by Calculated Risk on 7/12/2014 11:14:00 AM

Saturday, July 12, 2014

Schedule for Week of July 13th

The key reports this week are June Retail Sales on Tuesday and June Housing Starts on Thursday.

For manufacturing, the June Industrial Production and Capacity Utilization report, and the July NY Fed (Empire State) and Philly Fed surveys, will be released this week.

Fed Chair Janet Yellen will present the Semiannual Monetary Policy Report to the Congress on Tuesday and Wednesday.

No economic releases scheduled.

8:30 AM ET: Retail sales for June will be released.

8:30 AM ET: Retail sales for June will be released.This graph shows retail sales since 1992 through May 2014. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). On a monthly basis, retail sales increased 0.3% from April to May (seasonally adjusted), and sales were up 4.3% from May 2013.

The consensus is for retail sales to increase 0.6% in June, and to increase 0.5% ex-autos.

8:30 AM: NY Fed Empire Manufacturing Survey for July. The consensus is for a reading of 17.0, down from 19.3 in June (above zero is expansion).

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for May. The consensus is for a 0.6% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for June from the BLS. The consensus is for a 0.3% increase in prices.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 79.2%.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 50, up from 49 in June. Any number above 50 indicates that more builders view sales conditions as good than poor.

10:00 AM: Testimony by Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 310 thousand from 304 thousand.

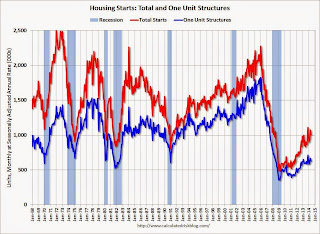

8:30 AM: Housing Starts for June.

8:30 AM: Housing Starts for June. Total housing starts were at 1.001 million (SAAR) in May. Single family starts were at 625 thousand SAAR in May.

The consensus is for total housing starts to increase to 1.020 million (SAAR) in June.

10:00 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of 15.5, down from 17.8 last month (above zero indicates expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for July). The consensus is for a reading of 83.0, up from 82.5 in June.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for June 2014

Unofficial Problem Bank list unchanged at 465 Institutions

by Calculated Risk on 7/12/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 10, 2014.

Changes and comments from surferdude808:

For the second time this year, there are no changes to the Unofficial Problem Bank List to report. So the list remains unchanged at 465 institutions with assets of $147.6 billion. For comparison purposes, a year ago the list held 742 institutions with assets of $271.3 billion. Next week there will be some changes to report as the OCC should be issuing an update on its enforcement action activity on Friday.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 465.

Friday, July 11, 2014

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in June

by Calculated Risk on 7/11/2014 08:42:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for several selected cities in June.

Comments from CR: Tom Lawler has been sending me this table every month for several years. I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us.

On distressed: Total "distressed" share is down in all of these markets, mostly because of a sharp decline in short sales.

Short sales are down in all of these areas.

Foreclosures are down in most of these areas too, although foreclosures are up a little in Nevada and Mid-Atlantic.

The All Cash Share (last two columns) is mostly declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| June-14 | June-13 | June-14 | June-13 | June-14 | June-13 | June-14 | June-13 | |

| Las Vegas | 10.8% | 31.0% | 10.1% | 9.0% | 20.9% | 40.0% | 34.7% | 55.3% |

| Reno** | 10.0% | 24.0% | 7.0% | 6.0% | 17.0% | 30.0% | ||

| Phoenix | 3.8% | 12.7% | 6.2% | 8.7% | 10.0% | 21.5% | 25.6% | 37.5% |

| Sacramento | 7.0% | 19.7% | 6.5% | 7.3% | 13.5% | 27.0% | 19.8% | 29.9% |

| Mid-Atlantic | 4.8% | 7.6% | 7.5% | 6.3% | 12.2% | 13.9% | 16.5% | 15.9% |

| Hampton Roads | 20.1% | 22.8% | ||||||

| Northeast Florida | 32.3% | 37.3% | ||||||

| Toledo | 28.4% | 31.5% | ||||||

| Des Moines | 14.9% | 17.5% | ||||||

| Tucson | 26.1% | 28.1% | ||||||

| Omaha | 16.3% | 14.9% | ||||||

| Georgia*** | 24.6% | N/A | ||||||

| Houston | 4.4% | 8.4% | ||||||

| Memphis* | 13.0% | 18.9% | ||||||

| Birmingham AL | 14.0% | 19.4% | ||||||

| Springfield IL** | 8.5% | 11.8% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/11/2014 06:11:00 PM

From housing economist Tom Lawler:

Based on local realtor association/MLS reports released so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.96 million in June, up 1.4% from May’s pace, but down 3.9% from last June’s seasonally adjusted pace.CR Note: The NAR is scheduled to release June existing home sales on Tuesday, July 22nd.

Based on a combination of realtor/MLS reports and reports from entities that track listings, I “gueestimate” that the NAR’s existing home inventory estimate for June will be 2.350 million, up about 3.1% from May and up 8.8% from last June. Finally, based on local realtor reports I predict that the NAR’s estimate for the median SF home sales price in June be up 3.9% from last June.

On inventory, if Lawler is correct, this would put inventory in June at about the same level as in June 2012 (two years ago) when prices started increasing faster. Now this should mean slower price increases. Note: the NAR reported inventory at 2.280 million in May, up 6.0% from May 2013.

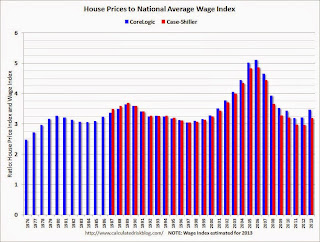

House Prices to National Average Wage Index

by Calculated Risk on 7/11/2014 02:55:00 PM

One of the metrics we'd like to follow is a ratio of house prices to incomes. Unfortunately most income data is released with a significantly lag, and there is always a question on what income data to use (the average total income is skewed by the income of a few people).

And for key measures of house prices - like Case-Shiller and CoreLogic - we have indexes, not actually prices.

But we can construct a ratio of the house price indexes to some measure of income.

For this graph I decided to look at house prices and the National Average Wage Index from Social Security.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the ratio of house price indexes divided by the National Average Wage Index (the Wage index is first divided by 1000).

This uses the annual average CoreLogic index since 1976, and also the National Case-Shiller index since 1987.

As of 2013, house prices were just above the historical ratio. Prices have increased further in 2014, but it appears house prices relative to incomes is still below the 1989 peak.

Going forward, I think it would be a positive if wages outpaced, or at least kept pace with house prices increases for a few years.

Notes: The national wage index for 2013 is estimated using the same increase as in 2012.