by Calculated Risk on 12/11/2014 12:23:00 PM

Thursday, December 11, 2014

Fed's Flow of Funds: Household Net Worth "dipped slightly" in Q3

The Federal Reserve released the Q3 2014 Flow of Funds report today: Flow of Funds.

According to the Fed, household net worth decreased slightly in Q3 compared to Q2:

The net worth of households and nonprofits dipped slightly to $81.3 trillion during the third quarter of 2014. The value of directly and indirectly held corporate equities decreased $0.7 trillion and the value of real estate rose $245 billion.Prior to the recession, net worth peaked at $67.9 trillion in Q2 2007, and then net worth fell to $54.9 trillion in Q1 2009 (a loss of $13.0 trillion). Household net worth was at $81.3 trillion in Q3 2014 (up $26.4 trillion from the trough in Q1 2009).

The Fed estimated that the value of household real estate increased to $20.4 trillion in Q3 2014. The value of household real estate is still $2.2 trillion below the peak in early 2006.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP. Household net worth, as a percent of GDP, is above peak in 2006 (housing bubble), and above the stock bubble peak.

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc) net of liabilities (mostly mortgages). Note that this does NOT include public debt obligations.

This ratio was increasing gradually since the mid-70s, and then we saw the stock market and housing bubbles. The ratio has been trending up but decreased slightly in Q3.

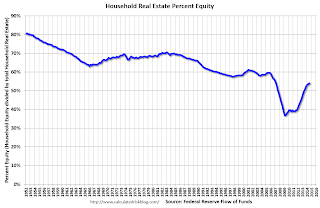

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q3 2014, household percent equity (of household real estate) was at 53.9% - up from Q2, and the highest since Q1 2007. This was because of an increase in house prices in Q3 (the Fed uses CoreLogic).

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have far less than 53.9% equity - and millions still have negative equity.

The third graph shows household real estate assets and mortgage debt as a percent of GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Mortgage debt increased by $12 billion in Q3.

Mortgage debt has declined by $1.26 trillion from the peak. Studies suggest most of the decline in debt has been because of foreclosures (or short sales), but some of the decline is from homeowners paying down debt (sometimes so they can refinance at better rates).

The value of real estate, as a percent of GDP, was down in Q3 (as GDP increased faster than house prices), and somewhat above the average of the last 30 years (excluding bubble).

Weekly Initial Unemployment Claims decreased to 294,000

by Calculated Risk on 12/11/2014 09:15:00 AM

Earlier from the DOL reported:

In the week ending December 6, the advance figure for seasonally adjusted initial claims was 294,000, a decrease of 3,000 from the previous week's unrevised level of 297,000. The 4-week moving average was 299,250, an increase of 250 from the previous week's unrevised average of 299,000.The previous week was unrevised at 297,000.

There were no special factors impacting this week's initial claims

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 299,250.

This was close to the consensus forecast of 296,000, and the level suggests few layoffs.

Retail Sales increased 0.7% in November

by Calculated Risk on 12/11/2014 08:34:00 AM

On a monthly basis, retail sales increased 0.7% from October to November (seasonally adjusted), and sales were up 5.1% from November 2013. Sales in October were revised up from 0.3% to 0.5%.

From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $449.3 billion, an increase of 0.7 percent from the previous month, and 5.1 percent above November 2013. ... The September to October 2014 percent change was revised from +0.3 percent to +0.5 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline increase 0.9%.

Retail sales ex-autos increased 0.5%.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.0% on a YoY basis (5.1% for all retail sales).

Retail sales ex-gasoline increased by 6.0% on a YoY basis (5.1% for all retail sales).The increase in November was above consensus expectations of a 0.4% increase. Both September and October were revised up.

This was a strong report.

Wednesday, December 10, 2014

Thursday: Retail Sales, Unemployment Claims, Q3 Flow of Funds

by Calculated Risk on 12/10/2014 07:24:00 PM

Big stories today: Falling oil prices, possible budget deal, and Q3 GDP likely to be revised up.

On oil prices, from the WSJ: Oil Prices Tumble Amid Global Supply Glut

The benchmark U.S. oil price slid 4.5% to $60.94 a barrel, the lowest level since July 2009 on the New York Mercantile Exchange. It was the biggest one-day drop since Nov. 28, the session that followed OPEC’s decision to maintain its oil-output target.On the budget, from Peter Orzag at Bloomberg: Don't Get Too Excited About the Budget Deal

Brent crude, a gauge of global prices, fell 3.9%, or $2.60, to $64.24 a barrel, also the lowest since July 2009 on ICE Futures Europe.

Thanks to the spending bill that House and Senate leaders have negotiated, the federal government will avoid a shutdown. And that's great. Unfortunately, though, that’s the highest praise that can be attached to the deal.It seems likely there won't be a shutdown. But that is a concern for 2015.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 296 thousand from 297 thousand.

• Also at 8:30 AM, Retail sales for November will be released. The consensus is for retail sales to increase 0.4% in November, and to increase 0.1% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.3% increase in inventories.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in November

by Calculated Risk on 12/10/2014 03:55:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in November.

On distressed: Total "distressed" share is down in these markets mostly due to a decline in short sales (the Mid-Atlantic was unchanged).

Short sales are down significantly in these areas.

Foreclosures are up in Las Vegas and the Mid-Atlantic (working through the logjam).

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Nov-14 | Nov-13 | Nov-14 | Nov-13 | Nov-14 | Nov-13 | Nov-14 | Nov-13 | |

| Las Vegas | 9.5% | 21.0% | 8.7% | 7.0% | 18.2% | 28.0% | 32.8% | 43.7% |

| Reno** | 6.0% | 17.0% | 6.0% | 6.0% | 12.0% | 23.0% | ||

| Phoenix | 28.0% | 34.0% | ||||||

| Minneapolis | 3.1% | 5.0% | 10.2% | 16.9% | 13.4% | 21.9% | ||

| Mid-Atlantic | 4.7% | 7.5% | 11.0% | 8.1% | 15.7% | 15.7% | 19.1% | 19.6% |

| Chicago (City) | 20.2% | 30.8% | ||||||

| Tucson | 26.3% | 32.2% | ||||||

| Toledo | 35.4% | 37.2% | ||||||

| Des Moines | 19.3% | 19.9% | ||||||

| Peoria | 19.7% | 21.8% | ||||||

| Georgia*** | 26.5% | N/A | ||||||

| Omaha | 21.1% | 21.6% | ||||||

| Memphis* | 15.1% | 20.5% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||