by Calculated Risk on 11/09/2014 09:52:00 PM

Sunday, November 09, 2014

Sunday Night Futures

It seems like I'm posting a link to an article like this every week, from Reuters: U.S. gasoline prices fell 13 cents in past 2 weeks-Lundberg

The average price of a gallon of gasoline in the United States dropped 13 cents in the past two weeks to its cheapest in nearly four years, according to the latest Lundberg survey released on Sunday.Lower gasoline prices should give a boost to retailers (ex-gasoline).

Gasoline prices fell to $2.94 per gallon of regular grade gasoline, its lowest level since December 2010, according to the survey conducted on Nov. 7.

Monday:

• At 10:00 AM ET, the Fed will release the new monthly Labor Market Conditions Index (LMCI).

Weekend:

• Schedule for Week of November 9th

• Employment: Party Like It's 1999!

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are unchanged and DOW futures are up slightly (fair value).

Oil prices were down over the last week with WTI futures at $78.98 per barrel and Brent at $83.87 per barrel. A year ago, WTI was at $95, and Brent was at $105 - so prices are down around 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.91 per gallon (down about 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Employment: Party Like It's 1999!

by Calculated Risk on 11/09/2014 06:13:00 PM

As of the October BLS report, the economy has added 2.225 million private sector jobs, and 2.285 million total jobs in 2014.

To be the best year since 1999, the economy needs to add an additional 176 thousand private sector jobs (probably happen in November), and 222 thousand total nonfarm jobs.

Also interesting: For the first time since 2008, the public sector will add jobs in 2014. State and local governments started adding a few jobs last year, but austerity has been ongoing at the Federal level. According to the WSJ The Federal Government Now Employs the Fewest People Since 1966

Not since July 1966 has the federal government’s workforce been so small. ... But that’s only the raw numbers! As a share of the total workforce ... data going back to 1939 would show no point where the federal government’s share of employment was so low.In the last 75 years (when the BLS started tracking the data), the public sector (non-military) shed jobs in 12 years. Three of those years were at the end of WWII, two in the early '80s, and the last five consecutive years (unprecedented streak since the Great Depression).

Here is a table of the annual change in total nonfarm and private sector payrolls jobs since 1999. The last three years have been near the best since 1999 (2005 was the best year for total nonfarm, and 2011 the best for private jobs).

It seems very likely that 2014 will be the best year since 1999 for both total nonfarm and private sector employment.

| Change in Payroll Jobs per Year (000s) | ||

|---|---|---|

| Total, Nonfarm | Private | |

| 1999 | 3,177 | 2,716 |

| 2000 | 1,946 | 1,682 |

| 2001 | -1,735 | -2,286 |

| 2002 | -508 | -741 |

| 2003 | 105 | 147 |

| 2004 | 2,033 | 1,886 |

| 2005 | 2,506 | 2,320 |

| 2006 | 2,085 | 1,876 |

| 2007 | 1,140 | 852 |

| 2008 | -3,576 | -3,756 |

| 2009 | -5,087 | -5,013 |

| 2010 | 1,058 | 1,277 |

| 2011 | 2,083 | 2,400 |

| 2012 | 2,236 | 2,294 |

| 2013 | 2,331 | 2,365 |

| 20141 | 2,742 | 2,670 |

| 1 2014 is current pace annualized (through October). | ||

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 11/09/2014 12:57:00 PM

This is an update to a previous post through October.

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

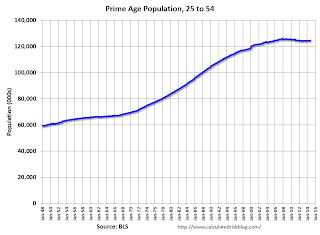

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through October 2014.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

Saturday, November 08, 2014

Unofficial Problem Bank list declines to 419 Institutions

by Calculated Risk on 11/08/2014 04:52:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 7, 2014.

Changes and comments from surferdude808:

Surprising these days to have a bank failure in three out of the past four weeks, but that is just what happened. Along with the failure there were two other removals this week that push the Unofficial Problem Bank List count down to 419 institutions with assets of $131.9 billion. A year ago, the list held 661 institutions with assets of $228.8 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 419.

Frontier Bank, FSB, Palm Desert, CA ($88 million) became the 17th failure this year and 40th institution headquartered in California to fail since the on-set of the Great Recession. Other removals include an action termination at Carver Federal Savings Bank, New York, NY ($648 million) and a change in control and recapitalization of Michigan Commerce Bank, Ann Arbor, MI ($922 million).

Next week should be quiet as the OCC likely will not provide an update on its latest enforcement action activity until November 21st.

Schedule for Week of November 9th

by Calculated Risk on 11/08/2014 11:50:00 AM

The key economic report this week is October retail sales on Friday.

The MBA is expected to release the Q3 National Delinquency Survey on Friday.

At 10:00 AM ET: The Fed will release the new monthly Labor Market Conditions Index (LMCI).

The is a federal/bank holiday. The Bond market will be closed in observance of the Veterans Day. The stock market will be open for trading.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

7:30 AM ET: NFIB Small Business Optimism Index for October.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.2% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 275 thousand from 278 thousand.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in August to 4.835 million from 4.605 million in July.

The number of job openings (yellow) were up 23% year-over-year. Quits were up 5% year-over-year.

2:00 PM ET: The Monthly Treasury Budget Statement for October.

8:30 AM ET: Retail sales for October will be released.

8:30 AM ET: Retail sales for October will be released.This graph shows retail sales since 1992 through September 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales decreased 0.3% from August to September (seasonally adjusted), and sales were up 4.3% from September 2013.

The consensus is for retail sales to increase 0.2% in October, and to increase 0.2% ex-autos.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for November). The consensus is for a reading of 87.5, up from 86.9 in October.

10:00 AM: The Mortgage Bankers Association (MBA) Q3 2014 National Delinquency Survey (NDS).

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for September. The consensus is for a 0.3% increase in inventories.