by Calculated Risk on 8/12/2014 08:01:00 PM

Tuesday, August 12, 2014

Wednesday: Retail Sales

A must read piece from Tim Duy: Heading Into Jackson Hole

Bottom Line: Anything other than a dovish message coming from the Jackson Hole conference will be a surprise. Tight labor markets alone will not justify an aggressive pace of tightening. An aggressive pace requires that those tight labor markets manifest themselves into higher wage growth and higher inflation. Yellen seems content to normalize slowly until she sees the white in the eyes of inflation.CR Note: Yellen will be patient.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for July will be released. On a monthly basis, retail sales increased 0.2% from May to June (seasonally adjusted), and sales were up 4.3% from June 2013. The consensus is for retail sales to increase 0.2% in July, and to increase 0.4% ex-autos.

• At 10:00 AM, the Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.4% increase in inventories.

EIA Forecast: Gasoline Prices expected to decline to $3.30 per gallon in December

by Calculated Risk on 8/12/2014 05:40:00 PM

It is difficult to forecast oil and gasoline prices due to world events, but currently the EIA expects gasoline prices to decline further this year according to the Short Term Energy Outlook released today:

• The market's perception of reduced risk to Iraqi oil exports and news regarding increasing Libyan oil exports contributed to a drop in the Brent crude oil spot price to an average of $107 per barrel (bbl) in July, $5/bbl lower than the June average. EIA projects Brent crude oil prices to average $107/bbl over the second half of 2014 and $105/bbl in 2015. ...Steady or declining gasoline prices would be a positive for the economy. Right now gasoline prices are down to around $3.47 per gallon nationally according to the Gasbuddy.com.

• Regular gasoline retail prices fell to an average of $3.61 per gallon (gal) in July, 8 cents/gal below the June average. Regular gasoline retail prices are projected to continue to decline to an average of $3.30/gal in December. EIA expects regular gasoline retail prices to average $3.50/gal in 2014 and $3.46/gal in 2015, compared with $3.51/gal in 2013.

emphasis added

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Treasury: Budget Deficit declined in July 2014 compared to July 2013

by Calculated Risk on 8/12/2014 02:18:00 PM

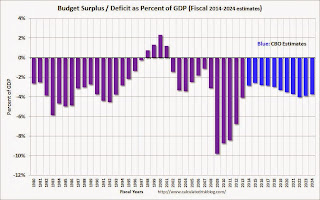

The Treasury released the July Monthly Treasury Statement today. The Treasury reported a $94 billion deficit in July 2014, down from $97 billion in July 2013. For fiscal year 2014 through July, the deficit was $460 billion compared to $607 billion for the same period in fiscal 2013 (the fiscal year end in September).

In April, the Congressional Budget Office (CBO) released their new Updated Budget Projections: 2014 to 2024. The projected budget deficits were reduced for each of the next ten years, and the projected deficit for 2014 was revised down from 3.0% to 2.8%. Based on the Treasury release today, I expect the deficit for fiscal 2014 to be close to the current CBO projection. The CBO will publish new budget projections this month.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The deficit should decline further next year and is projected to stay below 3% for the next 5 years.

The decline in the deficit, as a percent of GDP, from almost 10% to under 3% in 2014 is the fastest decline in the deficit since the demobilization following WWII (not shown on graph).

As an aside, the states are doing better too. In California: Controller Releases July Cash Update

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in July 2014. Total revenues for the first month of Fiscal Year 2014-15 totaled $5.4 billion, beating estimates in the Budget Act by $231.9 million, or 4.5 percent.

"Even though July is usually a weak revenue collection month, the new fiscal year is off to a strong start," Chiang said. "While the State plans to borrow operating funds through revenue anticipation notes, the $2.8 billion needed solely for smoothing out the timing of revenues is at the lowest level since the 2006-07 fiscal year. If we can continue to reduce short- and long-term debts, we can continue to improve our fiscal condition."

emphasis added

BLS: Jobs Openings increased to 4.7 million in June, Highest since 2001

by Calculated Risk on 8/12/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.7 million job openings on the last business day of June, little changed from 4.6 million in May, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in June for total nonfarm and total private. The number of quits was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in June to 4.671 million from 4.577 million in May. This is the highest level since February 2001.

The number of job openings (yellow) are up 18% year-over-year compared to June 2013.

Quits are up 15% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the fifth consecutive month, and that quits are increasing.

NFIB: Small Business Optimism Index increases in July

by Calculated Risk on 8/12/2014 08:51:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Ticks Up Slightly

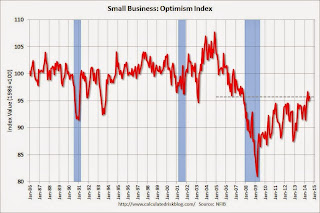

July’s Optimism Index technically rose 0.7 points to a reading of 95.7. ...Hiring plans increased to 13, the highest since 2007.

Labor Markets. NFIB owners increased employment by an average of 0.01 workers per firm in July (seasonally adjusted), the tenth positive month in a row and the best string of gains since 2006.

emphasis added

And in another good sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 13, down from 16 last year - and "taxes" and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.7 in July from 95.0 in June.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.