by Calculated Risk on 3/21/2014 09:24:00 AM

Friday, March 21, 2014

ATA Trucking Index increased in February

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Jumped 2.8% in February

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 2.8% in February, after plunging 4.5% the previous month. January’s drop was slightly more than the 4.3% reported on February 19, 2014. In February, the index equaled 127.6 (2000=100) versus 124.1 in January. The all-time high was in November 2013 (131.0).

Compared with February 2013, the SA index increased 3.6%.

...

“It is pretty clear that winter weather had a negative impact on truck tonnage during February,” said ATA Chief Economist Bob Costello. “However, the impact wasn’t as bad as in January because of the backlog in freight due to the number of storms that hit over the January and February period.”

“The fundamentals for truck freight continue to look good,” he said. “Several other economic indicators also snapped back in February. We have a hole to dig out of from such a bad January, but I feel like we are moving in the right direction again. I remain optimistic for 2014.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index rebounded in February after the sharp decline in January.

Thursday, March 20, 2014

Fed: Large Banks "collectively better positioned" to cope with "an extremely severe economic downturn"

by Calculated Risk on 3/20/2014 09:04:00 PM

Note: I was strong early supporter of bank stress tests, and I'm glad the Fed has continued testing banks on an annual basis. Hopefully this will continue ...

From the Federal Reserve: Press Release

According to the summary results of bank stress tests announced by the Federal Reserve on Thursday, the largest banking institutions in the United States are collectively better positioned to continue to lend to households and businesses and to meet their financial commitments in an extremely severe economic downturn than they were five years ago. This result reflects continued broad improvement in their capital positions since the financial crisis.From the WSJ: Fed 'Stress Test' Results: 29 of 30 Big Banks Could Weather Big Shock

Reflecting the severity of the most extreme stress scenario--which features a deep recession with a sharp rise in the unemployment rate, a drop in equity prices of nearly 50 percent, and a decline in house prices to levels last seen in 2001--projected loan losses at the 30 bank holding companies in the latest stress tests would total $366 billion during the nine quarters of the hypothetical stress scenario. The aggregate tier 1 common capital ratio, which compares high-quality capital to risk-weighted assets, would fall from an actual 11.5 percent in the third quarter of 2013 to the minimum level of 7.6 percent in the hypothetical stress scenario. That minimum post-stress number is significantly higher than the 30 firms' actual tier 1 common ratio of 5.5 percent measured in the beginning of 2009.

The Fed said 29 of the 30 largest institutions have enough capital to continue lending even when faced with a hypothetical jolt to the U.S. economy lasting into 2015, including a severe drop in housing prices and a spike in the unemployment rate.

The results will factor into the Fed's decision next week to approve or deny individual banks' plans for returning billions of dollars to shareholders through dividends or share buybacks. The Fed's annual "stress tests" are designed to ensure large banks can withstand severe losses without needing a government rescue.

Fed: Q4 Household Debt Service Ratio near 30 year low

by Calculated Risk on 3/20/2014 04:51:00 PM

Here is an update of the Fed's Household Debt Service ratio through Q4 2013 Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio increased slightly in Q4, and is near a record low. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

Also the DSR for mortgages (blue) are near the low for the last 30 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape than a few years ago.

Earlier: Philly Fed Manufacturing Survey indicated Expansion in March

by Calculated Risk on 3/20/2014 02:27:00 PM

From the Philly Fed: March Manufacturing Survey

Manufacturing activity rebounded in March, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, and shipments increased and recorded positive readings this month, suggesting a return to growth following weather‐related weakness in February. Firms’ employment levels were reported near steady, but responses reflected optimism about adding to payrolls over the next six months. The surveyʹs indicators of future activity reflected optimism about continued growth over the next six months.This was above the consensus forecast of a reading of 4.0 for March.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from a reading of ‐6.3 in February to 9.0 this month, nearing its reading in January.

The employment index remained positive for the ninth consecutive month but edged 3 points lower, suggesting near‐steady employment.

emphasis added

Click on graph for larger image.

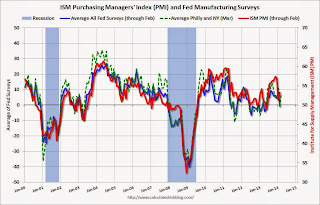

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys was negative in February (probably weather related), and turned positive again in March. This suggests stronger expansion in the ISM report for March.

Comments on Existing Home Sales

by Calculated Risk on 3/20/2014 11:59:00 AM

The NAR reported this morning that inventory was up 5.3% year-over-year in February.

A few points:

• Inventory is the KEY number in the NAR release.

• The NAR inventory data is "noisy" (and difficult to forecast based on other data), however it appears inventory bottomed in early 2013.

• The headline NAR inventory number is NOT seasonally adjusted (and there is a clear seasonal pattern).

• Inventory is still very low, and with the low level of inventory, there is still upward pressure on prices.

• I expect inventory to increase in 2014, and I expect the year-over-year increase to be in the 10% to 15% range by the end of 2014.

• However, if inventory doesn't increase, prices will probably increase a little faster than expected (a key reason to watch inventory right now).

Click on graph for larger image.

Click on graph for larger image.

The NAR does not seasonally adjust inventory, even though there is a clear seasonal pattern. Trulia chief economist Jed Kolko sent me the seasonally adjusted inventory (see graph of NAR reported and seasonally adjusted).

This shows that inventory bottomed in January 2013 (on a seasonally adjusted basis), and inventory is now up about 6.8% from the bottom. On a seasonally adjusted basis, inventory was mostly unchanged in February compared to January.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were down 7.1% from February 2013, but normal equity sales were probably up from February 2013, and distressed sales down. The NAR reported that 16% of sales were distressed in February (from a survey that isn't perfect):

Distressed homes – foreclosures and short sales – accounted for 16 percent of February sales, compared with 15 percent in January and 25 percent in February 2013.Last year the NAR reported that 25% of sales were distressed sales.

A rough estimate: Sales in February 2013 were reported at 4.95 million SAAR with 25% distressed. That gives 1.24 million distressed (annual rate), and 3.71 million conventional. In February 2014, sales were 4.60 million SAAR, with 16% distressed. That gives 0.74 million distressed, and 3.86 million conventional. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up. A positive sign!

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in February (red column) were above the sales for 2008 through 2011, and below sales for the last two year.

Overall this report was as expected (fewer distressed sales pulling down overall sales), and inventory needs to be watched closely.

Earlier:

• Existing Home Sales in February: 4.60 million SAAR, Inventory up 5.3% Year-over-year