by Calculated Risk on 7/06/2014 07:51:00 PM

Sunday, July 06, 2014

Sunday Night Futures

On inflation: I'm sympathetic to people like Joe Weisenthal at Business Insider who is looking for signs of inflation increasing; I'm starting to look for signs of real wage increases and inflation too. I just think inflation isn't a concern right now (Weisenthal was correct on inflation over the last several years in contrast to the people who were consistently wrong on inflation).

It is easy to understand the concern about inflation when we see articles like this from Ben Leubsdorf and Jon Hilsenrath at the WSJ: As Food Prices Rise, Fed Keeps a Watchful Eye

The consumer price of ground beef in May rose 10.4% from a year earlier while pork chop prices climbed 12.7%. The price of fresh fruit rose 7.3% and oranges 17.1% ... The U.S. Department of Agriculture predicts overall food prices will increase 2.5% to 3.5% this year after rising 1.4% in 2013, as measured by the Labor Department's consumer-price index.Meanwhile gasoline prices are up year-over-year too (see graph below). I suspect this is going to reignite the CPI (or PCE prices) vs. core prices again.

For food prices, the drought in California is having an impact. From an earlier WSJ article:

Because California boasts a bigger agricultural sector than any other state, the drought could have an outsize economic impact nationally, raising produce prices.And gasoline and oil prices have been impacted by the turmoil in Iraq. Monetary policy can't halt the violence in Iraq or make it rain in California - and this is why it is important to track various core measures of inflation.

On the Employment Report:

• June Employment Report: 288,000 Jobs, 6.1% Unemployment Rate

• Comment on Employment Report

• More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

Weekend:

• Mid-Year Review: Ten Economic Questions for 2014

• Schedule for Week of July 6th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 11 (fair value).

Oil prices moved mostly sideways down the last week with WTI futures at $103.91 per barrel and Brent at $110.61 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.65 per gallon (about 20 cents higher than a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Is Inflation Coming?

by Calculated Risk on 7/06/2014 02:42:00 PM

Joe Weisenthal at Business Insider writes: These Three Charts Show Inflation Is Finally Right Around The Corner

After this week's strong Jobs Report, it's becoming conventional wisdom that the economy is heating up for real this time. After numerous false starts and disappointments since the financial crisis, it appears we've kicked into a higher gear.I also think the economy is picking up, and I agree that as slack diminishes, we will probably see real wage growth and an uptick in inflation.

A stronger economy should mean higher inflation. That's because as the economy grows, slack diminishes in the economy (both industrial slack and labor market slash) and that puts pricing pressure on existing resources. It makes sense, as the unemployed become more scarce, employed workers have greater bargaining power for wages.

However, this is unconvincing:

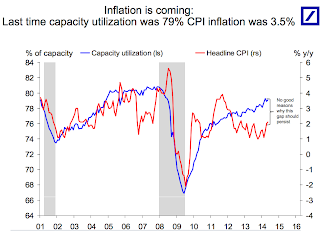

These three charts from Deutsche Bank economist Torsten Slok make for a good overview of the case that inflation is coming. ... Historically, when Capacity Utilization is as high as its now (suggesting not much industrial slack) the inflation rate has been much higher.

Click on graph for larger image.

Click on graph for larger image.Here is the first chart. This shows capacity utilization and the year-over-year change in CPI.

Capacity Utilization has been increasing, and the author write "No good reasons why this gap should persist" (gap between Capacity utilization on the chart and CPI).

Whenever I see a correlation chart like this, I like to see what happened in earlier periods.

The second graph shows the same data, but this time starting in 1990 (instead of 2001).

The second graph shows the same data, but this time starting in 1990 (instead of 2001).For most of the '90s there was a huge "gap" between capacity utilization and CPI.

There were periods when capacity utilization was higher than now - and inflation lower. As an example, capacity utilization was close to 83% in 1998, and YoY inflation averaged 1.5%.

So I don't think the first graph is convincing that inflation is "right around the corner". (the last two graphs are from a small survey and also not convincing).

My view is inflation is increasing a little (as was expected), but is not a concern this year.

More Employment Graphs: Duration of Unemployment, Unemployment by Education, Construction Employment and Diffusion Indexes

by Calculated Risk on 7/06/2014 11:39:00 AM

Thursday on the employment report:

• June Employment Report: 288,000 Jobs, 6.1% Unemployment Rate

• Comments on Employment Report

A few more employment graphs by request ...

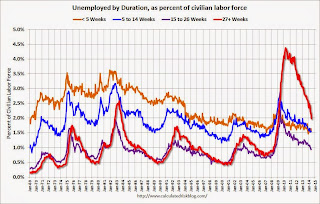

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, and both the "less than 5 weeks" and 6 to 14 weeks" are close to normal levels.

The long term unemployed is just below 2.0% of the labor force - the lowest since February 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment.

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This graph shows total construction employment as reported by the BLS (not just residential).

This graph shows total construction employment as reported by the BLS (not just residential).Since construction employment bottomed in January 2011, construction payrolls have increased by 583 thousand.

Historically there is a lag between an increase in activity and more hiring - and it appears hiring should pickup more this year.

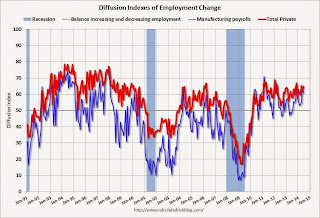

The BLS diffusion index for total private employment was at 64.8 in June, up from 62.9 in May.

The BLS diffusion index for total private employment was at 64.8 in June, up from 62.9 in May.For manufacturing, the diffusion index decreased to 61.1, down from 63.6 in May.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth was widespread in June.

Saturday, July 05, 2014

Unofficial Problem Bank list declines to 465 Institutions

by Calculated Risk on 7/05/2014 05:29:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 3, 2014.

Changes and comments from surferdude808:

Generally a quiet week for the Unofficial Problem Bank List with three removals but none from failure as no one expected the FDIC to close on bank on the July 4th weekend. After the removals, the list count drops to 465 institutions with assets of $147.6 billion. The list is down significantly from a year ago when it included 743 institutions with assets of $271.5 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 465.

The FDIC terminated the action against Monroe Bank & Trust, Monroe, MI ($1.2 billion Ticker: MBTF). The other two banks removed -- Harrington Bank, FSB, Chapel Hill, NC ($225 million) and Community Bank of San Joaquin, Stockton, CA ($125 million Ticker: BKOT) -- found their way off the list through a merger with a healthier bank.

Next week is expected to see few changes as the OCC likely will not be providing an update on it enforcement actions until July 18th. Enjoy the holiday weekend.

Schedule for Week of July 6th

by Calculated Risk on 7/05/2014 08:37:00 AM

This will be a very light week for economic data.

No economic releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for June.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for May from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In April, the number of job openings (yellow) were up 17% year-over-year compared to April 2013, and Quits were up 11% year-over-year.

3:00 PM: Consumer Credit for May from the Federal Reserve. The consensus is for credit to increase $17.5 billion.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Minutes for the Meeting of June 17-18, 2014.

Early: Trulia Price Rent Monitors for June. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 316 thousand from 315 thousand.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for May. The consensus is for a 0.6% increase in inventories.

At 4:30 PM, Speech by Fed Vice Chairman Stanley Fischer, Financial Sector Reform, At the Martin Feldstein Lecture, hosted by the National Bureau of Economic Research, Cambridge, Massachusetts

2:00 PM ET: The Monthly Treasury Budget Statement for June.