by Calculated Risk on 8/15/2014 09:15:00 AM

Friday, August 15, 2014

Fed: Industrial Production increased 0.4% in July

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.4 percent in July for its sixth consecutive monthly gain. Manufacturing output advanced 1.0 percent in July, its largest increase since February. The production of motor vehicles and parts jumped 10.1 percent, while output in the rest of the manufacturing sector rose 0.4 percent. The production at mines moved up 0.3 percent, its ninth consecutive monthly increase. The output of utilities dropped 3.4 percent, as weather that was milder than usual for July reduced demand for air conditioning. At 104.4 percent of its 2007 average, total industrial production in July was 5.0 percent above its year-earlier level. Capacity utilization for total industry edged up 0.1 percentage point to 79.2 percent in July, a rate 1.7 percentage points above its level of a year earlier and 0.9 percentage point below its long-run (1972–2013) average.

emphasis added

Click on graph for larger image.

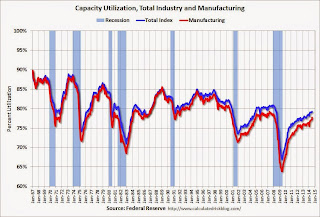

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.3 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.2% is 0.9 percentage points below its average from 1972 to 2012 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased 0.4% in July to 104.4. This is 24.7% above the recession low, and 3.6% above the pre-recession peak.

The monthly change for Industrial Production was slightly above expectations.

NY Fed: Empire State Manufacturing Survey indicates "business conditions continued to improve" in August

by Calculated Risk on 8/15/2014 08:30:00 AM

From the NY Fed: Empire State Manufacturing Survey

The August 2014 Empire State Manufacturing Survey indicates that business conditions continued to improve for New York manufacturers, but the improvement was less wide-spread than in the previous month. The headline general business conditions index retreated eleven points to 14.7, after reaching a four-year high in July. The new orders index slipped almost five points to 14.1, while the shipments index edged up a point to 24.6—a multiyear high. ...This is the first of the regional surveys for August. The general business conditions index was below the consensus forecast of a reading of 20.0, but still indicates solid expansion (above zero suggests expansion). However this is slower expansion in August than in July (the index was at a four-year high in July).

Labor market conditions were mixed but continued to improve overall. The index for number of employees slipped three points to 13.6, suggesting a slight pullback in the pace of hiring. However, the average workweek index rose six points to 8.0, signaling a slight increase in hours worked.

Despite the pullback in most of the survey’s indexes for current conditions, optimism about the near-term outlook grew increasingly widespread. The index for future general business conditions climbed eighteen points to 46.8—its highest level in two-and-a-half years.

emphasis added

Thursday, August 14, 2014

Friday: Industrial Production, NY Fed Mfg Survey, PPI, Consumer Sentiment

by Calculated Risk on 8/14/2014 08:15:00 PM

First from the WSJ: New Rules Near on Credit-Ratings Firms

The rules, expected to be somewhat tougher than those proposed more than three years ago, will take additional steps to ensure that the firms' interest in winning business doesn't affect ratings analysis, said the people familiar with the process.The downgrades might have triggered the crisis, but the key problem wasn't the downgrade - it was that the bonds were rated too high when first rated. I'll review why this happened (ratings too high) again soon.

Credit raters have been lambasted by critics and lawmakers over their actions in the run-up to the 2008 financial crisis. A 2011 U.S. congressional report cited widespread and sudden downgrades of mortgage-related bonds as being perhaps "more than any other single event ... the immediate trigger for the financial crisis." The bonds had previously been given top-notch ratings by the firms.

Friday:

• At 8:30 AM ET, the NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 20.0, down from 25.6 in July (above zero is expansion).

• Also at 8:30 AM, the Producer Price Index for July from the BLS. The consensus is for a 0.1% increase in prices.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 82.3, up from 81.8 in July.

Repeat: U.S. Population by Age and Distribution, 1900 through 2060

by Calculated Risk on 8/14/2014 04:30:00 PM

Repeat: Here are graphs of the U.S population by age and distribution, from 1900 through 2060. The population data and estimates are from the Census Bureau (actual through 2010 and projections through 2060).

There are many interesting points - the Depression baby bust (that started before the Depression), the baby boom, the 2nd smaller baby bust following the baby boom, the "echo" boom" and more.

What jumps out at me are the improvements in health care ... and also that the largest cohorts will all soon be under 40.

Notes: For animation, population is in thousands (not labeled)! Prior to 1940, the oldest group in the Census data was "75+". From 1940 through 1985, the oldest group was "85+". Starting in 1990, the oldest group is 100+.

Reader Druce put together the graphic below of the U.S population distribution, by age, from 1900 through 2060 using a slider. In 1900, the graph was fairly steep, but with improving health care, the graph has flattened out over the last 100 years.

DataQuick on California Bay Area: July Home Sales down 9% Year-over-year, Distressed Sales and Investor Buying declines

by Calculated Risk on 8/14/2014 01:34:00 PM

From DataQuick: Sluggish Bay Area Home Sales in July; Prices Up – at a Slower Pace

A total of 8,474 new and resale houses and condos sold in the nine-county Bay Area last month. That was up 7.1 percent from 7,915 in June and down 9.3 percent from 9,339 in July last year, according to Irvine-based CoreLogic DataQuick, a real estate information service.A few key year-over-year trends: 1) declining distressed sales, 2) generally declining investor buying, 3) flat or declining total sales, but 4) flat or some increase in non-distressed sales.

Bay Area sales usually decline around 5 percent from June to July. Sales for the month of July have varied from 6,666 in 1995 to 14,258 in 2004. The average since 1988, when CoreLogic DataQuick statistics begin, is 9,333. ...

...

Last month foreclosure resales – homes that had been foreclosed on in the prior 12 months – accounted for 2.7 percent of resales, down from a revised 2.9 percent from the month before, and down from 4.6 percent a year ago. Foreclosure resales in the Bay Area peaked at 52.0 percent in February 2009, while the monthly average over the past 17 years is 9.8 percent.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 4.2 percent of Bay Area resales last month. That was down from an estimated 4.4 percent in June and down from 8.5 percent a year earlier.

Last month absentee buyers – mostly investors – accounted for 18.8 percent of all Bay Area home sales, which was the lowest absentee share of purchases since that figure was 18.5 percent in September 2010.

emphasis added

Though total sales were down 9.3% year-over-year, the percent of non-distressed sales was down about 2%.