by Calculated Risk on 8/12/2014 05:40:00 PM

Tuesday, August 12, 2014

EIA Forecast: Gasoline Prices expected to decline to $3.30 per gallon in December

It is difficult to forecast oil and gasoline prices due to world events, but currently the EIA expects gasoline prices to decline further this year according to the Short Term Energy Outlook released today:

• The market's perception of reduced risk to Iraqi oil exports and news regarding increasing Libyan oil exports contributed to a drop in the Brent crude oil spot price to an average of $107 per barrel (bbl) in July, $5/bbl lower than the June average. EIA projects Brent crude oil prices to average $107/bbl over the second half of 2014 and $105/bbl in 2015. ...Steady or declining gasoline prices would be a positive for the economy. Right now gasoline prices are down to around $3.47 per gallon nationally according to the Gasbuddy.com.

• Regular gasoline retail prices fell to an average of $3.61 per gallon (gal) in July, 8 cents/gal below the June average. Regular gasoline retail prices are projected to continue to decline to an average of $3.30/gal in December. EIA expects regular gasoline retail prices to average $3.50/gal in 2014 and $3.46/gal in 2015, compared with $3.51/gal in 2013.

emphasis added

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Treasury: Budget Deficit declined in July 2014 compared to July 2013

by Calculated Risk on 8/12/2014 02:18:00 PM

The Treasury released the July Monthly Treasury Statement today. The Treasury reported a $94 billion deficit in July 2014, down from $97 billion in July 2013. For fiscal year 2014 through July, the deficit was $460 billion compared to $607 billion for the same period in fiscal 2013 (the fiscal year end in September).

In April, the Congressional Budget Office (CBO) released their new Updated Budget Projections: 2014 to 2024. The projected budget deficits were reduced for each of the next ten years, and the projected deficit for 2014 was revised down from 3.0% to 2.8%. Based on the Treasury release today, I expect the deficit for fiscal 2014 to be close to the current CBO projection. The CBO will publish new budget projections this month.

Click on graph for larger image.

Click on graph for larger image.

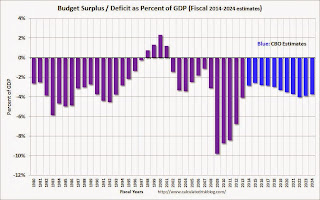

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The deficit should decline further next year and is projected to stay below 3% for the next 5 years.

The decline in the deficit, as a percent of GDP, from almost 10% to under 3% in 2014 is the fastest decline in the deficit since the demobilization following WWII (not shown on graph).

As an aside, the states are doing better too. In California: Controller Releases July Cash Update

State Controller John Chiang today released his monthly report covering California's cash balance, receipts and disbursements in July 2014. Total revenues for the first month of Fiscal Year 2014-15 totaled $5.4 billion, beating estimates in the Budget Act by $231.9 million, or 4.5 percent.

"Even though July is usually a weak revenue collection month, the new fiscal year is off to a strong start," Chiang said. "While the State plans to borrow operating funds through revenue anticipation notes, the $2.8 billion needed solely for smoothing out the timing of revenues is at the lowest level since the 2006-07 fiscal year. If we can continue to reduce short- and long-term debts, we can continue to improve our fiscal condition."

emphasis added

BLS: Jobs Openings increased to 4.7 million in June, Highest since 2001

by Calculated Risk on 8/12/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 4.7 million job openings on the last business day of June, little changed from 4.6 million in May, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) increased over the 12 months ending in June for total nonfarm and total private. The number of quits was little changed for government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for June, the most recent employment report was for July.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in June to 4.671 million from 4.577 million in May. This is the highest level since February 2001.

The number of job openings (yellow) are up 18% year-over-year compared to June 2013.

Quits are up 15% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

It is a good sign that job openings are over 4 million for the fifth consecutive month, and that quits are increasing.

NFIB: Small Business Optimism Index increases in July

by Calculated Risk on 8/12/2014 08:51:00 AM

From the National Federation of Independent Business (NFIB): Small Business Optimism Ticks Up Slightly

July’s Optimism Index technically rose 0.7 points to a reading of 95.7. ...Hiring plans increased to 13, the highest since 2007.

Labor Markets. NFIB owners increased employment by an average of 0.01 workers per firm in July (seasonally adjusted), the tenth positive month in a row and the best string of gains since 2006.

emphasis added

And in another good sign, the percent of firms reporting "poor sales" as the single most important problem has fallen to 13, down from 16 last year - and "taxes" and "regulations" are the top problems at 22 (taxes are usually reported as the top problem during good times).

Click on graph for larger image.

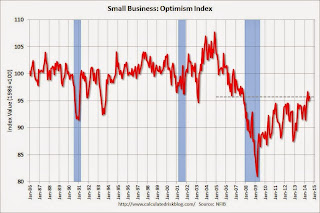

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.7 in July from 95.0 in June.

Note: There is high percentage of real estate related businesses in the "small business" survey - and this has held down over all optimism.

Monday, August 11, 2014

Tuesday: Job Openings

by Calculated Risk on 8/11/2014 08:01:00 PM

The Job Openings and Labor Turnover Survey (JOLTS) is a key monthly report used by the Federal Reserve. The June survey results will be released tomorrow.

The Atlanta Fed has a great graphic on the labor market that uses three parameters from JOLTS (See: Labor Market Spider Chart©).

Dave Altig includes the spider chart in a post at the Atlanta Fed's Macroblog: Getting There?

Regarding labor markets, here is our favorite type of snapshot, courtesy of the Atlanta Fed’s Labor Market Spider Chart:See this link Labor Market Spider Chart© for a larger interactive version of the spider chart. Note that Job Vacancies, Hires and Quits are all from JOLTS - and we will get an update Tuesday.

There is a lot to like in that picture. Leading indicators, payroll employment, vacancies posted by employers, and small business confidence are fully recovered relative to their levels at the end of the Great Recession.

On the less positive side, the numbers of people who are marginally attached or who are working part-time while desiring full-time hours remain elevated, and the overall job-finding rate is still well below prerecession levels. Even so, these indicators are noticeably better than they were at this time last year.

That year-over-year improvement is an important observation: the period from mid-2012 to mid-2013 showed little progress in the broader measures of labor-market performance that we place in the resource “utilization” category. During the past year, these broad measures have improved at the same relative pace as the standard unemployment statistic.

And a post from John Robertson at Macroblog: Are We There Yet?

Tuesday:

• At 7:30 AM ET, the NFIB Small Business Optimism Index for July.

• At 10:00 AM, the Job Openings and Labor Turnover Survey for June from the BLS. In May, the number of job openings (yellow) were up 19% year-over-year compared to May 2013, and Quits were up 15% year-over-year.

• At 2:00 PM, the Monthly Treasury Budget Statement for July. Note: The CBO's estimate is the deficit through July in fiscal 2014 was $462 billion, compared to $607 billion for the same period in fiscal 2013.