by Calculated Risk on 5/20/2014 10:50:00 AM

Tuesday, May 20, 2014

Philly Fed: State Coincident Indexes increased in 47 states in April

From the Philly Fed:

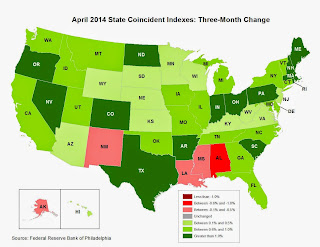

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2014. In the past month, the indexes increased in 47 states, decreased in two, and remained stable in one, for a one-month diffusion index of 90. Over the past three months, the indexes increased in 45 states and decreased in five, for a three-month diffusion index of 80.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

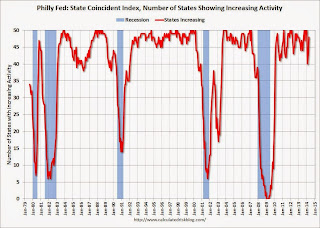

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In April, 48 states had increasing activity(including minor increases). This measure declined sharply during the winter, but is now back to normal for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is mostly green again.

Zillow: Negative Equity declines further in Q1 2014

by Calculated Risk on 5/20/2014 09:35:00 AM

From Zillow: Negative Equity Continues to Fall, Concentrated in Bottom Tier

According to the first quarter Zillow Negative Equity Report, the national negative equity rate continued to decline to 18.8 percent, down 12.6 percentage points from its 31.4 percent peak in the first quarter of 2012. Negative equity has fallen for eight consecutive quarters as home values have risen. The national negative equity rate fell from 25.4 percent in the first quarter of 2013 and 19.4 percent in the fourth quarter, while the pace of annual home value growth slowed to 5.7 percent in the first quarter of 2014, from 6.6 percent at the end of the fourth quarter of 2013. However, more than 9.7 million homeowners with a mortgage still remain underwater.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q1 2014 compared to Q1 2013.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Figure6Figure 6 shows the loan-to-value (LTV) distribution for homeowners with a mortgage in 2014 Q1 versus 2013 Q1. The bulk of underwater homeowners, roughly 47 percent, are underwater by up to 20 percent of their loan value, and will soon cross over into positive equity territory. However they will still be effectively underwater, as they will not gain enough of a profit in the sale of their current house to pay the expenses and down payment associated with buying a new home.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (the light red columns). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or the loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 6.2% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic will release their Q1 negative equity report in the next couple of weeks. For Q4, CoreLogic reported there were 6.5 million properties with negative equity, and that will be down further in Q1 2014.

Monday, May 19, 2014

Amusing: A False Story on Auto Inventory

by Calculated Risk on 5/19/2014 09:25:00 PM

For fun, an interesting story from Barry Ritholtz: The Truth About Auto Sales

This week, an e-mail landed in my inbox with the header “Unsold Cars.” ...From Snopes.com: Unsold Cars

Normally, I would have deleted the e-mail without a second thought. But several things about it warranted further notice.

The first were aerial photos of thousands of cars. Wow, this really was a lot of cars.

The second was the phrase “Timestamp: Friday, May 16th, 2014,” which suggests that these photos were brand new.

What struck me was how familiar it all looked. Maybe that was because I posted those same photos on The Big Picture blog and Business Insider in February 2009.

The origin of the photos was a Jan. 16, 2009, article in the Guardian by Nick Mead. Note that this was smack in the middle of the financial crisis, when anything purchased on credit simply froze

Claim: Photographs show thousands and thousands of unsold cars deteriorating until they are scrapped.From Matt Hardigree at Jalopnik.com That Zero Hedge Article On Unsold Cars Is Bullshit

FALSE

The visuals are strong, the headline is clear, and you almost don't have to read the article to viscerally understand the problem. I, more than anyone, get the appeal of this story because it seems to largely rip off an article I wrote — including the images and headline — more than five years ago (which itself was largely a rehash of a Guardian article)....Glad to see people knock this down so quickly. Unfortunately stories like this never really die ... and the original story hasn't been corrected.

I would think that most intelligent people would read this and obviously see the flaws but, alas, I've had enough emails about it this morning that I feel the need to refute it. And since it's a (bad) copy of something I wrote, I have an extra responsibility to kill this misunderstanding before it has a chance to spread.

Weekly Update: Housing Tracker Existing Home Inventory up 6.8% year-over-year on May 19th

by Calculated Risk on 5/19/2014 03:01:00 PM

Here is another weekly update on housing inventory ...

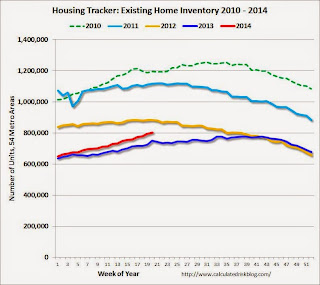

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

In 2013 (Blue), inventory increased for most of the year before declining seasonally during the holidays. Inventory in 2013 finished up 2.7% YoY compared to 2012.

Inventory in 2014 (Red) is now 6.8% above the same week in 2013.

Inventory is still very low - still below the level in 2012 (yellow) when prices started increasing - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

CoreLogic on Housing: "Cash Sales Share Shows Clear Downward Year-Over-Year Trend"

by Calculated Risk on 5/19/2014 12:05:00 PM

From CoreLogic: Cash Sales Made up 40 Percent of Total Home Sales in February

Cash sales made up 40.2 percent of total home sales in February 2014, down from 43.7 percent the previous year and 40.8 percent the previous month. Cash sales share comparisons should be made on a year-over-year basis due to the seasonal nature of the housing market , and by that measurement, the trend in cash sales is clearly down. Prior to the housing crisis, the cash sales share of total home sales averaged approximately 25 percent. The peak occurred in January 2011, when cash transactions made up 46.2 percent of total home sales.Reports that cash sales were up sharply in 2014 were incorrect. This fits with data from Tom Lawler.

And a post from Sam Khater at CoreLogic: REO Inventory Rising Once Again

After reaching a trough in August of 2013 of 375,000 properties, the number of real estate owned (REO) properties increased 15 percent to 430,000 as of March 2014 (Figure 1). The increase in REO properties was broad based, rising in 46 states. While the increase was moderate nationally, some states had large increases. Idaho led the way with the stock of REO properties nearly doubling between August 2013 and March 2014. Maryland had the 2nd largest increase in the number of REO properties, which increased 78 percent, followed by Nevada (up 70 percent), Oregon (up 47 percent) and North Dakota (up 42 percent).

The rise in REOs across most states reflects several inter-related factors ...

This graph from CoreLogic shows the recent increase in REOs.

This graph from CoreLogic shows the recent increase in REOs.Note: The number of REOs at Fannie and Freddie was down slightly in Q1, but has increased in recent quarters. The FDIC reported a slight decrease in REOs in Q4 (dollars). So most of the recent increase in REOs reported by CoreLogic was probably due to private label (the worst of the worst).