by Calculated Risk on 9/25/2014 07:01:00 AM

Thursday, September 25, 2014

Black Knight: Mortgage Delinquencies increased in August

According to Black Knight's First Look report for August, the percent of loans delinquent increased in August compared to July - mostly due to an increase in short term delinquencies - and declined by 5% year-over-year.

Note: Usually delinquencies increase seasonally in September, but this might have moved to August this year. The increase was mostly in the 30 day bucket.

Also the percent of loans in the foreclosure process declined further in August and were down 32% over the last year. Foreclosure inventory was at the lowest level since March 2008.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.90% in August, up from 5.64% in July. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 1.80% in August from 1.85% in July.

The number of delinquent properties, but not in foreclosure, is down 129,000 properties year-over-year, and the number of properties in the foreclosure process is down 428,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for August in early October.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2014 | July 2014 | Aug 2013 | Aug 2012 | |

| Delinquent | 5.90% | 5.64% | 6.20% | 6.87% |

| In Foreclosure | 1.80% | 1.85% | 2.66% | 4.12% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,852,000 | 1,713,000 | 1,836,000 | 1,910,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,143,000 | 1,136,000 | 1,288,000 | 1,520,000 |

| Number of properties in foreclosure pre-sale inventory: | 913,000 | 935,000 | 1,341,000 | 2,020,000 |

| Total Properties | 3,908,000 | 3,786,000 | 4,465,000 | 5,450,000 |

Wednesday, September 24, 2014

Thursday: Unemployment Claims, Durable Goods

by Calculated Risk on 9/24/2014 08:15:00 PM

On August Durable Goods from MarketWatch: What goes up must come down: Durable-goods orders set to sink

After flying high in July, orders for U.S. durable goods are likely to take a big dive in August.Thursday:

But don’t pay any heed. The record 22.6% surge in orders in July was propelled mainly by a pile of new contracts for Boeing jets. Those orders tumbled in August and will drag orders into deep negative territory. Economists polled by MarketWatch forecast a 17.3% in new orders.

Strip out airplanes and autos, however, and Wall Street expects orders for durable goods to rise by 1% or more in August.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 300 thousand from 280 thousand.

• Also at 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 17.1% decrease in durable goods orders (last month durable goods orders were up 22.6% due to aircraft orders).

• At 11:00 AM, the Kansas City Fed manufacturing survey for September.

Lawler on Homebuilder KB Home and New Home Sales Report

by Calculated Risk on 9/24/2014 04:35:00 PM

From housing economist Tom Lawler: KB Home: Net Orders Up 5% YOY, Orders/Community Flat; Deliveries Down on Delays in Construction Schedules and Customer Mortgage Loan Closings

KB Home reported that net home orders in the quarter ended August 31, 2014 totaled 1,827, up 5.2% from the comparable quarter of 2013. Net orders per community were virtually unchanged from a year ago. The company’s sales cancellation rate, expressed as a % of gross orders, was 31% last quarter, down from 33% in the comparable quarter of 2013. Home deliveries last quarter totaled 1,793, down 1.8% from the comparable quarter of 2013, at an average sales price of $327,000, up 9.3% from a year ago. The company’s order backlog at the end of August was 3,432, up 12.9% from last August.

In its press release the company said that “(d)eliveries in the quarter were tempered by delays in construction schedules and customer mortgage loan closings that resulted in some deliveries being deferred to the fourth quarter.” Delays in customer mortgage loans closings were mainly related to a poorly-executed transition to Home Community Mortgage, LLC, the company’s new mortgage banking joint venture (with Nationstar).

The press release also included commentary on the average selling price.

“The overall average selling price rose 9% to $327,000, up from $299,100 for the same period of 2013. The Company's average selling price has now increased on a year-over-year basis for the last 17 quarters.The company’s CEO said that it had seen “(d)uring the third quarter there was an appreciable uptick in our traffic levels,” and in the conference call officials said that traffic last quarter was up 24% from a year ago.

“The average selling price increased primarily due to the Company's continued positioning of its new home communities in land-constrained submarkets that typically feature higher household incomes, higher median home sales prices and stronger demand for larger home sizes, as well as generally favorable market conditions.

“Average selling prices were higher in all of the Company's homebuilding regions compared to the same quarter of 2013, with increases ranging from 9% in the Central and Southeast regions to 21% in the West Coast region.”

In the previous quarter’s earnings conference call on June 27, KB Home’s CEO raised some eyebrows by saying that the company had seen some “re-emergence” of first-time home buyers, though in response to questions he noted that observed increases in first-time home buyers were in a limited number of areas with strong job growth. He did not talk about re-emerging first-time home buyer demand today.

He did, however, mention that household formations have been increasing, which suggests that his staff either hadn’t looked at or didn’t want to show him the latest CPS and ACS data on households.

And from Tom Lawler on the New Home sales report: Census Estimates that New SF Home Sales Jumped in August; Sales Estimate for the West Surged to Fastest Pace in Almost Seven Years, But Will Probably Be Revised Downward

Census estimated that new SF home sales ran at a seasonally adjusted annual rate of 504,000 in August, up 18.0% from July’s upwardly-revised (to 427,000 from 412,000) pace. (Revisions to May and June sales were de minimis). According to Census estimates, new SF home sales in the West ran at a seasonally adjusted annual rate of 153,000, up 50.0% from July’s pace and up 84.3% from last August’s pace, and the highest seasonally-adjusted sales pace since January 2008. Census’ unadjusted estimate for new SF home sales in the West last month was the highest for an August since 2007.

Based on limited anecdotal and builder reports, the Census estimate for new home sales in the West seem way to high, and a significant downward revision next month would not be surprising.

| New Single-Family Home Sales, Census Estimates | |||||

|---|---|---|---|---|---|

| Total | Northeast | Midwest | South | West | |

| 2012 (Full Year) | 368 | 29 | 47 | 195 | 97 |

| 2013 (Full Year) | 429 | 31 | 61 | 233 | 105 |

| July 2014 (SAAR) | 427 | 24 | 58 | 243 | 102 |

| August 2014 (SAAR) | 504 | 31 | 58 | 262 | 153 |

Comments on New Home Sales

by Calculated Risk on 9/24/2014 01:59:00 PM

The new home sales report for August was above expectations at 504 thousand on a seasonally adjusted annual rate basis (SAAR). This was the highest sales rate since May 2008. However, we need to remember this was just one month of data.

Also sales for the previous three months were revised up a combined 16,000 sales SAAR.

The Census Bureau reported that new home sales this year, through August, were 307,000, Not seasonally adjusted (NSA). That is up 2.7% from 299,000 during the same period of 2013 (NSA). Not much of a gain from last year. Right now it looks like sales will barely be up this year (maybe 3% or so for the year).

Sales were up 33.0% year-over-year in August - however sales declined sharply in Q3 2013 as mortgage rates increased - so this was an easy comparison. The comparison for September will be pretty easy too.

This graph shows new home sales for 2013 and 2014 by month (Seasonally Adjusted Annual Rate).

The comparisons to last year are easy right now, and I expect to see year-over-year growth for the 2nd half of 2014.

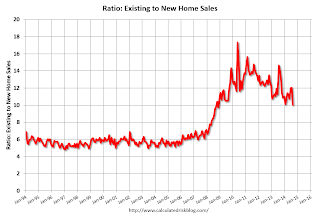

And here is another update to the "distressing gap" graph that I first started posting several years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to decline or move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

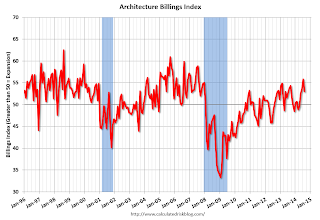

AIA: "Architecture Billings Index Exhibits Continued Strength" in August

by Calculated Risk on 9/24/2014 11:25:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Exhibits Continued Strength

On the heels of recording its strongest pace of growth since 2007, there continues to be an increasing level of demand for design services signaled in the latest Architecture Billings Index (ABI). As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the August ABI score was 53.0, down from a mark of 55.8 in July. This score reflects an increase in design activity (any score above 50 indicates an increase in billings). The new projects inquiry index was 62.6, following a very strong mark of 66.0 the previous month.

The AIA has added a new indicator measuring the trends in new design contracts at architecture firms that can provide a strong signal of the direction of future architecture billings. The score for design contracts in August was 56.9.

“One of the key triggers for accelerating growth at architecture firms is that long-stalled construction projects are starting to come back to life in many areas across the country,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Long awaited access to credit from lending institutions and an increasing comfort level in the overall economy has helped revitalize the commercial real estate sector in recent months. Additionally, though, a crucial component to a broader industry-wide recovery is the emerging demand for new projects such as education facilities, government buildings and, in some cases, hospitals.”

• Regional averages: Northeast (58.1) , South (55.1), West (52.5), Midwest (51.0) [three month average]

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.0 in August, down from 55.8 in July. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So the readings over the last year suggest an increase in CRE investment this year and in 2015.