by Calculated Risk on 4/08/2014 08:59:00 PM

Tuesday, April 08, 2014

Wednesday: FOMC Minutes

On Sunday I listed a few possible reasons for the decline in the labor force participation rate for prime-working age men. One of the reasons I suggested was more men were being "Mr. Mom". I looked for some research on this, and sure enough the percent of stay-at-home father families has increased from 0.7% in the 1968 to 1979 period, to 2.5% in the 2000 to 2012 period (percent of married families).

Meanwhile the prime-working age men participation rate fell from an average of 95.0% (1968 to 1979) to 90.3% (2000 - 2012). Clearly "Mr. Mom" has been a factor.

From Karen Z. and Amit Kramer at the University of Illinois at Urbana-Champaign The Rise of Stay-at-Home Father Families in the U.S.: The Role of Gendered Expectations, Human Capital, and Economic Downturns

Stay-at-home father families in which the mother is the sole- or primary-earner of income (Chesley 2011) represent a small but growing percentage of two-parent families in the United States. These families, in which the mother is the sole income earner, are estimated to make up three to four percent of two-parent households in the United States (Fields 2002; Kramer, Kelly, and McCulloch forthcoming). The higher participation rates of women in the labor force, as well as the impact of the 2009 Great Recession, which have affected men’s employment more than women’s (Harrington, Van Deusen, and Ladge 2010), combined with greater projected growth rates in occupations that are dominated by women, such as health and education (Boushey 2009), suggest that the proportion of stay-at-home father families in the U.S. is likely to increase.The other factors too as I noted in the post on Sunday.

Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Monthly Wholesale Trade: Sales and Inventories for February. The consensus is for a 0.5% increase in inventories.

• At 2:00 PM, the FOMC Minutes for the Meeting of March 18-19, 2014.

"A Closer Look at Post-2007 Labor Force Participation Trends"

by Calculated Risk on 4/08/2014 06:42:00 PM

This is an excellent overview of many of the labor force participation trends.

From Melinda Pitts, John Robertson, and Ellyn Terry at Marcoblog: A Closer Look at Post-2007 Labor Force Participation Trends

And the promise of another post using micro data:

[A]n important assumption in the BLS projection is that the post-2007 decline in prime-age participation will not persist. Indeed, the data for the first quarter of 2014 does suggest that some stabilization has occurred.

But separating what is trend from what is cyclical is challenging. The rapid pace of the decline in participation among the prime-age population between 2007 and 2013 is somewhat puzzling. Could this decline reflect a temporary cyclical effect or something more permanent? A follow-up blog will explore this question in more detail using the micro data from the Current Population Survey.

When will total payroll employment exceed the pre-recession peak?

by Calculated Risk on 4/08/2014 03:57:00 PM

Total payroll employment is getting close to the pre-recession peak.

Of course this doesn't include population growth and new entrants into the workforce (the workforce has continued to grow and is now 2.2 million higher than in January 2008). Since January 2008, the Civilian noninstitutional population1 has increased by 12.8 million people, although the prime working-age population (25 to 54) has actually declined by 1.5 million.

Still reaching a new high in employment will be a significant milestone in the recovery.

The graph below shows both total non-farm payroll (blue, left axis) and private payroll (red, right axis) since January 2007. Both total non-farm and private payroll employment peaked in January 2008.

The dashed line is the pre-recession peak.

Click on graph for larger image.

Click on graph for larger image.

The pre-recession peak for total non-farm payroll employment was 138.365 million. Currently there are 137.927 million total non-farm payroll jobs, or 436 thousand fewer than the pre-recession peak.

It is possible that total non-farm payroll will be at a new high in May.

The pre-recession peak for private payroll employment was 115.977 million. As we discussed last week, currently there are 116.087 million private payroll jobs, or 110 thousand above the pre-recession peak.

1 From the BLS: "Civilian noninstitutional population (Current Population Survey) Included are persons 16 years of age and older residing in the 50 States and the District of Columbia who are not inmates of institutions (for example, penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces."

Las Vegas Real Estate in March: Year-over-year Non-contingent Inventory up 128%

by Calculated Risk on 4/08/2014 12:14:00 PM

This is a key distressed market to follow since Las Vegas has seen the largest price decline of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported GLVAR reports rising home prices and more homes available for sale

GLVAR said the total number of existing local homes, condominiums and townhomes sold in March was 3,094, up from 2,518 in February, but down from 3,642 one year ago.There are several key trends that we've been following:

...

GLVAR continued to track the transition from distressed to more traditional home sales, where lenders are not controlling the transaction. GLVAR has been reporting fewer short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. In March, 12.9 percent of all existing local home sales were short sales, down from 14 percent in February. Another 11.7 percent of all March sales were bank-owned properties, down from 12 percent in February.

GLVAR said 43.1 percent of all existing local homes sold in March were purchased with cash. That’s down from 46.8 percent the previous month, and well short of the February 2013 peak of 59.5 percent.

...

The total number of single-family homes listed for sale on GLVAR’s Multiple Listing Service in March was 13,944. That’s up 2.3 percent from 13,624 listed in February and up 1.8 percent from 13,693 listed one year ago. GLVAR reported a total of 3,701 condos and townhomes listed for sale on its MLS in March, up 3.9 percent from 3,561 listed in February and up 7.2 percent from one year ago. ...

By the end of March, GLVAR reported 6,470 single-family homes listed without any sort of offer. That’s up 2.4 percent from 6,316 such homes listed in February, and a 127.9 percent jump from one year ago.

emphasis added

1) Overall sales were down about 15% year-over-year.

2) Conventional sales were up 16% year-over-year. In March 2013, only 55.5% of all sales were conventional. This year, in March 2014, 75.4% were conventional.

3) The percent of cash sales is down year-over-year (investor buying appears to be declining).

4) and most interesting right now is that non-contingent inventory (year-over-year) is now increasing rapidly. Non-contingent inventory is up 127.9% year-over-year (more than double)!

Inventory has clearly bottomed in Las Vegas (A major theme for housing last year). And fewer distressed sales and more inventory means price increases will slow (a major theme for 2014).

BLS: Jobs Openings increase to 4.2 million in February

by Calculated Risk on 4/08/2014 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

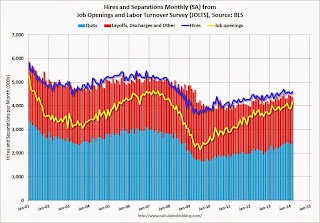

There were 4.2 million job openings on the last business day of February, up from January, the U.S. Bureau of Labor Statistics reported today. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

...

Quits are generally voluntary separations initiated by the employee. Therefore, the quits rate can serve as a measure of workers’ willingness or ability to leave jobs. ... The number of quits (not seasonally adjusted) was little changed over the 12 months ending in February for total nonfarm, total private, and government.

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for February, the most recent employment report was for March.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in February to 4.173 million from 3.874 million in January.

The number of job openings (yellow) is up 4% year-over-year compared to February 2013.

Quits increased in February and are up about 5% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report - and the data is noisy month-to-month, but the general trend suggests a gradually improving labor market. It is a good sign that job openings are over 4 million and at the highest level since January 2008.