by Calculated Risk on 9/13/2014 01:01:00 PM

Saturday, September 13, 2014

Schedule for Week of September 14th

The key economic report this week is August housing starts on Thursday.

For manufacturing, the August Industrial Production and Capacity Utilization report, and the September NY Fed (Empire State) and Philly Fed manufacturing surveys, will be released this week.

For prices, PPI will be released Tuesday, and CPI on Wednesday.

The FOMC meets on Tuesday and Wednesday, and the FOMC is expected to taper QE3 asset purchases another $10 billion per month at this meeting.

Also the BLS will release the 2014 preliminary employment Benchmark Revision, and the Fed will release the Q2 Flow of Funds report on Thursday.

8:30 AM: NY Fed Empire Manufacturing Survey for September. The consensus is for a reading of 16.0, up from 14.7 in August (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.3%.

8:30 AM: The Producer Price Index for August from the BLS. The consensus is for a 0.1% increase in prices, and a 0.1% increase in core PPI.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Consumer Price Index for August. The consensus is for no change in CPI in August and for core CPI to increase 0.2%.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 56, up from 55 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to reduce monthly QE3 asset purchases from $25 billion per month to $15 billion per month at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 305 thousand from 315 thousand.

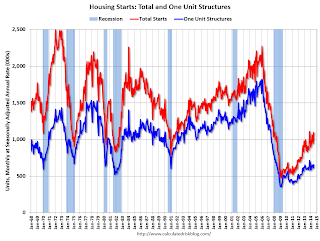

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. Total housing starts were at 1.093 million (SAAR) in July. Single family starts were at 656 thousand SAAR in July.

The consensus is for total housing starts to decrease to 1.040 million (SAAR) in August.

8:45 AM: Speech by Fed Chair Janet Yellen, The Importance of Asset Building for Low and Middle Income Households, At the Corporation for Enterprise Development's 2014 Assets Learning Conference, Washington, D.C. (via prerecorded video)

10:00 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 22.0, down from 28.0 last month (above zero indicates expansion).

10:00 AM: 2014 Current Employment Statistics (CES) Preliminary Benchmark Revision. From the BLS:

"Each year, the Current Employment Statistics (CES) survey estimates are benchmarked to comprehensive counts of employment from the Quarterly Census of Employment and Wages (QCEW) for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The final benchmark revision will be issued with the publication of the January 2015 Employment Situation news release in February."12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for August 2014

Unofficial Problem Bank list declines to 435 Institutions

by Calculated Risk on 9/13/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 12, 2014.

Changes and comments from surferdude808:

Two mergers lowered the Unofficial Problem Bank List to 435 institutions with assets of $137.5 billion. A year ago, the list held 700 institutions with assets of $246 billion. Finding their way off the list by finding a merger partner were United Central Bank, Garland, TX ($1.3 billion) and Idaho Banking Company, Boise, ID ($96 million). Idaho Banking company had also been operating under a Prompt Corrective Action order since February 2011. Next Friday we expect for the OCC to provide an update on its enforcement action activities.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 435.

Friday, September 12, 2014

Housing: "Price cuts are back"

by Calculated Risk on 9/12/2014 06:56:00 PM

From Tim Logan and Andrew Khouri at the LA Times: Housing price cuts point to a shift in Southland market

The latest sign that buyers are gaining leverage in Southern California's housing market: Price cuts are back.Inventory has increased significantly in a number of markets, after bottoming in 2013. And more inventory means slower price increases (maybe even price declines in some markets). Yet many sellers have listed their homes assuming the double digit price increases would continue. The result: no buyers and price cuts.

The number of homes with reduced asking prices has risen sharply in recent months ... In Orange County, the region's priciest market, about one-third of sellers have been forced to cut prices, according to data from real estate firm Redfin. ...

These trends have been building all year. But home sellers -- often the last to see market shifts -- are finally getting the message, said Paul Reid, a Redfin agent in Temecula.

"A lot of what we've seen over the last six or eight weeks is people lowering their prices to get buyers in the door," Reid said.

A few Analysts comments on FOMC meeting next week

by Calculated Risk on 9/12/2014 01:18:00 PM

Here are some analyst comments on the upcoming FOMC meeting. From Nomura:

We expect the September FOMC meeting to give us additional insight into the future path of monetary policy. We will receive another round of FOMC forecasts for the first time since June, which will incorporate significant new data. Forecasts should also be extended to 2017, thus giving us a better sense of how the participants judge the current balance between actual and potential output.From Merrill Lynch:

We expect the FOMC to make changes to its forward guidance. At a minimum, we expect the FOMC to add language that stresses the “data dependence” of future interest rate decisions. We expect the FOMC to continue to state that the adjustment of interest rates, when it comes, will be “balanced” and that it expects interest rates to converge to normal levels more slowly than employment and inflation. But in light of sustained improvement in labor market performance, and the inherent complexities in assessing their state, we expect that the FOMC to drop its assessment that “lift-off” is still a “considerable time” away

[P]inpointing the exact timing of the first rate hike is more of a guess than a forecast. Nonetheless, the case for an earlier move has grown over the last several months. ... The more immediate question is: when will the Fed change its rhetoric enough to scare the markets? In particular, could the FOMC do something big in its announcement on Wednesday? It is hard to predict the specific changes, but the risk of a hawkish signal is high:And from Goldman Sachs:

• Given the soft August jobs report, we expect them to continue to see a “significant underutilization of labor resources.” That language change probably requires a couple of better jobs reports.

• It is a close call, but we expect them to modify their promise to keep the funds rate near zero for “considerable time.” However, they will try to change the statement in a market neutral fashion, dropping the reference to “considerable time” and substituting “considerable reduction in slack and notable progress toward the inflation goal.”

• We expect small changes in the FOMC forecasts. In particular, we see some risk of another uptick in the “dot plot.” At this meeting, they introduce forecasts for 2017, and we expect median “dots” of 3.25 to 3.50%.

• Finally, we think Yellen and her allies will try to avoid shocking the markets. In the past, when the FOMC has reworked its forward guidance, they have often softened the blow by explicitly noting that their view on the likely timing of the exit has not changed or by downplaying the change in the press conference.

With respect to the appropriate timing of the first hike of the funds rate, recent comments point to a greater clustering of FOMC participants' views around mid-2015. In particular, one or two FOMC participants (namely, Presidents Lockhart and Rosengren) have likely pulled forward their views on the most appropriate date for liftoff; there is nothing to indicate that those previously expecting a mid-2015 hike have moved; and the more hawkish participants have also likely stayed in place.CR note: I'll post some thoughts on the upcoming meeting this weekend.

Preliminary September Consumer Sentiment increases to 84.6

by Calculated Risk on 9/12/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for September was at 84.6, up from 82.5 in August.

This was above the consensus forecast of 83.1. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.