by Calculated Risk on 5/04/2014 12:59:00 PM

Sunday, May 04, 2014

Participation Rate: Trends and Cohorts

A frequent question is: "I've heard the participation rate for older workers is increasing, yet you say one of the reasons the overall participation rate has fallen is because people are retiring. Is this a contradiction?"

Answer: This isn't a contradiction. When we talk about an increasing participation rate for older workers, we are referring to people in a certain age group. As an example, for people in the "60 to 64" age group, the participation rate has increased over the last ten years from 51.1% in April 2004 to 55.7% in April 2014 (see table at bottom for changes in all 5 year age groups over the last 10 years).

However, when we talk about the overall participation rate, we also need to know how many people are in a particular age group at a given time. As an example, currently there is a large cohort that has recently moved into the "60 to 69" age group. To calculate the overall participation rate we need to multiple the participation rate for each age group by the number of people in the age group.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the population in each 5 year age group in April 2004 (blue) and April 2014 (red). Note: Not Seasonally Adjusted, Source: BLS.

In April 2004, the two largest groups were in the "40 to 44" and "45 to 49" age groups. These people are now the 50 to 59 age group.

In April 2004, there were also a large number of people in the 50 to 59 age group. These people are now 60 to 69.

The following table summarizes what has happened if we follow these two cohorts (40 to 49 in April 2004, and 50 to 59 and April 2004).

| Cohort 11 | Apr-04 | Apr-14 |

|---|---|---|

| Population | 44,508 | 43,455 |

| Participation Rate | 83.8% | 74.9% |

| Labor Force | 37,294 | 32,535 |

| Cohort 22 | Apr-04 | Apr-14 |

| Population | 35,373 | 33,322 |

| Participation Rate | 76.1% | 45.2% |

| Labor Force | 26,915 | 15,065 |

| 1Cohort 1: People aged 40 to 49 in April 2004. 2Cohort 2: People aged 50 to 59 in April 2004. | ||

So even though the participation rate for an age group is increasing, the participation rate for a cohort decreases as it moves into an older age group. This shows we need to follow 1) the trend for each age group, and 2) the number of people in each age group.

Note in the table below that the participation rate has been falling sharply for younger age groups (staying in school - a positive for the future) - and that the population is increasing for those age groups. This is another key trend that has been pushing down the overall participation rate.

This table is population, labor force and participation rate by age group for April 2004 and April 2014.

| Populaton and Labor Force by Age Group (000s) NSA | |||

|---|---|---|---|

| Apr-04 | Apr-14 | ||

| 16 to 19 Age Group | Population | 16,198 | 16,652 |

| Participation Rate | 40.7% | 31.1% | |

| Labor Force | 6,600 | 5,174 | |

| 20 to 24 Age Group | Population | 20,173 | 22,107 |

| Participation Rate | 74.2% | 69.2% | |

| Labor Force | 14,970 | 15,287 | |

| 25 to 29 Age Group | Population | 18,886 | 21,151 |

| Participation Rate | 81.4% | 79.8% | |

| Labor Force | 15,383 | 16,871 | |

| 30 to 34 Age Group | Population | 20,027 | 20,877 |

| Participation Rate | 83.4% | 81.4% | |

| Labor Force | 16,712 | 17,001 | |

| 35 to 39 Age Group | Population | 20,595 | 19,332 |

| Participation Rate | 83.3% | 81.9% | |

| Labor Force | 17,151 | 15,841 | |

| 40 to 44 Age Grou[ | Population | 22,683 | 20,232 |

| Participation Rate | 83.9% | 82.6% | |

| Labor Force | 19,026 | 16,701 | |

| 45 to 49 Age Group | Population | 21,825 | 20,554 |

| Participation Rate | 83.7% | 81.4% | |

| Labor Force | 18,268 | 16,737 | |

| 50 to 54 Age Group | Population | 19,247 | 22,306 |

| Participation Rate | 80.4% | 78.1% | |

| Labor Force | 15,480 | 17,416 | |

| 55 to 59 Age Group | Population | 16,126 | 21,149 |

| Participation Rate | 70.9% | 71.5% | |

| Labor Force | 11,435 | 15,119 | |

| 60 to 64 Age Group | Population | 12,499 | 18,441 |

| Participation Rate | 51.1% | 55.7% | |

| Labor Force | 6,384 | 10,273 | |

| 65 to 69 Age Group | Population | 9,716 | 14,881 |

| Participation Rate | 26.6% | 32.2% | |

| Labor Force | 2,585 | 4,792 | |

| 70 to 74 Age Group | Population | 8,349 | 10,915 |

| Participation Rate | 15.3% | 19.0% | |

| Labor Force | 1,280 | 2,070 | |

| 75 and older | Population | 16,434 | 18,841 |

| Participation Rate | 6.0% | 8.3% | |

| Labor Force | 986 | 1,563 | |

| Total | Population | 222,758 | 247,438 |

| Participation Rate | 65.7% | 62.6% | |

| Labor Force | 146,260 | 154,845 | |

Saturday, May 03, 2014

Goldman Sachs on the Labor Force Participation Rate

by Calculated Risk on 5/03/2014 06:05:00 PM

Another note on the labor force participation rate:

From Goldman Sachs chief economist Jan Hatzius:

• Since the start of the Great Recession in late 2007, the labor force participation rate has fallen by more than three percentage points, including a sharp drop in April back to the late-2013 lows. The extent of the decline has surprised many economists, ourselves included. What accounts for it, and will it continue?CR Notes:

• The first question is relatively easy to answer. Using an approach similar to that of a recent Philadelphia Fed study, we can show that the decline reflects a combination of 1) more retirements, 2) more disability, 3) higher school enrollment, and 4) more discouraged workers.

• The second question is more difficult, but we believe the answer is no. The most important reason is that the big increase in retirements in the last three years looks far less “structural” to us than generally believed. Many people seem to have pulled forward their retirement because of the weak job market. This leaves correspondingly fewer retirements for future years, and it means that the impact of retirements on participation is likely to become much less negative.

• The other drags on participation are also likely to abate or reverse. Inflows into disability insurance are now slowing sharply, consistent with past cyclical patterns. The school enrollment surge has started to reverse as young workers are finding better job opportunities. And stronger labor demand is likely to pull many discouraged workers back into the job market.

• If participation does stabilize or rise a bit, the decline in the unemployment rate should slow even if payroll growth stays at the sturdy levels seen in recent months. This is one key reason why we believe Fed rate hikes are still far off.

1) Here is the referenced Philadelphia Fed study:

Analyzing people’s reasons for not participating in the labor force provides a relatively clear idea of the causes of declines in the labor force participation rate. The number of disabled persons has been steadily rising; retirement had not played much of a role until around 2010, at which point it started to make a large impact on the overall participation rate. In particular, the decline in the participation rate in the past one-and-a-half years (when the unemployment rate declined faster than expected) is mostly due to retirement. Furthermore, nonparticipation due to enrollment in school has been another significant contributor to the secular decline in the participation rate since 2000.2) Here are the most recent projections from BLS economist Mitra Toossi: Labor force projections to 2022: the labor force participation rate continues to fall. The participation rate is projected to decline for the next couple of decades.

There is no question that more workers dropped out of the labor force due to discouragement during and after the Great Recession and that there are more discouraged workers now than before the recession. These facts clearly reflect the continued weakness of the U.S. labor market. However, it is not clear whether the overall participation rate will increase any time soon, given that the underlying downward trend due to retirement is likely to continue.

Several studies try to separate “cyclical” factors from “structural” factors when explaining the behavior of the participation rate. However, the foregoing analysis casts some doubt on the usefulness of such labeling. For example, the label “cyclical” often implies — whether implicitly or explicitly — that declines in the participation rate explained by “cyclical” factors will reverse as the economy improves. However, this presumption may not hold. In particular, the decision to retire is clearly affected by cyclical factors, but this decision is unlikely to be reversed.

3) Headlines that blare Workforce Participation at 36-Year Low as Jobs Climb aren't helpful. A large decline in the participation rate has been expected for some time, and those that keep saying "the participation rate is at a multi-decade low" are not contributing to the discussion. There is a question of how much of the decline is related to demographic trends (retirement, more young people staying in school are two key trends), and how much is cyclical - but some key recent research now supports my view that a majority is demographics.

Schedule for Week of May 4th

by Calculated Risk on 5/03/2014 01:02:00 PM

This will be a light week for economic data.

The key reports are the Trade Balance report for March, and the ISM non-manufacturing (service) survey for April.

Also Fed Chair Janet Yellen will testify to Congress on the economic outlook.

Early: the Black Knight Mortgage Monitor for March.

10:00 AM: ISM non-Manufacturing Index for April. The consensus is for a reading of 54.0, up from 53.1 in March. Note: Above 50 indicates expansion, below 50 contraction.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. Imports increased and exports decreased in February.

The consensus is for the U.S. trade deficit to be at $40.2 billion in March from $42.3 billion in February.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Joint Economic Committee, U.S. Congress

3:00 PM: Consumer Credit for March from the Federal Reserve. The consensus is for credit to increase $15.1 billion.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 344 thousand.

Early: Trulia Price Rent Monitors for April. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

9:30 AM: Testimony by Fed Chair Janet Yellen, The Economic Outlook, Before the Committee on the Budget, U.S. Senate

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS.

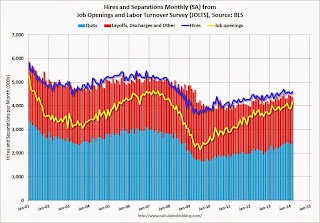

10:00 AM: Job Openings and Labor Turnover Survey for March from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

In February, the number of job openings (yellow) were up 4% year-over-year compared to February 2013, and Quits were up about 5% year-over-year.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for March. The consensus is for a 0.5% increase in inventories.

Unofficial Problem Bank list declines to 509 Institutions

by Calculated Risk on 5/03/2014 08:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2, 2014.

Changes and comments from surferdude808:

With four removals this week, the Unofficial Problem Bank List fell to 509 institutions with assets of $163.3 billion. A year ago, the list held 773 institutions with assets of $284.9 billion.

Actions were terminated against Ocean Bank, Miami, FL ($3.3 billion); TruPoint Bank, Grundy, VA ($441 million); and Liberty Bank, South San Francisco, CA ($219 million). First Federal Savings and Loan Association of Hammond, Hammond, IN ($40 million) found its way off the list through an unassisted merger. Next week should be light in terms of changes to the list as we will not receive an update from the OCC for another two weeks.

Friday, May 02, 2014

Merrill: Q1 GDP now tracking negative 0.4%

by Calculated Risk on 5/02/2014 06:30:00 PM

The data flow suggests Q1 was even weaker than the 0.1% real annualized growth rate reported earlier this week. From Merrill Lynch:

The advance 1Q GDP report revealed growth of only 0.1% qoq saar, about a full percentage point less than we had expected. After accounting for weaker-than-expected construction spending and nondurable inventories in March, 1Q GDP is now tracking -0.4%. This is clearly disappointing and pulls down estimates for annual GDP growth.

...

With all the optimism to start this year, nobody was predicting the economy would contract in 1Q. Based on the Blue Chip forecasts in December last year, the average forecast for 1Q was 2.5% with the top 10 highest forecasts of 3.2% and bottom 10 of 2.0%. Obviously, we were all taken by surprise by this brutally cold winter.

It seems that the economy cannot catch a break – each year there is some explanation for a lack of momentum. It was the European crisis in 2010, the US debt rating downgrade/Greek exit in 2011, gridlock in Washington in 2012 and fiscal tightening/government shutdown in 2013. But the shock from weather does not linger and actually reverses quite quickly. With the harsh winter weather in our rearview mirror, we can focus on the underlying healing of the economy, which we think has been significant.

We believe the economy is on track to bounce back, leading us to revise up 2Q GDP growth to 3.6% from 3.2%. However, this increase does not entirely offset the weakness in 1Q, leaving our forecast for annual GDP growth to slip to 2.5% from 2.7%.

...

Importantly, we think the strength in 2Q is not just a one-quarter bounce. We expect growth to remain strong, averaging 3.4% growth in both 3Q and 4Q.