by Calculated Risk on 12/01/2014 01:36:00 PM

Monday, December 01, 2014

Housing: Demographics for Renting and Buying

It was over four years ago that we started discussing the turnaround for apartments. Then, in January 2011, I attended the NMHC Apartment Strategies Conference in Palm Springs, and the atmosphere was very positive. (note: the beginning of this post is from an earlier post on apartment supply and demand).

The drivers were 1) very low new supply, and 2) strong demand (favorable demographics, and people moving from owning to renting).

The demographics are still favorable for apartments, since a large cohort is still moving into the 20 to 34 year old age group (a key age group for renters). Also, in 2015, based on Census Bureau projections, the two largest 5 year cohorts will be 20 to 24 years old, and 25 to 29 years old (the largest cohorts will no longer be the "boomers"). Note: Household formation would be a better measure than population, but reliable data for households is released with a long lag.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in the 20 to 34 year age group has been increasing. This is actual data from the Census Bureau for 1985 through 2010, and current projections from the Census Bureau from 2015 through 2035.

The circled area shows the recent and projected increase for this group.

From 2020 to 2030, the population for this key rental age group is expected to remain mostly unchanged.

This favorable demographic is a key reason I've been positive on the apartment sector for the last several years - and I expect new apartment construction to stay strong for several more years.

This graph is from 1990 to 2060 (all data from BLS: 1990 to 2013 is actual, 2014 to 2060 is projected).

We can see the surge in the 20 to 29 age group (red). Once this group exceeded the peak in earlier periods, there was an increase in apartment construction. This age group will peak in 2018 (until the 2030s), and the 25 to 34 age group (orange, dashed) will peak in 2023. This suggests demand for apartments will soften starting around 2020 +/-.

For buying, the 30 to 39 age group (blue) is important (note: see Demographics and Behavior for some reasons for changing behavior). The population in this age group is increasing, and will increase significantly over the next 10+ years.

This demographics is positive for home buying, and this is a key reason I expect single family housing starts to continue to increase in coming years.

ISM Manufacturing index at 58.7 in November

by Calculated Risk on 12/01/2014 10:00:00 AM

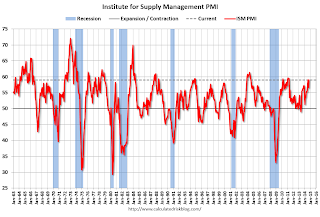

The ISM manufacturing index suggests slightly slower expansion in November than in October. The PMI was at 58.7% in November, down from 59.0% in October. The employment index was at 54.9%, down from 55.5% in October, and the new orders index was at 66.0%, up from 65.8%.

From the Institute for Supply Management: November 2014 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in November for the 18th consecutive month, and the overall economy grew for the 66th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The November PMI® registered 58.7 percent, a decrease of 0.3 percentage point from October’s reading of 59 percent, indicating continued expansion in manufacturing. The New Orders Index registered 66 percent, an increase of 0.2 percentage point from the reading of 65.8 percent in October. The Production Index registered 64.4 percent, 0.4 percentage point below the October reading of 64.8 percent. The Employment Index grew for the 17th consecutive month, registering 54.9 percent, a decrease of 0.6 percentage point below the October reading of 55.5 percent. Inventories of raw materials registered 51.5 percent, a decrease of 1 percentage point from the October reading of 52.5 percent. The Prices Index registered 44.5 percent, down 9 percentage points from the October reading of 53.5 percent, indicating lower raw materials prices in November relative to October. Comments from the panel are upbeat about strong demand and new orders, with some expressing concerns about West Coast port slowdowns and the threat of a potential dock strike."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 58.2%, and indicates solid expansion in November.

Sunday, November 30, 2014

Monday: ISM Manufacturing

by Calculated Risk on 11/30/2014 08:27:00 PM

From Professor Hamilton at Econbrowser: A glut of oil?

The world is awash in oil, I’m hearing. The problem is, it’s fairly expensive oil.Monday:

...

[C]onsider the United States, where production has grown 2 mb/d since 2004. More than 3 mb/d of that growth has come from fracking of oil trapped in tight geologic formations. Without tight oil, U.S. production would be down more than a million barrels a day over the last ten years and down 5-1/2 mb/d from its peak in 1970.

...

So here’s the basic picture. The current surplus of oil was brought about primarily by the success of unconventional oil production in North America, most new investments in which are not sustainable at current prices. Without that production, the price of oil could not remain at current levels. It’s just a matter of how long it takes for the high-cost North American producers to cut back in response to current incentives. And when they do, the price has to go back up.

• At 10:00 AM ET, the ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October. The ISM manufacturing index indicated solid expansion in October at 59.0%. The employment index was at 55.5%, and the new orders index was at 65.8%.

Weekend:

• Schedule for Week of November 30th

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down 4 and DOW futures are down 25 (fair value).

Oil prices were down sharply over the last week with WTI futures at $64.37 per barrel and Brent at $68.50 per barrel. A year ago, WTI was at $93 and Brent was at $111 per barrel - so prices are down more 30% to 40% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.77 per gallon (down about 50 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

WSJ: "Mortgage Lenders Set to Relax Standards"

by Calculated Risk on 11/30/2014 10:16:00 AM

These are the changes (mostly to reps and warrants) that FHFA Director Melvin Watt discussed in October: Prepared Remarks of Melvin L. Watt, Director, FHFA, At the Mortgage Bankers Association Annual Convention

From Joe Light at the WSJ: Mortgage Lenders Set to Relax Standards

Some of the largest U.S. mortgage lenders are preparing to further ease standards for borrowers after the release of new guidelines this month from mortgage giants Fannie Mae and Freddie Mac.This should make mortgages available to more people, but I expect the overall impact will be small.

...

Some lenders, including Wells Fargo & Co. and SunTrust Banks Inc., said borrowers should begin to see initial changes in a few weeks, including faster turnaround times for mortgage applications to be processed.

...

After the financial crisis, Fannie and Freddie made banks repurchase tens of billions of dollars in loans that the companies said didn’t meet their standards. In turn, many lenders stopped making loans to all but the most pristine of borrowers.

In many cases, they required borrowers to have substantially higher credit scores and put in place other measures—so-called credit overlays—that were more stringent than what Fannie and Freddie required.

With the new agreement, “I’ve been told with absolute confidence that some lenders are lifting almost all of their overlays,” said David Stevens, president of the Mortgage Bankers Association.

Saturday, November 29, 2014

Schedule for Week of November 30th

by Calculated Risk on 11/29/2014 01:21:00 PM

The key report this week is the November employment report on Friday.

Other key reports include the November ISM manufacturing index on Monday, November vehicle sales on Tuesday, the November ISM non-manufacturing index on Wednesday, and the October Trade Deficit on Friday.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.

10:00 AM: ISM Manufacturing Index for November. The consensus is for a decrease to 58.2 from 59.0 in October.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated solid expansion in October at 59.0%. The employment index was at 55.5%, and the new orders index was at 65.8%.

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for November. The consensus is for light vehicle sales to increase to 16.5 million SAAR in November from 16.3 million in October (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: Construction Spending for October. The consensus is for a 0.5% increase in construction spending.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 226,000 payroll jobs added in November, down from 230,000 in October.

10:00 AM: ISM non-Manufacturing Index for November. The consensus is for a reading of 57.7, up from 57.1 in October. Note: Above 50 indicates expansion.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 313 thousand.

8:30 AM: Employment Report for November. The consensus is for an increase of 225,000 non-farm payroll jobs added in November, up from the 214,000 non-farm payroll jobs added in October.

The consensus is for the unemployment rate to decline to 5.7% in November.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In October, the year-over-year change was 2.64 million jobs, and it appears the pace of hiring is increasing. Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

8:30 AM: Trade Balance report for October from the Census Bureau.

8:30 AM: Trade Balance report for October from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $41.5 billion in October from $43.0 billion in September.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is for a 0.1 decrease in October orders.

3:00 PM: Consumer Credit for October from the Federal Reserve. The consensus is for credit to increase $16.3 billion.