by Calculated Risk on 9/06/2014 06:06:00 PM

Saturday, September 06, 2014

Update: Prime Working-Age Population Growing Again

This is an update to a previous post through August.

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through August 2014.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

Schedule for Week of September 7th

by Calculated Risk on 9/06/2014 01:12:00 PM

The key report this week is August retail sales on Friday.

3:00 PM: Consumer Credit for July from the Federal Reserve. The consensus is for credit to increase $17.4 billion.

7:30 AM ET: NFIB Small Business Optimism Index for August.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for July from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in June to 4.671 million from 4.577 million in May. This was the highest level since February 2001.

The number of job openings (yellow) were up 18% year-over-year compared to June 2013. Quits were up 15% year-over-year.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for July. The consensus is for a 0.5% increase in inventories.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 300 thousand from 302 thousand.

10:00 AM: The Q2 Quarterly Services Report from the Census Bureau.

2:00 PM ET: The Monthly Treasury Budget Statement for August.

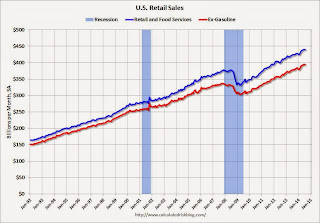

8:30 AM ET: Retail sales for August will be released.

8:30 AM ET: Retail sales for August will be released.This graph shows retail sales since 1992 through July 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales were unchanged from June to July (seasonally adjusted), and sales were up 3.7% from July 2013.

The consensus is for retail sales to increase 0.4% in August, and to increase 0.3% ex-autos.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for September). The consensus is for a reading of 83.1, up from 82.5 in August.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for July. The consensus is for a 0.5% increase in inventories.

Friday, September 05, 2014

Unofficial Problem Bank list declines to 437 Institutions

by Calculated Risk on 9/05/2014 09:40:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Sept 5, 2014.

Changes and comments from surferdude808:

The Federal Reserve terminating two actions were the only changes to the Unofficial Problem Bank List this week. After removal, the list holds 437 institutions with assets of $138.9 billion. A year ago, the list held 704 institutions with assets of $249.8 billion.CR Note: The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public. (CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.)

The Fed terminated actions against Commercial Bank, Harrogate, TN ($771 million) and American Bank, Bozeman, MT ($313 million). With these terminations, there are only 44 or 5.1 percent of the 858 banks supervised by the Fed operating under a formal enforcement action. In comparison, 6.2 percent of the state non-member banks supervised by the FDIC and 10.5 percent of the national banks supervised by the OCC are operating under a formal agreement.

Next week should be as quiet as the OCC will likely not provide an update on its enforcement action activity until September 19th.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

When the list was increasing, the official and "unofficial" counts were about the same. Now with the number of problem banks declining, the unofficial list is lagging the official list. This probably means regulators are changing the CAMELS rating on some banks before terminating the formal enforcement actions.

Lawler: Latest Release Shows Sizable Revisions in S&P/Case-Shiller “National” Home Price Index

by Calculated Risk on 9/05/2014 04:35:00 PM

From housing economist Tom Lawler:

This week’s S&P/Case-Shiller Home Price Report for June 2014 contained two data “surprises.” The first was that the SPCS “National” HPI, previously released only quarterly, will now be published on a monthly basis. The second, and much more dramatic, surprise was that the historical data for the SPCS “National” HPI was revised substantially. Here is a table showing growth rates in the previously-published National HPI and the revised National HPI over selected periods, using not seasonally adjusted data.

While the revised HPI shows very similar growth rates to the previous HPI from 1990 to 2000, it shows (1) slower growth rates during the 2000-2006 period; (2) a substantially smaller peak-to-trough decline from mid-2006 to late 2011/early 2012; and (3) a somewhat slower growth rate from early 2012 to early 2014.

| Growth Rates, Previous vs. Revised SPCS "National" HPI | ||||

|---|---|---|---|---|

| Cumulative Previous | % Change Revised | Annualized Previous | % Change Revised | |

| Q2/1990 - Q2/2000 | 35.8% | 35.3% | 3.1% | 3.1% |

| Q2/2000 - Q2/2006 | 83.0% | 76.0% | 10.6% | 9.9% |

| Q2/2006 - Q1/2012 | -34.6% | -26.3% | -7.1% | -5.2% |

| Q1/2012 - Q1/2014 | 21.4% | 18.7% | 10.2% | 8.9% |

| Peak* | Q2/2006 | Q2/2006 | ||

| Trough* | Q1/2012 | Q4/2011 | ||

| Peak-to-Trough % Change | -34.6% | -26.7% | ||

| *For Quarterly HPI | ||||

The catalyst for this revision appears to a change in the sources of sales transactions data to sources used by CoreLogic, which “bought” the SPCS HPIs last year. Here is an excerpt from a July 2014 “methodology” report.

“The sources for sale transaction data were changed to sources used by CoreLogic, Inc. beginning with the March 2014 update of the S&P/Case-Shiller indices. Since the repeat sale pair samples collected from CoreLogic sources are not identical to samples collected from prior sources1, divisors are used to prevent any breaks in the index series. The divisors applied to index points estimated for March 2014 and all months afterward are listed below. The divisors are calculated by calculating the index value for February, 2014 with the old data source and the new data source separately. If we assume that the change in the data source increases the index level for February 2014 by 5%. Then the divisor is set to 1.05 and the index based on the new data source is divided by 1.05 for March 2014 and all subsequent months. This prevents a jump in the index and preserves the month-to-month percentage changes.”

While this paragraph appears to be related to the construction of the 20 metro area HPIs, I’m assuming that new CoreLogic data sources were used to construct revised national HPIs.

A Bloomberg article picked up on these revisions, though Case-Shiller principal economist David Stiff’s “explanation” in that article seemed incomplete. According to article Stiff said that “the index only looks different because it’s been rebuilt with new, higher quality data.” He also said that “CoreLogic’s data allowed Case-Shiller to weed out more bank repossessions,” implying that the major source of the revisions was that Case-Shiller’s HPI previously erroneously included non-arms-length transactions such as bank repossessions.

It seems highly unlikely, however, that this factor was the major reason for revisions in the national HPI. First, there were no similar revisions in pre-2014 data for the HPIs for the 20 metro areas SPCS publishes. Second, the new national HPI grew by seven percentage points less than the previous national HPI from Q2/2000 to Q2/2006, when distressed transactions were de minimis.

A more likely (though not verified) reason is that the new SPCS National HPI, using CoreLogic’s larger database, now covers a much wider geographic area than the old SPCS HPI. The geographic coverage of the old SPCS National HPI was pretty “light.” Here is SPCS’ estimate of its coverage of the housing market in each Census division (based on market value).

| Division Coverage (% Value) | Zero-Coverage States | |

|---|---|---|

| New England | 93.5% | Maine |

| Middle Atlantic | 76.1% | |

| East North Central | 63.3% | Indiana, Wisconsin |

| West North Central | 53.0% | North Dakota, South Dakota |

| South Atlantic | 63.0% | South Carolina, West Virginia |

| East South Central | 38.3% | Alabama, Mississippi |

| West South Central | 48.7% | |

| Mountain | 70.4% | Idaho, Montana, Wyoming |

| Pacific | 91.6% | Alaska |

While SPCS is now apparently using data sources used by CoreLogic, the two HPIs are still significantly different, now mainly reflecting methodological and aggregation differences.

The “new” SPCS “National” HPI now looks much more similar to the FHFA Expanded Dataset HPI, once the latter is adjusted (albeit crudely) to be market-value weighted instead of housing unit weighted (SPCS is value weighted). If one were to construct a FHFA “National” HPI by applying Census 2000 market value weights to each FHFA State HPI, here is what it would look like relative to the previous and revised SPCS National HPI.

Payroll Employment: Best Years, Worst Month

by Calculated Risk on 9/05/2014 01:32:00 PM

One of the dumbest comments I saw this morning was from Douglas Holtz-Eakin who wrote "Disaster in August jobs!"

Really? Was this a "disaster"? I'm sure Holtz-Easkin wrote "disaster" in 1984 when payroll employment only increased 128 thousand in one month (on the way to almost 3.9 million for the year). Or "DISASTER" (all caps) in 1983 when payroll jobs plunged 308 thousand one month (on the way to almost 3.5 million for the year).

Or how about in 1997 when the economy lost 39 thousand jobs one month (on the way to 3.4 million jobs added for the year)?

For fun, below is a table of the best years for job growth since 1980 with the worst month of the year. Obviously there is a significant amount of volatility in the employment report.

If the August report was a "jobs disaster" then there is a "disaster" every year! It would be important if this is the start of lower employment reports, but I think that is very unlikely.

Note 1: Job growth was stronger in the '80s and '90s when the prime working age population was growing quickly. This decade the prime working age population has actually declined, so we should expect as much job growth, see: Demographics: Prime Working-Age Population Growing Again

Note 2: I've called out Holtz-Eakin before. He voted to ban 'the phrases "Wall Street" and "shadow banking" and also the words "interconnection" and "deregulation" from' the Financial Crisis Inquiry Commissiom report! Oh my ...

| Non-Farm Payroll: Best Years, Worst Month | ||

|---|---|---|

| Year | Annual (000s) | Worst Month (000s) |

| 1984 | 3,880 | 128 |

| 1994 | 3,851 | 200 |

| 1983 | 3,458 | -308 |

| 1997 | 3,408 | -39 |

| 1988 | 3,242 | 94 |

| 1999 | 3,177 | 107 |

| 1987 | 3,153 | 171 |

| 1998 | 3,047 | 124 |

| 1996 | 2,825 | -18 |

| 1993 | 2,817 | -49 |

| 2014 | 2,5851 | 142 |

| 2005 | 2,506 | 67 |

| 1985 | 2,502 | 124 |

| 2013 | 2,331 | 84 |

| 2012 | 2,236 | 88 |

| 1995 | 2,159 | -16 |

| 2006 | 2,085 | 2 |

| 2011 | 2,083 | 70 |

| 2004 | 2,033 | 32 |

| 12014 is the hiring pace through August. | ||