by Calculated Risk on 6/30/2014 10:00:00 AM

Monday, June 30, 2014

NAR: Pending Home Sales Index increased 6.1% in May, down 5.2% year-over-year

From the NAR: Pending Home Sales Surge in May

Pending home sales rose sharply in May, with lower mortgage rates and increased inventory accelerating the market, according to the National Association of Realtors®. All four regions of the country saw increases in pending sales, with the Northeast and West experiencing the largest gains.Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in June and July.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 6.1 percent to 103.9 in May from 97.9 in April, but still remains 5.2 percent below May 2013 (109.6).

...

The PHSI in the Northeast jumped 8.8 percent to 86.3 in May, and is now 0.2 percent above a year ago. In the Midwest the index rose 6.3 percent to 105.4 in May, but is still 6.6 percent below May 2013.

Pending home sales in the South advanced 4.4 percent to an index of 117.0 in May, and is 2.9 percent below a year ago. The index in the West rose 7.6 percent in May to 95.4, but remains 11.1 percent below May 2013.

Sunday, June 29, 2014

Monday: Chicago PMI, Pending Home Sales

by Calculated Risk on 6/29/2014 09:00:00 PM

Monday:

• At 9:45 AM ET, the Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

• At 10:00 AM, the Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Weekend:

• Demographics: Prime and Near-Prime Population and Labor Force

• Schedule for Week of June 29th

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 11 (fair value).

Oil prices moved down slightly over the last week with WTI futures at $105.45 per barrel and Brent at $113.10 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.68 per gallon, up about 20 cents from a year ago. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Demographics: Prime and Near-Prime Population and Labor Force

by Calculated Risk on 6/29/2014 12:33:00 PM

Earlier this week, I posted some demographic data for the U.S., see: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group and The Future is still Bright!

I pointed out that "even without the financial crisis we would have expected some slowdown in growth this decade (just based on demographics). The good news is that will change soon."

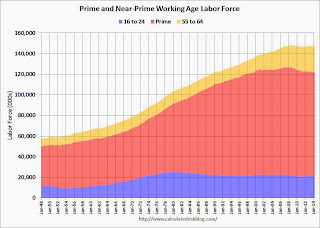

Here are a couple more graphs making this point. The first shows prime and near-prime working age population in the U.S. since 1948 (this is population, not labor force).

Click on graph for larger image.

Click on graph for larger image.

There was a huge surge in the prime working age population in the '70s, '80s and '90s - and the prime age population has been mostly flat recently (even declined a little).

The near-prime group has been growing - especially the 55 to 64 age group.

The good news is the prime working age group will start growing again by 2020, and this should boost economic activity.

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The second graph shows prime and near-prime working age labor force in the U.S. since 1948 (this is labor force - the first graph was population).

The prime working age labor force grew even quicker than the population in the '70s and '80s due the increase in participation of women. In fact, the prime working age labor force was increasing 3%+ per year in the '80s!

So when compare economic growth to the '70s, '80, or 90's we have to remember this difference in demographics (the '60s saw solid economic growth as near-prime age groups increased).

As Bruegel notes, the working age population in the US is expected to grow over the next few decades - so the US has much better demographics than Europe, China or Japan (not included).

The key points are:

1) A slowdown in the US was expected this decade just based on demographics (the housing bust, financial crisis were piled on top of weak demographics).

2) The prime working age population in the US will start growing again soon.

Saturday, June 28, 2014

Schedule for Week of June 29th

by Calculated Risk on 6/28/2014 01:11:00 PM

This will be a busy holiday week for economic data with several key reports including the June employment report on Thursday.

Other key reports include the ISM manufacturing index on Tuesday, June vehicle sales on Tuesday, and the May Trade Deficit and June ISM non-manufacturing index on Thursday.

Fed Chair Janet Yellen will speak on Financial Stability.

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a decrease to 64.0, down from 65.5 in May.

10:00 AM ET: Pending Home Sales Index for May. The consensus is for a 1% increase in the index.

10:30 AM: Dallas Fed Manufacturing Survey for June. This is the last of the regional Fed manufacturing surveys for June.

Early: Reis Q2 2014 Office Survey of rents and vacancy rates.

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for June. The consensus is for light vehicle sales to decrease to 16.4 million SAAR in June from 16.7 million in May (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the May sales rate.

10:00 AM: Construction Spending for May. The consensus is for a 0.5% increase in construction spending.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May.

10:00 AM: ISM Manufacturing Index for June. The consensus is for an increase to 55.6 from 55.4 in May.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in May at 55.4%. The employment index was at 52.8%, and the new orders index was at 56.9%.

Early: Reis Q2 2014 Apartment Survey of rents and vacancy rates.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for June. This report is for private payrolls only (no government). The consensus is for 210,000 payroll jobs added in June, up from 180,000 in May.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is for a 0.3% decrease in May orders.

11:00 AM: Speech by Fed Chair Janet Yellen, Financial Stability, At the Inaugural Michel Camdessus Central Banking Lecture at the International Monetary Fund, Washington, D.C.

Early: Reis Q2 2014 Mall Survey of rents and vacancy rates.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 314 thousand from 312 thousand.

8:30 AM: Employment Report for June. The consensus is for an increase of 211,000 non-farm payroll jobs added in June, down from the 217,000 non-farm payroll jobs added in May.

The consensus is for the unemployment rate to be unchanged at 6.3% in May.

This graph shows the percentage of payroll jobs lost during post WWII recessions through May. The red line is back to zero!

This graph shows the percentage of payroll jobs lost during post WWII recessions through May. The red line is back to zero!The economy has added 9.4 million private sector jobs since employment bottomed in February 2010 (8.8 million total jobs added including all the public sector layoffs).

There are 617 thousand more private sector jobs now than when the recession started in 2007, and total employment is now 98 thousand above the pre-recession peak.

8:30 AM: Trade Balance report for May from the Census Bureau.

8:30 AM: Trade Balance report for May from the Census Bureau. Both imports and exports increased in April.

The consensus is for the U.S. trade deficit to be at $45.1 billion in May from $47.2 billion in April.

10:00 AM: ISM non-Manufacturing Index for June. The consensus is for a reading of 56.2, down from 56.3 in May. Note: Above 50 indicates expansion.

All US markets are closed in observance of the Independence Day holiday.

Unofficial Problem Bank list declines to 468 Institutions, Q2 2014 Transition Matrix

by Calculated Risk on 6/28/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 27, 2014.

Changes and comments from surferdude808:

FDIC providing an update on its enforcement action activities and a deeper scrubbing of the list drove a net decline in the Unofficial Problem Bank List to 468 institutions with assets of $149.2 billion. In all, there were 21 removals and one addition this week. A year ago, the list held 749 institutions with assets of $273.3 billion. During this June, the list declined by a net 28 institutions after 26 action terminations, two failures, one merger, and one addition. The failure this week, The Freedom State Bank, Freedom, OK surprisingly was not on the list as the only action issued by FDIC that can be located is a Prompt Corrective Action order only issued less than 60 days ago.

Removals this week were The Bank of Delmarva, Seaford, DE ($425 million); Community Bank of the South, Smyrna, GA ($348 million); Mercantile Bank, Quincy, IL ($347 million); The Pueblo Bank and Trust Company, Pueblo, CO ($320 million); First Farmers & Merchants Bank, Cannon Falls, MN ($265 million); Firstier Bank, Kimball, NE ($245 million); SouthPoint Bank, Birmingham, AL ($202 million); Marine Bank & Trust Company, Vero Beach, FL ($152 million); Bank of Fairfield, Fairfield, WA ($147 million); Concord Bank, St. Louis, MO ($138 million); Town & Country Bank, Las Vegas, NV ($120 million); Freedom Bank of America, Saint Petersburg, FL ($107 million); State Bank of Park Rapids, Park Rapids, MN ($100 million); Community Pride Bank, Isanti, MN ($94 million); First Bank, West Des Moines, IA ($90 million); First Carolina Bank, Rocky Mount, NC ($89 million); Sherburne State Bank, Becker, MN ($84 million); Bank of the Prairie, Olathe, KS ($80 million); Security Bank, New Auburn, WI ($75 million); Holladay Bank & Trust, Salt Lake City, UT ($51 million); and Maple Bank, Champlin, MN ($51 million).

The sole addition this week Community 1st Bank Las Vegas, Las Vegas, NM ($146 million).

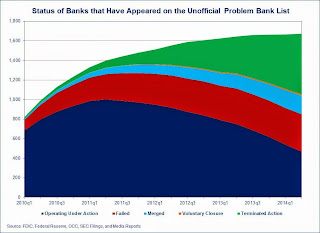

We have updated the Unofficial Problem Bank List transition matrix through the second quarter of 2014. Full details are available in the accompanying table and a graphic depicting trends in how institutions have arrived and departed the list. Since publication of the Unofficial Problem Bank List started in August 2009, a total of 1,672 institutions have appeared on the list. New entrants have slowed since late 2012, but this quarter seven institutions were added up from only three being added in the previous two quarters.

At the end of the second quarter, only 468 or 28 percent of the banks that have been on a list at some point remain. Action terminations of 619 account for around 51 percent of the 1,204 institutions removed. However, a significant number of institutions have left the list through failure. So far, 381 institutions have failed accounting for nearly 32 percent of departures. Should another institution on the list not fail, then more than 22 percent of the 1,672 institutions making an appearance would have failed. A 22 percent default rate would be more than double the rate often cited by media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 141 | (55,759,559) | |

| Unassisted Merger | 32 | (6,697,723) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 154 | (184,269,578) | |

| Asset Change | (5,411,792) | ||

| Still on List at 6/30/2014 | 58 | 13,590,663 | |

| Additions after 8/7/2009 | 478 | 135,599,760 | |

| End (6/30/2014) | 468 | 149,190,423 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 478 | 206,393,188 | |

| Unassisted Merger | 158 | 71,031,845 | |

| Voluntary Liquidation | 10 | 2,324,142 | |

| Failures | 227 | 111,634,071 | |

| Total | 873 | 391,383,246 | |

| 1Institution not on 8/7/2009 or 6/30/2014 list but appeared on a weekly list. | |||