by Calculated Risk on 5/13/2014 03:13:00 PM

Tuesday, May 13, 2014

DataQuick on SoCal: April Home Sales down 6.6% Year-over-year, Non-Distressed sales up 17% Year-over-year

From DataQuick: Faster Pace for Southland Home Sales; Median Sale Price Edges Higher

Southern California’s housing market perked up a bit in April, with sales rising more than usual from March and dipping below a year earlier by the smallest degree in six months. Home prices edged higher again but at a slower pace, the result of more inventory, affordability constraints and less pressure from investors, a real estate information service reported.Both distressed sales and investor buying is declining - and this has been dragging down overall sales. However the year-over-year decline for sales in April was the smallest since last October.

A total of 20,008 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 13.4 percent from 17,638 sales in March, and down 6.6 percent from 21,415 sales in April last year, according to San Diego-based DataQuick.

On average, sales have increased 1.4 percent between March and April since 1988, when DataQuick’s statistics begin. Southland sales have fallen on a year-over-year basis for seven consecutive months, but last month’s decline was the smallest since sales fell 4.4 percent last October.

This April’s sales were higher than in April 2012 and 2011. That’s a significant change from February and March this year, which had the lowest home sales for those particular months in six years.

...

“The housing market’s pulse quickened a bit in April. If the inventory grows more, which we consider likely, it’s going to make it a lot easier for sales to reach at least an average level, which we haven’t seen in more than seven years. There are certainly factors undermining housing demand, including affordability constraints, credit challenges and less investment activity. But there are considerable forces fueling demand, too: Employment is rising, families are growing, and more people can qualify to buy again after losing a home to foreclosure or a short sale over the past eight years,” said Andrew LePage, a DataQuick analyst.

Foreclosure resales – homes foreclosed on in the prior 12 months – accounted for 5.9 percent of the Southland resale market in April. That was down from a revised 6.3 percent the prior month and down from 12.4 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009.

Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 5.4 percent of Southland resales last month. That was down from a revised 7.3 percent the prior month and down from 16.6 percent a year earlier.

Absentee buyers – mostly investors and some second-home purchasers – bought 26.1 percent of the homes sold last month, which is the lowest share since November 2011, when 25.1 percent of homes sold to absentee buyers.

emphasis added

Even though total sales are still down year-over-year, the percent of non-distressed sales is up almost 17%. There were 20,008 total sales this year, and 11.3% were distressed. In April 2013, there were 21,415 total sales, and 29% were distressed. A big positive change.

NFIB: Small Business Optimism Index increases in April, Highest since 2007

by Calculated Risk on 5/13/2014 01:25:00 PM

From the National Federation of Independent Business (NFIB) earlier this morning: NFIB: Optimism Improves, But Don't Get Too Excited

April’s Small Business Optimism Index rose 1.8 points to a post-recession high of 95.2. The economy continues to perform modestly and April’s index followed suit as it crossed the 95 marker for the first time since 2007. ...

Labor Markets. NFIB owners increased employment by an average of 0.07 workers per firm in April (seasonally adjusted), weaker than March but the seventh positive month in a row and the best string of gains since 2006.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 95.2 in April from 93.4 in March.

NY Fed: Household Debt increased in Q1 2014, Delinquency Rates Lowest Since Q3 2007

by Calculated Risk on 5/13/2014 11:00:00 AM

Here is the Q1 report: Household Debt and Credit Report. From the NY Fed:

In its Q1 2014 Household Debt and Credit Report, the Federal Reserve Bank of New York announced that outstanding household debt increased $129 billion from the previous quarter. The increase was led by rises in mortgage debt ($116 billion), student loan debt ($31 billion) and auto loan balances ($12 billion), slightly offset by a $27 billion declines in credit card and HELOC balances. Total household indebtedness stood at $11.65 trillion, 1.1 percent higher than the previous quarter. Overall household debt remains 8.1 percent below the peak of $12.68 trillion reached in Q3 2008. The report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample drawn from anonymized Equifax credit data.

Additionally, an update to a recent blog discussing the impact of student loan debt on housing and auto markets is available on our Liberty Street Economics Blog.

“We’ve observed household debt increase three quarters in a row and delinquency rates at their lowest levels since 2008,” said Andy Haughwout, vice president and economist at the New York Fed. “However, the direction of future mortgage originations will have an important implication on the household financial outlook and we will continue to monitor it.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q1.

This suggests households (in the aggregate) may be near the end of deleveraging. If so, this is a significant change that started mid-2013.

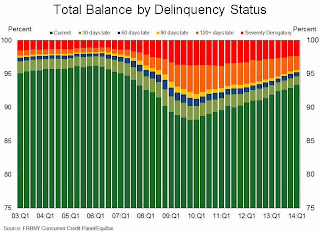

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. The percent of delinquent debt is steadily declining, although there is still a large percent of debt 90+ days delinquent (Yellow, orange and red). The overall delinquency rate has declined to 6.61% in Q1, from 7.12% in Q4. This is the lowest rate since Q3 2007.

The Severely Derogatory (red) rate has fallen to 2.34%, the lowest since Q1 2008.

The 120+ days late (orange) rate has declined to 2.09%, the lowest since Q3 2008.

Short term delinquencies are back to normal levels (lowest since 2006).

Here is the press release from the NY Fed: Household Debt Grows for the Fourth Consecutive Quarter

There are a number of credit graphs at the NY Fed site.

Retail Sales increased 0.1% in April

by Calculated Risk on 5/13/2014 08:30:00 AM

On a monthly basis, retail sales increased 0.1% from March to April (seasonally adjusted), and sales were up 3.8% from April 2013. Sales in March were revised up from a 1.1% increase to a 1.5% increase. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for April, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $434.6 billion, an increase of 0.1 percent from the previous month, and 4.0 percent above April 2013.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-autos were unchanged.

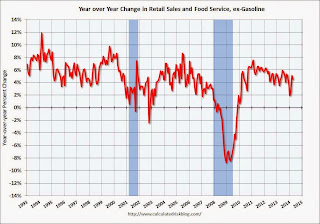

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.0% for all retail sales).

Retail sales ex-gasoline increased by 4.6% on a YoY basis (4.0% for all retail sales).The increase in April was well below consensus expectations - however sales in March were revised up.

Monday, May 12, 2014

Tuesday: Retail Sales, Q1 Household Debt and Credit

by Calculated Risk on 5/12/2014 07:45:00 PM

This could be significant from Nick Timiraos at the WSJ: Regulator Extends Greater Shield to Lenders on Mortgage 'Put-Backs'

Fannie Mae and Freddie Mac will extend new waivers to lenders ...Tuesday:

The changes are significant because some industry analysts and economists have said they could lay the groundwork for lenders to relax credit standards. Lenders and policy makers have faulted ambiguous rules around mortgage put-backs for lending standards that they say are unnecessarily rigid.

...

The FHFA's new director, Mel Watt, is set to make his first public speech on Tuesday in Washington.

emphasis added

• At 7:30 AM ET, the NFIB Small Business Optimism Index for April.

• At 8:30 AM, Retail sales for April will be released. The consensus is for retail sales to increase 0.4% in April, and to increase 0.6% ex-autos.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for March. The consensus is for a 0.4% increase in inventories.

• At 11:00 AM, the Q1 2014 Quarterly Report on Household Debt and Credit will be released by the Federal Reserve Bank of New York. Note: "In conjunction with the release of the report, the New York Fed will also post an update to a recent blog discussing the impact of student loan debt on housing and auto markets."