners who are underwater, around half are only underwater by 20 percent or less, which is to say they are close to escaping negative equity. (Figure 3) On the other hand, 1.9 percent of owners with a mortgage remain deeply underwater, owing at least twice what their home is worth.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (8.2% in Q3 2014). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or their loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight to ten years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 5.2% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic will release their Q3 negative equity report in the next couple of weeks. For Q2, CoreLogic reported there were 5.3 million properties with negative equity, and that will be down further in Q3 2014.

FOMC Projections and Press Conference

by Calculated Risk on 12/17/2014 02:18:00 PM

Statement here "Considerable time" replaced with "patient" - viewed as consistent with previous statement.

As far as the "Appropriate timing of policy firming", participant views were mostly unchanged (15 participants expect the first rate hike in 2015, and 2 in 2016).

The FOMC projections for inflation are still on the low side through 2017.

Yellen press conference here.

On the projections, GDP for 2014 was revised up, the unemployment rate was revised down again, and inflation projections were revised down (include core inflation). Note: These projections were submitted before the CPI report this morning.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2014 | 2015 | 2016 | 2017 |

| Dec 2014 Meeting Projections | 2.3 to 2.4 | 2.6 to 3.0 | 2.5 to 3.0 | 2.3 to 2.5 |

| Sept 2014 Meeting Projections | 2.0 to 2.2 | 2.6 to 3.0 | 2.6 to 2.9 | 2.3 to 2.5 |

| June 2014 Meeting Projections | 2.1 to 2.3 | 3.0 to 3.2 | 2.5 to 3.0 | n.a. |

The unemployment rate was at 5.8% in October and November.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2014 | 2015 | 2016 | 2017 |

| Dec 2014 Meeting Projections | 5.8 | 5.2 to 5.3 | 5.0 to 5.2 | 4.9 to 5.3 |

| Sept 2014 Meeting Projections | 5.9 to 6.0 | 5.4 to 5.6 | 5.1 to 5.4 | 4.9 to 5.3 |

| June 2014 Meeting Projections | 6.0 to 6.1 | 5.4 to 5.7 | 5.1 to 5.5 | n.a. |

As of October, PCE inflation was up 1.4% from October 2013, and core inflation was up 1.6%. The FOMC expects inflation to remain below their 2% target in 2015 (Note: the FOMC target is symmetrical around 2%).

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2014 | 2015 | 2016 | 2017 |

| Dec 2014 Meeting Projections | 1.2 to 1.3 | 1.0 to 1.6 | 1.7 to 2.0 | 1.9 to 2.0 |

| Sept 2014 Meeting Projections | 1.5 to 1.7 | 1.6 to 1.9 | 1.7 to 2.0 | 1.9 to 2.0 |

| June 2014 Meeting Projections | 1.5 to 1.7 | 1.5 to 2.0 | 1.6 to 2.0 | n.a. |

Here are the FOMC's recent core inflation projections:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2014 | 2015 | 2016 | 2017 |

| Dec 2014 Meeting Projections | 1.5 to 1.6 | 1.5 to 1.8 | 1.7 to 2.0 | 1.8 to 2.0 |

| Sept 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 1.9 | 1.8 to 2.0 | 1.9 to 2.0 |

| June 2014 Meeting Projections | 1.5 to 1.6 | 1.6 to 2.0 | 1.7 to 2.0 | n.a. |