by Calculated Risk on 11/10/2014 11:42:00 AM

Monday, November 10, 2014

Another Recession Caller

Barry Ritholtz tweeted this morning: "Forcaster who was wrong about recession in 2010 sees recession in 2015" and included a link to this article from Bloomberg: Predictors of ’29 Crash See 65% Chance of 2015 Recession

“Clearly the direction of most of the recent global economic news suggests movement toward a 2015 downturn,” chairman David Levy told clients in an Oct. 23 edition of a monthly forecasting report ... Why the gloom? Levy argues the U.S. and many advanced economies still have balance-sheet excesses exposing them to renewed financial crisis. There is limited room for policy makers to reverse any slump, and low inflation risks tipping into deflation in many parts of the world.Although there are geopolitical downside risks, and there is the potential for some disastrous political showdown in the U.S. (unlikely), I don't see a recession any time soon.

Of course I could be wrong, but currently I'm not on recession watch!

This reminds me of all those recession calls in 2011 and 2012. As an example, ECRI called several recessions since August 2011 and all of their calls were wrong.

Part of the problem in forecasting recently is the sluggish recovery has ups and downs, and each down looks like the start of a recession to some models. Another problem is that negative news sells ... and there is an entire industry that sells doom and gloom. It appears Levy is basing his call on the international showdown, but I doubt that will exert enough of a drag to take the U.S. into recession.

But this does give me a chance to post an update to the recession probability chart from FRED.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph is based on research by economists Chauvet and Piger. From Professor Piger's site:

"Historically, three consecutive months of smoothed probabilities above 80% has been a reliable signal of the start of a new recession, while three consecutive months of smoothed probabilities below 20% has been a reliable signal of the start of a new expansion."This approach is useful for calling a recession in real time (of course, no one thinks the U.S. is in recession now). Longer term, one of the best leading indicators - residential investment - is still increasing and is still very low, and suggests the recovery will continue. I think a recession in 2015 is very unlikely.

FNC: Residential Property Values increased 6.3% year-over-year in September

by Calculated Risk on 11/10/2014 10:03:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their September index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values decreased 0.3% from August to September (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) decreased between 0.4% and 1.0% in September. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

Notes: In addition to the composite indexes, FNC presents price indexes for 30 MSAs. FNC also provides seasonally adjusted data.

The year-over-year (YoY) change was lower in September than in August, with the 100-MSA composite up 6.3% compared to September 2013. In general, for FNC, the YoY increase has been slowing since peaking in February at 9.3%.

The index is still down 19.3% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through September 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

All of the price indexes had been showing a slowdown in price increases.

The September Case-Shiller index will be released on Tuesday, November 25th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

Sunday, November 09, 2014

Sunday Night Futures

by Calculated Risk on 11/09/2014 09:52:00 PM

It seems like I'm posting a link to an article like this every week, from Reuters: U.S. gasoline prices fell 13 cents in past 2 weeks-Lundberg

The average price of a gallon of gasoline in the United States dropped 13 cents in the past two weeks to its cheapest in nearly four years, according to the latest Lundberg survey released on Sunday.Lower gasoline prices should give a boost to retailers (ex-gasoline).

Gasoline prices fell to $2.94 per gallon of regular grade gasoline, its lowest level since December 2010, according to the survey conducted on Nov. 7.

Monday:

• At 10:00 AM ET, the Fed will release the new monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of November 9th

• Employment: Party Like It's 1999!

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are unchanged and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $78.98 per barrel and Brent at $83.87 per barrel. A year ago, WTI was at $95, and Brent was at $105 - so prices are down around 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.91 per gallon (down about 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Employment: Party Like It's 1999!

by Calculated Risk on 11/09/2014 06:13:00 PM

As of the October BLS report, the economy has added 2.225 million private sector jobs, and 2.285 million total jobs in 2014.

To be the best year since 1999, the economy needs to add an additional 176 thousand private sector jobs (probably happen in November), and 222 thousand total nonfarm jobs.

Also interesting: For the first time since 2008, the public sector will add jobs in 2014. State and local governments started adding a few jobs last year, but austerity has been ongoing at the Federal level. According to the WSJ The Federal Government Now Employs the Fewest People Since 1966

Not since July 1966 has the federal government’s workforce been so small. ... But that’s only the raw numbers! As a share of the total workforce ... data going back to 1939 would show no point where the federal government’s share of employment was so low.In the last 75 years (when the BLS started tracking the data), the public sector (non-military) shed jobs in 12 years. Three of those years were at the end of WWII, two in the early '80s, and the last five consecutive years (unprecedented streak since the Great Depression).

Here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

It seems very likely that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,177 | 2,716 |

| 2000 | 1,946 | 1,682 |

| 2001 | -1,735 | -2,286 |

| 2002 | -508 | -741 |

| 2003 | 105 | 147 |

| 2004 | 2,033 | 1,886 |

| 2005 | 2,506 | 2,320 |

| 2006 | 2,085 | 1,876 |

| 2007 | 1,140 | 852 |

| 2008 | -3,576 | -3,756 |

| 2009 | -5,087 | -5,013 |

| 2010 | 1,058 | 1,277 |

| 2011 | 2,083 | 2,400 |

| 2012 | 2,236 | 2,294 |

| 2013 | 2,331 | 2,365 |

| 20141 | 2,742 | 2,670 |

| 1 2014 is current pace annualized (through October). | ||

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 11/09/2014 12:57:00 PM

This is an update to a previous post through October.

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

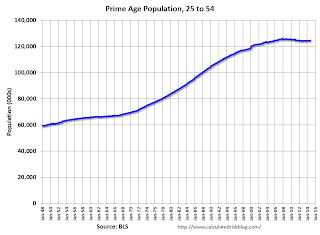

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2014.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.