by Calculated Risk on 7/31/2014 11:36:00 AM

Thursday, July 31, 2014

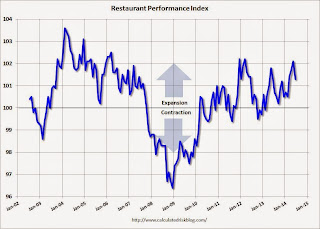

Restaurant Performance Index declined in June

From the National Restaurant Association: Restaurant Performance Index Declined in June Amid Softer Customer Traffic

Due in large part to softer customer traffic levels, the National Restaurant Association’s Restaurant Performance Index (RPI) registered a moderate decline in June. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 101.3 in June, down from a level of 102.1 in May and the first decline in four months. Despite the drop, the RPI remained above 100 for the 16th consecutive month, which signifies expansion in the index of key industry indicators.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The index decreased to 101.3 in June, down from 102.1 in May. (above 100 indicates expansion).

Restaurant spending is discretionary, so even though this is "D-list" data, I like to check it every month - and even with the monthly decline this is a solid reading.

Chicago PMI declines to 52.6

by Calculated Risk on 7/31/2014 09:52:00 AM

From the Chicago ISM: Chicago Business Barometer Down 10.0 points to 52.6 in July

The Chicago Business Barometer dropped 10.0 points to 52.6 in July, significantly down from May’s seven month high of 65.5, led by a collapse in Production and the ordering components, all of which have been strong since last fall.This was well below the consensus estimate of 63.0.

A monthly fall of this magnitude has not been seen since October 2008 and left the Barometer at its lowest level since June 2013.

In spite of the sharp decline this month, feedback from purchasing managers was that they saw the downturn as a lull rather than the start of a new downward trend. This was especially so given the recent strong performance and the fact that Employment managed to increase further in July.

emphasis added

Weekly Initial Unemployment Claims at 302,000, 4-Week Average Lowest since April 2006

by Calculated Risk on 7/31/2014 08:36:00 AM

The DOL reports:

In the week ending July 26, the advance figure for seasonally adjusted initial claims was 302,000, an increase of 23,000 from the previous week's revised level. The previous week's level was revised down by 5,000 from 284,000 to 279,000. The 4-week moving average was 297,250, a decrease of 3,500 from the previous week's revised average. This is the lowest level for this average since April 15, 2006 when it was 296,000. The previous week's average was revised down by 1,250 from 302,000 to 300,750.The previous week was revised down to 279,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 297,250.

This was lower than the consensus forecast of 305,000. The 4-week average is now at normal levels for an expansion.

Wednesday, July 30, 2014

Thursday: Unemployment Claims, Chicago PMI

by Calculated Risk on 7/30/2014 07:47:00 PM

From Tim Duy on the FOMC Statement at Economist's View

At the conclusion of this week's FOMC meeting, policymakers released yet another statement that only a FedWatcher could love. It is definitely an exercise in reading between the lines. The Fed cut another $10 billion from the asset purchase program, as expected. The statement acknowledged that unemployment is no longer elevated and inflation has stabilized. But it is hard to see this as anything more that describing an evolution of activity that is fundamentally consistent with their existing outlook. Continue to expect the first rate hike around the middle of next year; my expectation leans toward the second quarter over the third.Thursday:

...

Rather than something to worry over, I sense that the majority of the FOMC is feeling relief over the recent inflation data. It is often forgotten that the Fed WANTS inflation to move closer to 2%. The reality is finally starting to look like their forecast, which clears the way to begin normalizing policy next year. Given the current outlook, expect only gradual normalization. ...

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 305 thousand from 284 thousand.

• At 9:45 AM, the Chicago Purchasing Managers Index for July. The consensus is for a increase to 63.0, up from 62.6 in June.

Q2 GDP: Investment Contributions

by Calculated Risk on 7/30/2014 04:00:00 PM

Private investment rebounded in Q2. Residential investment increased at a 7.5% annual rate in Q2, equipment investment increased at a 7.0% annual rate, and investment in non-residential structures increased at a 5.3% annual rate.

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) increased in Q2, but the three quarter average was negative (red).

Residential investment is so low - as a percent of the economy - that this small decline is not a concern. However, for the rate of economic growth to increase, RI will probably have to continue to make positive contributions.

Equipment and software added 0.4 percentage points to growth in Q2 and the three quarter average moved higher (green).

The contribution from nonresidential investment in structures was also positive in Q2. Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery.

I expect to see all areas of private investment increase over the next few quarters - and that is key for stronger GDP growth.