by Calculated Risk on 5/16/2014 10:57:00 AM

Friday, May 16, 2014

BLS: "State unemployment rates were generally lower in April"

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally lower in April. Forty-three states had unemployment rate decreases, two states had increases, and five states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.

...

Rhode Island had the highest unemployment rate among the states in April, 8.3 percent. North Dakota again had the lowest jobless rate, 2.6 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement.

The states are ranked by the highest current unemployment rate. No state has double digit or even a 9% unemployment rate. Only Rhode Island (8.3%) and Nevada are at or above 8%.

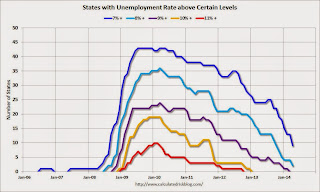

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 10 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 9% (purple), 2 states are at or above 8% (light blue), and 9 states are at or above 7% (blue).

Preliminary May Consumer Sentiment decreases to 81.8

by Calculated Risk on 5/16/2014 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for May was at 81.8, down from 84.1 in April.

This was below the consensus forecast of 84.5. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011, and another smaller spike down last October and November due to the government shutdown.

I expect to see sentiment at post-recession highs very soon.

Housing Starts at 1.072 Million Annual Rate in April

by Calculated Risk on 5/16/2014 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,072,000. This is 13.2 percent above the revised March estimate of 947,000 and is 26.4 percent above the April 2013 rate of 848,000.

Single-family housing starts in April were at a rate of 649,000; this is 0.8 percent above the revised March figure of 644,000. The April rate for units in buildings with five units or more was 413,000.

emphasis added

Building Permits:

Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,080,000. This is 8.0 percent above the revised March rate of 1,000,000 and is 3.8 percent above the April 2013 estimate of

Single-family authorizations in April were at a rate of 602,000; this is 0.3 percent above the revised March figure of 600,000. Authorizations of units in buildings with five units or more were at a rate of 453,000 in April.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in April (Multi-family is volatile month-to-month).

Single-family starts (blue) also increased in April.

The second graph shows total and single unit starts since 1968.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

The second graph shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was above expectations of 980 thousand starts in April. Note: Starts for February and March were revised up slightly. I'll have more later.

Thursday, May 15, 2014

Friday: Housing Starts, Consumer Sentiment

by Calculated Risk on 5/15/2014 08:39:00 PM

A reminder of a friendly bet I made with NDD on housing starts in 2014:

If starts or sales are up at least 20% YoY in any month in 2014, [NDD] will make a $100 donation to the charity of Bill's choice, which he has designated as the Memorial Fund in honor of his late co-blogger, Tanta. If housing permits or starts are down 100,000 YoY at least once in 2014, he make a $100 donation to the charity of my choice, which is the Alzheimer's Association.Of course, with the terms of the bet, we could both "win" at some point during the year. (I expect to "win" soon).

In April 2013, starts were at a 852 thousand seasonally adjusted annual rate (SAAR). For me to win, starts would have to be up 20% or at 1.022 million SAAR in April (possible). For NDD to win, starts would have to fall to 752 thousand SAAR (not likely). NDD could also "win" if permits fall to 790 thousand SAAR from 905 thousand SAAR in April 2013 (possible).

Friday:

• At 8:30 AM, Housing Starts for April. Total housing starts were at 946 thousand (SAAR) in March. Single family starts were at 635 thousand SAAR in March. The consensus is for total housing starts to increase to 980 thousand (SAAR) in April.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (preliminary for May). The consensus is for a reading of 84.5, up from 84.1 in April.

• At 10:00 AM, Regional and State Employment and Unemployment (Monthly) for April 2014.

Key Inflation Measures Show Increase, but still Low year-over-year in April

by Calculated Risk on 5/15/2014 04:55:00 PM

Note: The year-over-year change increased in April, but it is important to note that CPI declined in April 2013 (and core CPI was essentially unchanged) - and April 2013 was dropped out of the calculation this month so some increase in the year-over-year change was expected. Looking forward, I think inflation (year-over-year) will increase a little this year as growth picks up, but too much inflation will not be a concern this year.

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% (3.2% annualized rate) in April. The 16% trimmed-mean Consumer Price Index also increased 0.2% (2.9% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for April here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.3% (3.2% annualized rate) in April. The CPI less food and energy increased 0.2% (2.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.8%. Core PCE is for March and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 3.2% annualized, trimmed-mean CPI was at 2.9% annualized, and core CPI increased 2.9% annualized.

In general these measures suggest inflation remains below the Fed's target.