by Calculated Risk on 10/07/2014 08:49:00 AM

Tuesday, October 07, 2014

CoreLogic: House Prices up 6.4% Year-over-year in August

Notes: This CoreLogic House Price Index report is for August. The recent Case-Shiller index release was for July. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports Home Prices Rose by 6.4 Percent Year Over Year in August 2014

Home prices nationwide, including distressed sales, increased 6.4 percent in August 2014 compared to August 2013. This change represents 30 months of consecutive year-over-year increases in home prices nationally. On a month-over-month basis, home prices nationwide, including distressed sales, increased 0.3 percent in August 2014 compared to July 2014.

...

Excluding distressed sales, home prices nationally increased 5.9 percent in August 2014 compared to August 2013 and 0.3 percent month over month compared to July 2014. Also excluding distressed sales, 49 states and the District of Columbia showed year-over-year home price appreciation in August, with Mississippi being the only state to experience a year-over-year decline. ...

“The pace of year-over-year appreciation continues to slow down as real estate markets find more balance. Home price appreciation reached a peak of almost 12 percent year-over-year in October 2013 and has since subsided to the current pace of 6 percent,” said Mark Fleming, chief economist at CoreLogic. “Continued moderation of home price appreciation is a welcomed sign of more balanced real estate markets and less pressure on affordability for potential home buyers in the near future.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.3% in August, and is up 6.4% over the last year.

This index is not seasonally adjusted, and the index will probably turn negative month-to-month in September.

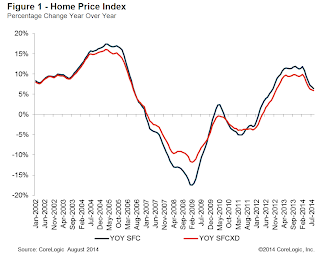

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for thirty consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).The YoY increases continue to slow.

This index was up 8.2% YoY in May, 7.2% in June, 6.8% in July, and now 6.4% in August.

Monday, October 06, 2014

Tuesday: Job Openings

by Calculated Risk on 10/06/2014 08:42:00 PM

An international economic overview from Bonddad: International Week in Review: The Sky Is Not Falling, But the Calculus Has Changed. Excerpt:

At times like this, gloom and doom commentary begins to take center stage as “sky is falling” headlines become click bait for various websites. Unfortunately for the bearish crowd a careful analysis indicates we are not near a major, cataclysmic market or economic event. However, it is clear that the underlying calculus regarding macro-economic analysis has changed, caused by a combination of increased geopolitical conflict, potentially higher interest rates in the US and UK and the ripple effects from this development, and growing economic concern regarding the EU, Japan and, to a lesser extent Australia.Tuesday:

• At 10:00 AM ET, the Job Openings and Labor Turnover Survey for August from the BLS. Jobs openings decreased slightly in July to 4.673 million from 4.675 million in June.

• At 3:00 PM, Consumer Credit for August from the Federal Reserve. The consensus is for credit to increase $20.5 billion.

Fun: News IQ Quiz

by Calculated Risk on 10/06/2014 04:45:00 PM

My view is most people are busy with other aspects of their lives, but these results are still pretty disappointing ...

From Jim Puzzanghera at the LA Times: Less than 1 in 4 Americans in survey know Janet Yellen is Fed chair

Janet L. Yellen made history this year when she became the first woman to lead the Federal Reserve, but most Americans apparently didn't notice.You can take the quiz here. All of the questions are pretty easy for those who follow the news.

Just 24% correctly identified her as the central bank's chair in results of a nationwide poll released Monday.

Nearly half of the respondents -- 48% -- in the Pew Research Center's News IQ survey said they didn't know who was the Fed's current chair after being read a list that included Yellen and three other names.

But I wonder how many people could find the countries mentioned on a map?

Update: Prime Working-Age Population Growing Again

by Calculated Risk on 10/06/2014 01:41:00 PM

This is an update to a previous post through September.

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through August 2014.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due to the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

Fed's Labor Market Conditions Index

by Calculated Risk on 10/06/2014 10:37:00 AM

The Fed staff has developed a labor market indicator that they call the Labor Market Conditions Index (LMCI). From the Fed: Assessing the Change in Labor Market Conditions

This Note describes a dynamic factor model of labor market indicators that we have developed recently, which we call the labor market conditions index (LMCI). ...The Fed staff released the updated LMCI through September this morning. This includes 19 indicators (see link above).

A factor model is a statistical tool intended to extract a small number of unobserved factors that summarize the comovement among a larger set of correlated time series.2 In our model, these factors are assumed to summarize overall labor market conditions.3 What we call the LMCI is the primary source of common variation among 19 labor market indicators. One essential feature of our factor model is that its inference about labor market conditions places greater weight on indicators whose movements are highly correlated with each other. And, when indicators provide disparate signals, the model's assessment of overall labor market conditions reflects primarily those indicators that are in broad agreement.

...

In terms of the average monthly changes, then, the labor market improvement seen in the current expansion has been roughly in line with its typical pace. That said, the cumulative increase in the index since July 2009 ... is still smaller in magnitude than the extraordinarily large decline during the Great Recession (... from January 2008 to June 2009).

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative change in the index. The Fed staff didn't release any commentary this morning, but the cumulative increase is still smaller than the decline during the Great Recession (suggesting slack in the labor market).