by Calculated Risk on 6/17/2014 11:12:00 AM

Tuesday, June 17, 2014

Key Inflation Measures Show Increase, Year-over-year still mostly below the Fed Target in May

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.2% annualized rate) in May. The 16% trimmed-mean Consumer Price Index also increased 0.3% (3.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for May here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.3% annualized rate) in May. The CPI less food and energy increased 0.3% (3.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 2.0%. Core PCE is for April and increased just 1.4% year-over-year.

On a monthly basis, median CPI was at 3.2% annualized, trimmed-mean CPI was at 3.2% annualized, and core CPI increased 3.1% annualized.

There key measures of inflation have moved up over the last few months, but on a year-over-year basis these measures suggest inflation remains at or below the Fed's target of 2%.

Housing Starts at 1.001 Million Annual Rate in May

by Calculated Risk on 6/17/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,001,000. This is 6.5 percent below the revised April estimate of 1,071,000, but is 9.4 percent above the May 2013 rate of 915,000.

Single-family housing starts in May were at a rate of 625,000; this is 5.9 percent below the revised April figure of 664,000. The May rate for units in buildings with five units or more was 366,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 991,000. This is 6.4 percent below the revised April rate of 1,059,000 and is 1.9 percent below the May 2013 estimate of 1,010,000.

Single-family authorizations in May were at a rate of 619,000; this is 3.7 percent above the revised April figure of 597,000. Authorizations of units in buildings with five units or more were at a rate of 347,000 in May.

Click on graph for larger image.

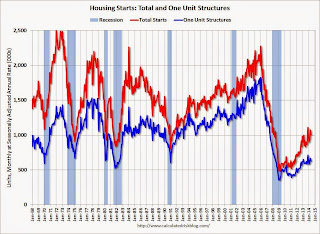

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in May (Multi-family is volatile month-to-month).

Single-family starts (blue) also decreased in May.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was Below expectations of 1.036 million starts in May. Note: Starts for March and April were revised slightly. I'll have more later.

Monday, June 16, 2014

Tuesday: Housing Starts, CPI

by Calculated Risk on 6/16/2014 07:31:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014 (I've already "won", and NDD made a donation to the Tanta Memorial Fund - but he could still win too):

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.In May 2013, starts were at a 915 thousand seasonally adjusted annual rate (SAAR). For me to win again (only one win counts), starts would have to be up 20% or at 1.098 million SAAR in May (possible). For NDD to win, starts would have to fall to 815 thousand SAAR (not likely). NDD could also "win" if permits fall to 910 thousand SAAR from 1.010 million SAAR in May 2013.

Tuesday:

• At 8:30 AM, Housing Starts for May. Total housing starts were at 1.072 million (SAAR) in April. Single family starts were at 649 thousand SAAR in April. The consensus is for total housing starts to decrease to 1.036 million (SAAR) in May.

• Also at 8:30 AM, Consumer Price Index for May. The consensus is for a 0.2% increase in CPI in May and for core CPI to increase 0.2%.

Weekly Update: Housing Tracker Existing Home Inventory up 13.7% year-over-year on June 16th

by Calculated Risk on 6/16/2014 03:30:00 PM

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 13.7% above the same week in 2013.

Inventory is still very low - but I expect inventory to be above the same week in 2012 very soon (prices bottomed in early 2012). This increase in inventory should slow price increases, and might lead to price declines in some areas.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess was inventory would be up 10% to 15% year-over-year at the end of 2014. Right now it looks like inventory might increase more than I expected.

Wall Street and A Dirty Little Secret

by Calculated Risk on 6/16/2014 12:26:00 PM

Josh Brown mentioned a post today at A Wealth of Common Sense: How The Unemployment Rate Affects Stock Market Performance. The author is discussing investing ...

The unemployment rate is a perfect example of the fact that the best times to invest are when things seem the worst.This reminds me of something I wrote in May 2011: Employment: A dirty little secret

[I]t really isn't much of a secret that Wall Street and corporate America like the unemployment rate to be a little high. But it is "dirty" in the sense that it is unspoken. Higher unemployment keeps wage growth down, and helps with margins and earnings - and higher unemployment also keeps the Fed on the sidelines. Yes, corporations like to see job growth, so people have enough confidence to spend (and they can have a few more customers). And they definitely don't want to see Depression era unemployment - but a slowly declining unemployment rate (even at 9%) with some job growth is considered OK.And from others, like Kash Mansori, also in 2011: Why a Bad Job Market is Good News for Some

[T]his opens up an interesting line of reasoning, one that is certainly not new but which this data reminds us of. If a bad labor market means that workers get a smaller share of the productivity they bring to their employers, then the owners of companies will have a strong preference for a weak labor market. Firms don't like recessions, of course -- it's hard to make money when your sales are falling. But companies do enjoy the way that a very slow recovery in the job market can allow them to keep wages down, and thus keep a larger share of the output of their workers for themselves.And from Paul Krugman: The Plight of the Employed

And may I suggest that employers, although they’ll never say so in public, like this situation? That is, there’s a significant upside to them from the still-weak economy. I don’t think I’d go so far as to say that there’s a deliberate effort to keep the economy weak; but corporate America certainly isn’t feeling much pain, and the plight of workers is actually a plus from their point of view.The good news is we might finally be seeing the beginning of more wage growth.