by Calculated Risk on 6/30/2014 01:55:00 PM

Monday, June 30, 2014

Schedule Update: Reis Office, Aparment and Mall Surveys to be released this week

Just an update to the weekly schedule ... adding the quarterly Reis surveys of rents and vacancy rates for offices, apartments and malls.

Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

Early: Reis Q2 2014 Apartment Survey of rents and vacancy rates.

Early: Reis Q2 2014 Mall Survey of rents and vacancy rates.

Dallas Fed: Manufacturing Activty Increases "Picks Up Pace" in June

by Calculated Risk on 6/30/2014 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Picks Up Pace

Texas factory activity increased again in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 11 to 15.5, indicating output grew at a faster pace than in May.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Other measures of current manufacturing activity also reflected growth in June. The new orders index rose from 3.8 to 6.5 but remained below the levels seen earlier in the year. The capacity utilization index held steady at 9.2. The shipments index came in at 10.3, similar to its May level, with nearly a third of manufacturers noting an increase in volumes.

Perceptions of broader business conditions were more optimistic this month. The general business activity index rose from 8 to 11.4. ...

Labor market indicators reflected stronger employment growth and longer workweeks. The June employment index rebounded to 13.1 after dipping to 2.9 in May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through June), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through May (right axis).

All of the regional surveys showed expansion in June, and it seems likely the ISM index will be at about the same level as in May, or increase slightly in June. The ISM index for June will be released tomorrow, Tuesday, July 1st.

NAR: Pending Home Sales Index increased 6.1% in May, down 5.2% year-over-year

by Calculated Risk on 6/30/2014 10:00:00 AM

From the NAR: Pending Home Sales Surge in May

Pending home sales rose sharply in May, with lower mortgage rates and increased inventory accelerating the market, according to the National Association of Realtors®. All four regions of the country saw increases in pending sales, with the Northeast and West experiencing the largest gains.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 6.1 percent to 103.9 in May from 97.9 in April, but still remains 5.2 percent below May 2013 (109.6).

...

The PHSI in the Northeast jumped 8.8 percent to 86.3 in May, and is now 0.2 percent above a year ago. In the Midwest the index rose 6.3 percent to 105.4 in May, but is still 6.6 percent below May 2013.

Pending home sales in the South advanced 4.4 percent to an index of 117.0 in May, and is 2.9 percent below a year ago. The index in the West rose 7.6 percent in May to 95.4, but remains 11.1 percent below May 2013.

Sunday, June 29, 2014

Monday: Chicago PMI, Pending Home Sales

by Calculated Risk on 6/29/2014 09:00:00 PM

Monday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

• At 10:00 AM, the Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Weekend:

• Demographics: Prime and Near-Prime Population and Labor Force

• Schedule for Week of June 29th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 11 (fair value).

Oil prices moved down slightly over the last week with WTI futures at $105.45 per barrel and Brent at $113.10 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.68 per gallon, up about 20 cents from a year ago. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demographics: Prime and Near-Prime Population and Labor Force

by Calculated Risk on 6/29/2014 12:33:00 PM

Earlier this week, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

Here are a couple more graphs making this point. The first shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

Click on graph for larger image.

Click on graph for larger image.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The near-prime group has been growing - especially the 55 to 64 age group.

The good news is the prime working age group will start growing again by 2020, and this should boost economic activity.

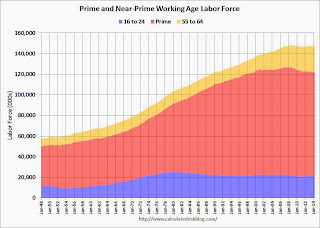

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased).

As Bruegel notes, the working age population in the US is expected to grow over the next few decades - so the US has much better demographics than Europe, China or Japan (not included).

The key points are:

1) A slowdown in the US was expected this decade just based on demographics (the housing bust, financial crisis were piled on top of weak demographics).

2) The prime working age population in the US will start growing again soon.