by Calculated Risk on 9/10/2014 07:01:00 PM

Wednesday, September 10, 2014

Thursday: Unemployment Claims, Quarterly Services Report

This is an important change ... from the WSJ: Cost of Employer Health Coverage Shows Muted Growth

The cost of employer health coverage continued its muted growth this year with a 3% increase that pushed the average annual premium for a family plan to $16,834, according to a major survey.Thursday:

The increase was slightly less than the 4% seen last year, according to the annual poll of employers performed by the nonprofit Kaiser Family Foundation along with the Health Research & Educational Trust, a nonprofit affiliated with the American Hospital Association. The share of the family-plan premium borne by employees was $4,823, or 29% of the total, the same percentage as last year.

The total annual cost of employer coverage for an individual was $6,025 in the 2014 survey, up 2%, a difference that wasn't statistically significant.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 302 thousand.

• At 10:00 AM, the Q2 Quarterly Services Report from the Census Bureau.

• At 2:00 PM, the Monthly Treasury Budget Statement for August.

Vehicle Sales: Fleet Turnover Ratio

by Calculated Risk on 9/10/2014 02:29:00 PM

Back in early 2009, I wrote a couple of posts arguing there would be an increase in auto sales - Vehicle Sales (Jan 2009) and Looking for the Sun (Feb 2009). This was an out-of-the-consensus call and helped me call the bottom for the US economy in mid-2009.

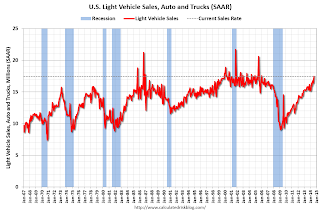

Here is an update to the U.S. fleet turnover graph.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate through August 2014 - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age or the composition of the fleet). Note: the number of registered vehicles is estimated for 2012 through 2014.

The wild swings in 2009 were due to the "cash for clunkers" program.

The estimated ratio for August was just over 14 years - back to a more normal level.

Note: I argued the turnover ratio would "probably decline to 15 or so eventually" and that has happened.

The current sales rate is now near the top (excluding one month spikes) of the '98/'06 auto boom.

Light vehicle sales were at a 17.45 million seasonally adjusted annual rate (SAAR) in August.

I now expect vehicle sales to mostly move sideways over the next few years.

FNC: Residential Property Values increased 7.4% year-over-year in July

by Calculated Risk on 9/10/2014 10:58:00 AM

In addition to Case-Shiller, and CoreLogic, I'm also watching the FNC, Zillow and several other house price indexes.

FNC released their July index data today. FNC reported that their Residential Price Index™ (RPI) indicates that U.S. residential property values increased 0.6% from June to July (Composite 100 index, not seasonally adjusted). The other RPIs (10-MSA, 20-MSA, 30-MSA) increased between 0.4% and 0.6% in July. These indexes are not seasonally adjusted (NSA), and are for non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales).

The year-over-year (YoY) change slowed in July, with the 100-MSA composite up 7.4% compared to July 2013. For FNC, the YoY increase has been slowing since peaking in February at 9.4%.

The index is still down 19.5% from the peak in 2006.

This graph shows the year-over-year change based on the FNC index (four composites) through July 2014. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

All of the price indexes are now showing a slowdown in price increases.

The July Case-Shiller index will be released on Tuesday, September 30th, and I expect Case-Shiller to show a further slowdown in YoY price increases.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey, Refinance Activity Lowest since 2008

by Calculated Risk on 9/10/2014 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 7.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 5, 2014. This week’s results included an adjustment for the Labor Day holiday. ...

The Refinance Index decreased 11 percent from the previous week, to the lowest level since November 2008. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier, to the lowest level since February 2014. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.27 percent, the first increase in four weeks, from 4.25 percent, with points increasing to 0.25 from 0.24 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 76% from the levels in May 2013 and at the lowest level since 2008.

As expected, refinance activity is very low this year.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 12% from a year ago.

Tuesday, September 09, 2014

Update: Framing Lumber Prices

by Calculated Risk on 9/09/2014 08:59:00 PM

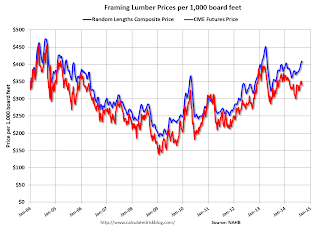

Here is another graph on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs. Then prices declined over 25% from the highs by mid-year 2013.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand), however prices haven't fallen as sharply either.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up about 12% from a year ago, and CME futures are up about 4% year-over-year.