by Calculated Risk on 11/15/2014 08:11:00 AM

Saturday, November 15, 2014

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in October

Economist Tom Lawler sent me the table below of short sales, foreclosures and cash buyers for a few selected cities in October.

On distressed: Total "distressed" share is down in these markets mostly due to a decline in short sales.

Short sales are down significantly in these areas.

Foreclosures are up slightly in several of these areas.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Oct-14 | Oct-13 | Oct-14 | Oct-13 | Oct-14 | Oct-13 | Oct-14 | Oct-13 | |

| Las Vegas | 10.6% | 21.0% | 8.9% | 6.0% | 19.5% | 27.0% | 35.1% | 44.9% |

| Reno** | 6.0% | 16.0% | 4.0% | 4.0% | 10.0% | 20.0% | ||

| Phoenix | 3.7% | 8.4% | 6.2% | 6.9% | 9.9% | 15.3% | 27.7% | 31.6% |

| Sacramento | 6.1% | 13.7% | 6.3% | 5.9% | 12.4% | 19.6% | 20.6% | 23.9% |

| Minneapolis | 2.7% | 5.1% | 9.8% | 16.4% | 12.5% | 21.5% | ||

| Mid-Atlantic | 4.8% | 8.2% | 10.0% | 7.9% | 14.9% | 16.1% | 19.2% | 19.9% |

| California * | 6.1% | 10.3% | 5.3% | 6.7% | 11.4% | 17.0% | ||

| Bay Area CA* | 3.5% | 7.3% | 2.7% | 3.7% | 6.2% | 11.0% | ||

| So. California* | 5.9% | 10.8% | 4.8% | 6.3% | 10.7% | 17.1% | ||

| Hampton Roads | 19.7% | 25.5% | ||||||

| Northeast Florida | 30.0% | 38.2% | ||||||

| Toledo | 38.2% | 37.1% | ||||||

| Tucson | 26.8% | 32.1% | ||||||

| Des Moines | 18.8% | 20.2% | ||||||

| Peoria | 22.8% | 21.1% | ||||||

| Georgia*** | 27.8% | N/A | ||||||

| Pensacola | 33.5% | 33.7% | ||||||

| Memphis* | 13.3% | 19.8% | ||||||

| Birmingham AL | 15.2% | 21.0% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Friday, November 14, 2014

Lawler: Early Read on Existing Home Sales in October

by Calculated Risk on 11/14/2014 04:22:00 PM

From housing economist Tom Lawler:

Based on local realtor/MLS reports from across the country released so far this month, I estimate that US existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.28 million, up 2.1% from September’s pace and up 2.9% from last October’s pace. My “best guess” is that the NAR’s estimate for the number of existing homes for sale at the end October will be down about 3% from September and up about 5.7% from last October. Finally, I “guesstimate” that the NAR’s estimate for the median existing SF home sales price in October will be up by about 4.4% from last October.

A few notes: first, not all realtor/MLS reports define “inventory” in the same way, and some of the publicly-released reports differ from reports sent to the NAR. These differences have made my NAR inventory estimates less reliable than my sales estimates. Second, lately the NAR median existing SF home sales prices have shown faster YOY growth than local realtor/MLS reports would have suggested, and in September the YOY increase in the median sales price in the Northeast was WAY higher than state realtor report would have indicated. I don’t know why.

I’ll update my estimate next week if newly-released realtor/MLS reports warrant an update.

CR Note: the NAR is scheduled to release October existing home sales next Thursday, The consensus is the NAR will report sales at a 5.10 million SAAR (the consensus will move up once this is posted!)

MBA National Delinquency Survey: Judicial vs. Non-Judicial Foreclosure States in Q3 2014

by Calculated Risk on 11/14/2014 02:13:00 PM

Earlier I posted the MBA National Delinquency Survey press release and a graph that showed mortgage delinquencies and foreclosures by period past due. There is a clear downward trend for mortgage delinquencies, however some states are further along than others. From the press release:

“On an aggregated basis, both judicial and non-judicial states saw decreases in loans in foreclosure, although the judicial states continue to have a combined foreclosure inventory rate that is around three times that of non-judicial states. New Jersey continues to lead the nation in loans in foreclosure, although it saw another decrease from the previous quarter. Florida, once with the highest percentage of loans in foreclosure, experienced a significant decrease in the third quarter. The foreclosure inventory in Florida has declined steadily for over two years now, and the percentage of loans in foreclosure is currently less than half of its peak in 2011. State level trends continue to be driven by local economic factors and state law. For example, a change in DC foreclosure mediation requirements was the likely cause of a shift of loans from the 90 days or more past due status to having the foreclosure process initiated,” [Mike Fratantoni, MBA’s chief economist] said.

Click on graph for larger image.

Click on graph for larger image.This graph is from the MBA and shows the percent of loans in the foreclosure process by state. Posted with permission. Blue is for judicial foreclosure states, and red for non-judicial foreclosure states.

The top states are New Jersey (7.96% in foreclosure, down from 8.10% in Q2), Florida (6.12%, down from 6.81%), New York (5.72%, down from 5.89%), and Maine (4.29% down from 4.51%). Nevada is the only non-judicial state in the top 10, and this is partially due to state laws that slow foreclosures (D.C added some new foreclosure mediation requirements).

Former bubble states California (1.05% down from 1.10%) and Arizona (0.85%, unchanged from Q2) are now far below the national average by every measure.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for nine consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.

For judicial foreclosure states, it appears foreclosure inventory peaked in Q2 2012 (foreclosure inventory is the number of mortgages in the foreclosure process). Foreclosure inventory in the judicial states has declined for nine consecutive quarters. This was three years after the peak in foreclosure inventories for non-judicial states.It looks like the judicial states will have a significant number of distressed sales for a couple more years - however the non-judicial states are closer to normal levels.

MBA: Mortgage Delinquency and Foreclosure Rates Decrease in Q3, Lowest since 2007

by Calculated Risk on 11/14/2014 10:05:00 AM

From the MBA: Mortgage Delinquencies Continue to Decrease in Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 5.85 percent of all loans outstanding at the end of the third quarter of 2014. The delinquency rate decreased for the sixth consecutive quarter and reached the lowest level since the fourth quarter of 2007. The delinquency rate decreased 19 basis points from the previous quarter, and 56 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 2.39 percent, down 10 basis points from the second quarter and 69 basis points lower than one year ago. This was the lowest foreclosure inventory rate seen since the fourth quarter of 2007.

...

“Delinquency rates and the percentage of loans in foreclosure fell to their lowest levels since 2007,” said Mike Fratantoni, MBA’s chief economist. “We are now back to pre-crisis levels for most measures. Foreclosure starts were unchanged on a seasonally adjusted basis, but increased slightly in the raw data. Given that this measure reached the lowest level in eight years last quarter, and given the continued decline in delinquency and foreclosure inventory rates, we expect that the increase in the unadjusted starts rate is just regular seasonal fluctuation.”

...

“On an aggregated basis, both judicial and non-judicial states saw decreases in loans in foreclosure, although the judicial states continue to have a combined foreclosure inventory rate that is around three times that of non-judicial states. New Jersey continues to lead the nation in loans in foreclosure, although it saw another decrease from the previous quarter. Florida, once with the highest percentage of loans in foreclosure, experienced a significant decrease in the third quarter."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of loans delinquent by days past due.

The percent of loans 30 days and 60 days delinquent are back to normal levels.

The 90 day bucket peaked in Q1 2010, and is more than two-thirds of the way back to normal.

The percent of loans in the foreclosure process also peaked in 2010 and is two-thirds of the way back to normal.

So it has taken about 4 years to reduce the backlog of seriously delinquent and in-foreclosure loans by two-thirds, so a rough guess is that serious delinquencies and foreclosure inventory will be back to normal in a couple more years. Most other measures are already back to normal (still working through the backlog).

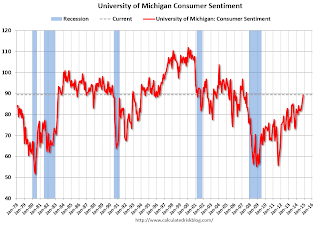

Preliminary November Consumer Sentiment increases to 89.4

by Calculated Risk on 11/14/2014 09:55:00 AM