by Calculated Risk on 10/02/2014 10:46:00 AM

Thursday, October 02, 2014

Reis: Apartment Vacancy Rate increased in Q3 to 4.2%, First quarterly increase since 2009

Reis reported that the apartment vacancy rate increased in Q3 to 4.2% from 4.1% in Q2. In Q3 2013 (a year ago), the vacancy rate was at 4.3%, and the rate peaked at 8.0% at the end of 2009.

Some comments from Reis Senior Economist Ryan Severino:

The national vacancy rate increased by 10 basis points to 4.2% during the third quarter. This is the first quarterly increase in vacancy since the fourth quarter of 2009. This is something that we have been warning about for some time. The national vacancy rate has been below 5.5% since the third quarter of 2011, a virtually unprecedented run. Ultimately, market conditions that tight were going to serve as a catalyst for new construction activity. Although the surge in construction occurred a bit late, due to the fallout from the Great Recession, it is now arriving. New construction continues to increase over time and will likely reach a post‐recession high this year. Meanwhile, demand has clearly declined from levels observed during 2010 and 2011. This type of slowing is expected, but demand should remain robust. The number of 20‐ to 30‐year olds, the prime rental cohort, will not peak until 2018 which should keep demand rather stout. However, the apartment market, like virtually all property types, is cyclical, and has a propensity to overbuild, even when things are booming. With construction anticipated to outpace net absorption over the next four years, we expect the national vacancy rate to slowly drift upward. However, we do not foresee a massive expansion in vacancy rates of the sort that accompanies recessions.

...

Nonetheless, 4.2% is still an incredibly tight market environment. Even as vacancy drifts slowly higher in the coming years, we do not anticipate that it will not surpass 5% by the end of the forecast horizon in 2018.

Construction overtook demand by a relatively wide margin during the third quarter, with a difference of 8,822 units. The 46,055 units delivered were just behind the fourth quarter of 2013's 47,950 units which are a post‐recession high. Moreover, completions this quarter were higher than completions for all of 2011 at construction's trough. In retrospect, the pullback in completions during the early stages of this year was at least partially attributable to the inclement weather experienced throughout much of the country. Once the weather improved, construction levels accelerated quickly. The market remains posed to deliver the highest level of new completions since 1999 when the economy was booming. That stands in contrast to today when economic growth is accelerating, but hardly booming.

However, net absorption has not ground to a halt. Though down from levels during 2010 and 2011, year to date, net absorption is actually tracking ahead of last year's pace, demonstrating just how strong demand remains ‐ despite the fact that the recovery in demand began four and a half years ago. Demographics are supporting demand. The most common age in the United States is 22, followed closely by 23, and then 21. There are a lot of young people in the market that are predominantly renters and not homeowners. This will continue to provide significant demand, even as new supply growth accelerates.

...

Asking and effective rents both grew by 1.0% during the third quarter. This is an increase from the second quarter and reflective of the seasonality often observed in the apartment market. Rents tend to grow the fastest during warmer months which are more conducive to moving and greater demand for apartment units, all else being equal. Year‐over‐year growth in rents appears to have stalled a bit this quarter. The 12‐month change in rent growth for asking and effective rents is 3.2% and 3.4%, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

Apartment vacancy data courtesy of Reis.

Weekly Initial Unemployment Claims decrease to 287,000

by Calculated Risk on 10/02/2014 08:35:00 AM

The DOL reports:

In the week ending September 27, the advance figure for seasonally adjusted initial claims was 287,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 293,000 to 295,000. The 4-week moving average was 294,750, a decrease of 4,250 from the previous week's revised average. The previous week's average was revised up by 500 from 298,500 to 299,000.The previous week was revised up to 295,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 294,750.

This was below the consensus forecast of 297,000 and in the normal range for an economic expansion.

Wednesday, October 01, 2014

Thursday: Unemployment Claims, Q3 Apartment Vacancy Rate

by Calculated Risk on 10/01/2014 08:56:00 PM

An interesting article on foreign buyers of U.S. real estate from Dionne Searceyoct at the NY Times: Indians Join the Wave of Investors in Condos and Homes in the U.S.

Foreign buyers now make up 7 percent of total existing-home sales ... Of those, Indians represent 6 percent of the purchases, spending $5.8 billion, up from $3.9 billion over the same period a year ago and on par with buyers from Britain.Thursday:

Canadians have long bought American property and still do so in big numbers, with purchases centered for the most part in Arizona, Florida and more recently in Las Vegas. Canada still accounts for the largest share of buyers, but China is the fastest-growing source of clients, according to the realtors’ group.

And Chinese buyers are bigger spenders. Their real estate purchases in the United States nearly doubled from last April to last March, increasing to $22 billion from the previous period. They accounted for nearly a quarter of all international sales in the current period.

• Early, Reis Q3 2014 Apartment Survey of rents and vacancy rates.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 297 thousand from 293 thousand.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 9.4 decrease in August orders.

Zillow: Case-Shiller House Price Index expected to slow further year-over-year in August

by Calculated Risk on 10/01/2014 06:01:00 PM

The Case-Shiller house price indexes for July were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Hopefully Zillow will start estimating the National Index.

From Zillow: Find Out Next Month’s Case-Shiller Numbers Today

The July S&P/Case-Shiller (SPCS) data out this morning indicated continued slowing in the housing market with the annual change in the 20-city index falling to 6.7 percent from 8.1 percent the prior month. Our current forecast for SPCS next month indicates further slowing with the annual increase in the 20-City Composite Home Price Index falling to 5.7 percent in August.So the Case-Shiller index will probably show a lower year-over-year gain in August than in July (6.7% year-over-year for the Composite 20 in July, 5.6% year-over-year for the National Index).

The non-seasonally adjusted (NSA) monthly increase in July for the 20-City index was 0.6 percent, and we expect it to fall to 0.3 percent next month.

All forecasts are shown in the table below. These forecasts are based on the July SPCS data release this morning and the August 2014 Zillow Home Value Index (ZHVI), released September 18. Officially, the SPCS Composite Home Price Indices for August will not be released until Tuesday, October 28.

| Zillow August 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | August 2013 | 178.71 | 174.56 | 164.49 | 160.57 |

| Case-Shiller (last month) | July 2014 | 188.29 | 184.50 | 173.34 | 169.67 |

| Zillow Forecast | YoY | 5.8% | 5.8% | 5.7% | 5.7% |

| MoM | 0.4% | 0.1% | 0.3% | 0.1% | |

| Zillow Forecasts1 | 189.1 | 184.7 | 173.9 | 169.8 | |

| Current Post Bubble Low | 146.45 | 149.90 | 134.07 | 137.12 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 29.1% | 23.2% | 29.7% | 23.8% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

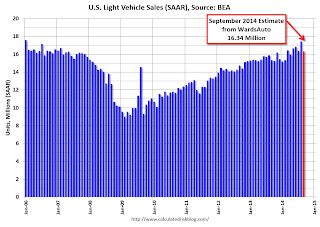

U.S. Light Vehicle Sales decrease to 16.34 million annual rate in September

by Calculated Risk on 10/01/2014 02:58:00 PM

Based on an WardsAuto estimate, light vehicle sales were at a 16.34 million SAAR in September. That is up 7% from September 2013, but down 6% from the 17.4 million annual sales rate last month.

This was below the consensus forecast of 16.8 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for September (red, light vehicle sales of 17.34 million SAAR from WardsAuto).

From WardsAuto:

After an August sales spike that drove the monthly SAAR to 17.45 million, September U.S. light vehicle sales cooled somewhat, dropping to an annualized rate just below 16.4 million on deliveries of 1.24 million LVs.

September's tally, nonetheless, represented a 4.7% uptick in daily sales compared with same-month year-ago, and brought year-to-date deliveries to 12.37 million units, a 5.4% improvement over the first nine months of 2013.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

This was the fifth consecutive month with a sales rate over 16 million.