by Calculated Risk on 7/14/2014 06:49:00 PM

Monday, July 14, 2014

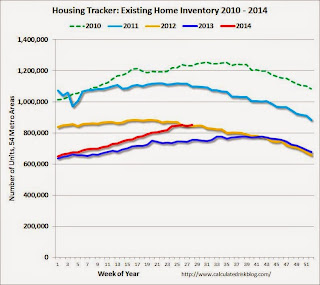

Weekly Update: Housing Tracker Existing Home Inventory up 13.1% YoY on July 14th

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data released was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 13.1% above the same week in 2013. (Note: There are differences in how the data is collected between Housing Tracker and the NAR).

Inventory is also about 0.9% above the same week in 2012. This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014 based on the NAR report. Right now it looks like inventory might increase more than I expected.

CNBC's Liesman to Santelli: "It is impossible for you to have been more wrong"

by Calculated Risk on 7/14/2014 01:59:00 PM

The second half of this video is the best part. Liesman walks through a number of Santelli's predictions - all wrong.

I've only picked on Santelli once when he misread the employment report, but Santelli is generally clueless about economics.

Update: The California Budget Surplus

by Calculated Risk on 7/14/2014 09:25:00 AM

In November 2012, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”At the time that was way out of the consensus view. And a couple of months later California announced a balanced budget, see The California Budget Surplus

The situation has improved since then. Here is the most recent update from California State Controller John Chiang: Controller Releases June Cash Update

State Controller John Chiang today released his monthly cash report for the month of June, and announced that the state's General Fund -- the primary account from which California funds its day-to-day operations and programs -- ended the fiscal year with a positive cash balance for the first time since June 30, 2007. A positive cash balance means that the state had funds available to meet all of its payment obligations without needing to borrow from Wall Street or the $23.8 billion available in its more than 700 internal special funds and accounts.This is just one state, but I've been expecting local and state governments (in the aggregate) to add to both GDP and employment in 2014.

...

According to the monthly report covering California's cash balance, receipts and disbursements in June 2014, the General Fund had $1.9 billion in cash on June 30, marking the first time it has ended the fiscal year in the black since 2007, when it ended the year with $2.5 billion in the bank.

For the 2013-14 fiscal year, revenues came in at $101.6 billion, or $2.1 billion (2.1 percent) more than projected in the Governor’s budget released in January.

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years.

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years.Note: Scale doesn't start at zero to better show the change.

In June 2014, state and local governments added 24,000 jobs. State and local government employment is now up 138,000 from the bottom, but still 606,000 below the peak.

It is pretty clear that state and local employment is now increasing.

Note: Federal government layoffs have slowed (actually added 2,000 in June), but Federal employment is still down 23,000 for the year.

Sunday, July 13, 2014

Sunday Night Futures

by Calculated Risk on 7/13/2014 10:10:00 PM

An update on funding the Highway Trust Fund from the WSJ: Officials From Both Parties Call for Congress to Consider Raising Gas Tax to Ensure More Stable Revenue for Roads

Some governors at their summer meeting here, both Democrats and Republicans, said Congress should consider increasing the gas tax to provide a more reliable revenue stream for the Highway Trust Fund. They also called for finding ways to ensure that electric and fuel-efficient vehicles help pay the costs of maintaining the nation's roads.At least this is supported by members of both parties at the state level, but this used to be supported by Congress and Republican Presidents too (read Reagan's comments when he raised the gasoline tax in 1982). Oh well ... I expect a bill to be passed again, but only a short term bill.

The trust fund is financed mostly by diesel and gasoline taxes that haven't increased since 1993 even as fuel economy has improved for most new vehicles, leaving the government without enough money to cover its share of spending on road repairs and highway construction.

Next year (a non-election year) is shaping up to be very ugly politically.

Weekend:

• Schedule for Week of July 13th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 4 and DOW futures are up 33 (fair value).

Oil prices moved down the last week with WTI futures at $100.76 per barrel and Brent at $106.70 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.61 per gallon (about the same as a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 7/13/2014 06:25:00 PM

The NAR will report June Existing Home Sales on Tuesday, July 22nd. The consensus isn't available yet, but eonomist Tom Lawler estimates the NAR will report sales of 4.96 million on a seasonally adjusted annual rate (SAAR) basis up from 4.89 million SAAR in May.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 4 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Over the last four years, the consensus average miss was 150 thousand with a standard deviation of 170 thousand. Lawler's average miss was 70 thousand with a standard deviation of 50 thousand.

Note: Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has been doing a little better recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | NA | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | --- | 4.96 | --- |

| 1NAR initially reported before revisions. | |||