by Calculated Risk on 8/04/2014 01:03:00 PM

Monday, August 04, 2014

Goldman Sachs' Hui on House Price Seasonal Adjustments

A few excerpts from some analysis by Goldman's Hui Shan: "Are investors getting too pessimistic about US housing"

This month’s housing data showed weakness in both price and activity measures. On the price side, market consensus expected 0.3% month-over-month growth in the S&P Case-Shiller 20-City Composite. The actual print was -0.3%, the first decline since January 2012 when house prices bottomed. ...CR Note: This is similar to the argument I made last week A few comments on the Seasonal Pattern for House Prices. The seasonal adjustment should normalize over the next few years.

In our previous research, we showed that seasonal adjustments have become a tricky business for housing owing to heightened distressed sales over the past few years (see “Enough about the weather: Let’s talk seasonal adjustments”, Mortgage Analyst, February 28, 2014). In the US housing market, more people buy and sell homes in the summer than in the winter because of the school calendar. A thinner market in the winter implies that sellers typically accept lower prices to close transactions. As a result, seasonal factors would nudge prices up in the winter and down in the summer to arrive at the seasonally adjusted series. Normally, such adjustments are within the range of plus/minus one percentage point.

The recent housing downturn is the most severe in US history since the Great Depression, featuring a wave of distressed sales. According to the National Association of Realtors, at the worst of the crisis, nearly half of home sales were distressed. Because distressed sales take place throughout the year while non-distressed sales are more concentrated in the summer, distressed sales account for a larger share of total sales in the winter than in the summer. Also, because distressed properties tend to transact at a significant discount relative to non-distressed properties, they drag down observed transaction prices and the effect is more pronounced in the winter (when the distressed share is high) than in the summer (when the distressed share is low). This amplifies the normal seasonal pattern. In recent years, seasonal adjustments have expanded from the normal “plus/minus one percentage point” to “plus/minus three percentage points”.

As the housing market recovers and the share of distressed sales drops, the true underlying seasonal pattern is normalizing. However, seasonal factors are usually derived using data from the past 5-7 years. In other words, we are using the amplified seasonal factors to adjust more muted seasonal patterns, meaning pushing up house prices too much in the winter and also pushing down house prices too much in the summer. This is consistent with what we have seen over the past year: the S&P Case-Shiller house price index beat consensus expectations at the beginning of the year and it was surprisingly weak for the May reading. This seasonal adjustment problem is likely to persist in coming months, causing the next few months’ house price prints to appear softer than they really are.

emphasis added

Black Knight releases Mortgage Monitor for June

by Calculated Risk on 8/04/2014 09:05:00 AM

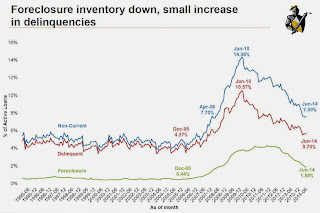

Black Knight Financial Services (BKFS, formerly the LPS Data & Analytics division) released their Mortgage Monitor report for June today. According to BKFS, 5.70% of mortgages were delinquent in June, up from 5.62% in May. BKFS reports that 1.88% of mortgages were in the foreclosure process, down from 2.93% in June 2013.

This gives a total of 7.58% delinquent or in foreclosure. It breaks down as:

• 1,728,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,155,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 951,000 loans in foreclosure process.

For a total of 3,834,000 loans delinquent or in foreclosure in June. This is down from 4,785,000 in May 2013.

This graph from BKFS shows percent of loans delinquent and in the foreclosure process over time.

Delinquencies and foreclosures are moving down - and might be back to normal levels in a couple of years.

From Black Knight:

An analysis of the month’s mortgage performance data showed that the nation’s inventory of loans in foreclosure is disproportionately distributed in states with judicial foreclosure processes. According to Kostya Gradushy, Black Knight’s manager of Research and Analytics, while foreclosure inventories have been declining nationwide, judicial states’ foreclosure inventories are 3.5 times that of their non-judicial counterparts.There is much more in the mortgage monitor.

“Nationally, the foreclosure inventory rate has declined for 26 straight months, and is currently at its lowest point since April 2008, but this can obscure the stark difference that remains between judicial and non-judicial states,” said Gradushy. “Although judicial states account for about 42 percent of all active mortgages, some 70 percent of loans in foreclosure are in these states. Today, the share of loans in foreclosure in judicial states is 3.23 percent – a significant decline from its January 2012 high of 6.6 percent, but still more than four times higher than the pre-crisis ‘norm.’ Further, more than 60 percent of the foreclosure inventory in judicial states has been past due for two years or more. In fact, these loans have been delinquent an average of 1,084 days, as compared to just 775 days in non-judicial states. The states with the highest number of average days past due for loans in foreclosure are all judicial states: New York and Hawaii are each above 1,300 days, while New Jersey and Florida both top 1,200 days. emphasis added

Sunday, August 03, 2014

Sunday Night Futures

by Calculated Risk on 8/03/2014 08:35:00 PM

Monday:

• Early: Black Knight Mortgage Monitor report for June.

Weekend:

• Schedule for Week of Aug 3rd

• Demographics: Prime Working-Age Population Growing Again

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 3 and DOW futures are down 50 (fair value).

Oil prices moved down over the last week with WTI futures at $97.70 per barrel and Brent at $105.73 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.50 per gallon (down more than a dime from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demographics: Prime Working-Age Population Growing Again

by Calculated Risk on 8/03/2014 03:25:00 PM

Earlier this year, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Changes in demographics are an important determinant of economic growth, and although most people focus on the aging of the "baby boomer" generation, the movement of younger cohorts into the prime working age is another key story in coming years. Here is a graph of the prime working age population (this is population, not the labor force) from 1948 through July 2014.

Click on graph for larger image.

Click on graph for larger image.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when we compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased sharply).

The prime working age population peaked in 2007, and appears to have bottomed at the end of 2012. The good news is the prime working age group has started to grow again, and should be growing solidly by 2020 - and this should boost economic activity in the years ahead.

The second shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

The second shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

The near-prime group has still been growing - especially the 55 to 64 age group.

The key points are:

1) A slowdown in the US was expected this decade just based on demographics (the housing bust, financial crisis were piled on top of weak demographics).

2) The prime working age population in the US will start growing solidly again soon.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 8/03/2014 12:09:00 PM

By request, here is an update on an earlier post through the July employment report.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a different comparison might be to look at the percentage change. Of course the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

First, here is a table for private sector jobs. The top two private sector terms were both under President Clinton. Reagan's 2nd term saw about the same job growth as during Carter's term. Note: There was a severe recession at the beginning of Reagan's first term (when Volcker raised rates to slow inflation) and a recession near the end of Carter's term (gas prices increased sharply and there was an oil embargo).

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Carter | 9,041 |

| Reagan 1 | 5,360 |

| Reagan 2 | 9,357 |

| GHW Bush | 1,510 |

| Clinton 1 | 10,885 |

| Clinton 2 | 10,070 |

| GW Bush 1 | -841 |

| GW Bush 2 | 379 |

| Obama 1 | 1,998 |

| Obama 21 | 3,687 |

| 1Eighteen months into 2nd term | |

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama is in the second year of his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 841,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 462,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,955,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,998,000 more private sector jobs at the end of Mr. Obama's first term. Eighteen months into Mr. Obama's second term, there are now 5,685,000 more private sector jobs than when he initially took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, and 2010. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 657,000 jobs). These job losses have mostly been at the state and local level, but more recently at the Federal level. This has been a significant drag on overall employment.

And a table for public sector jobs. Public sector jobs declined the most during Obama's first term, and increased the most during Reagan's 2nd term.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Carter | 1,304 |

| Reagan 1 | -24 |

| Reagan 2 | 1,438 |

| GHW Bush | 1,127 |

| Clinton 1 | 692 |

| Clinton 2 | 1,242 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Obama 1 | -713 |

| Obama 21 | 56 |

| 1Seventeen months into 2nd term | |

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in private employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are over at the state and local levels in the aggregate, but it appears cutbacks at the Federal level have slowed. Right now I'm expecting some increase in public employment in 2014, but nothing like what happened during Reagan's second term.